1. What Happened? Decoding Prodigy Investment’s Stake Change

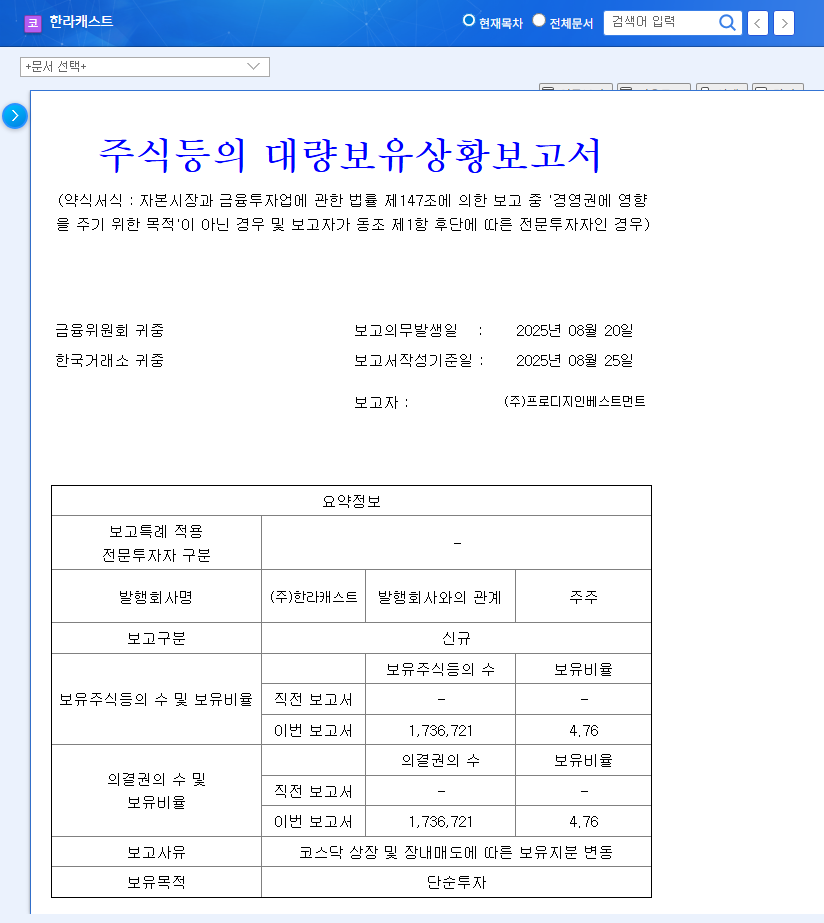

On August 25, 2025, Prodigy Investment announced a 4.76% stake in Hanlacast. This change resulted from Hanlacast’s KOSDAQ listing and subsequent over-the-counter sales. Prodigy’s 24th investment partnership acquired 2,239,221 shares on August 20th and sold 502,500 shares on the same day.

2. Why Does it Matter? Implications of the Stake Change

While the stake change could be interpreted as initial liquidity supply, it may negatively impact investor sentiment towards Hanlacast, given concerns about its deteriorating financial health. The change in stake by a major investor raises questions about future management involvement, a key point for investors to consider.

3. Understanding Hanlacast: Fundamentals and Recent Performance

Hanlacast is striving to secure growth drivers by entering the automotive electronics and secondary battery materials businesses. However, the sharp decline in operating profit and surge in debt ratio in the first half of 2025 are serious concerns. With weak performance attributed to rising raw material prices and increased SG&A expenses, the company’s ability to achieve tangible results from its growth strategies is crucial.

4. What Should Investors Do? Short-Term and Long-Term Strategies

In the short term, a cautious approach is advised, closely monitoring any further sales by the investment partnership and their scale. Investors should be mindful of potential stock volatility following the recent listing.

For the long term, it is crucial to observe whether Hanlacast’s new ventures yield tangible results and whether its financial structure improves, particularly focusing on its efforts to secure financial soundness and manage its debt ratio.

How will Prodigy Investment’s stake change affect Hanlacast’s stock price?

In the short term, it may create selling pressure, potentially leading to a price decline. The long-term trajectory depends on improvements in Hanlacast’s fundamentals.

What are the key investment points for Hanlacast?

The company’s efforts to secure future growth engines by entering the automotive electronics and secondary battery materials sectors are key investment points.

What are the key risks to consider when investing in Hanlacast?

Key risks include weak performance, deteriorating financial health, and the possibility of further stake changes by the investment partnership.

Leave a Reply