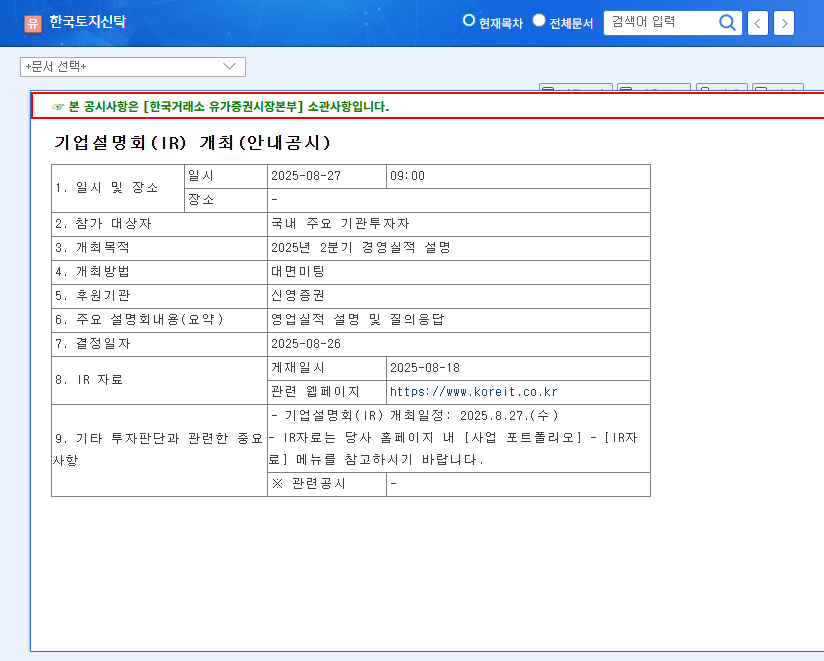

1. What Happened? Korea Land Trust Holds Q2 Earnings Call

Korea Land Trust held its Q2 2025 earnings call on August 27, 2025. The company shared its financial results and answered questions from investors.

2. Why Does It Matter? Navigating the Real Estate Downturn

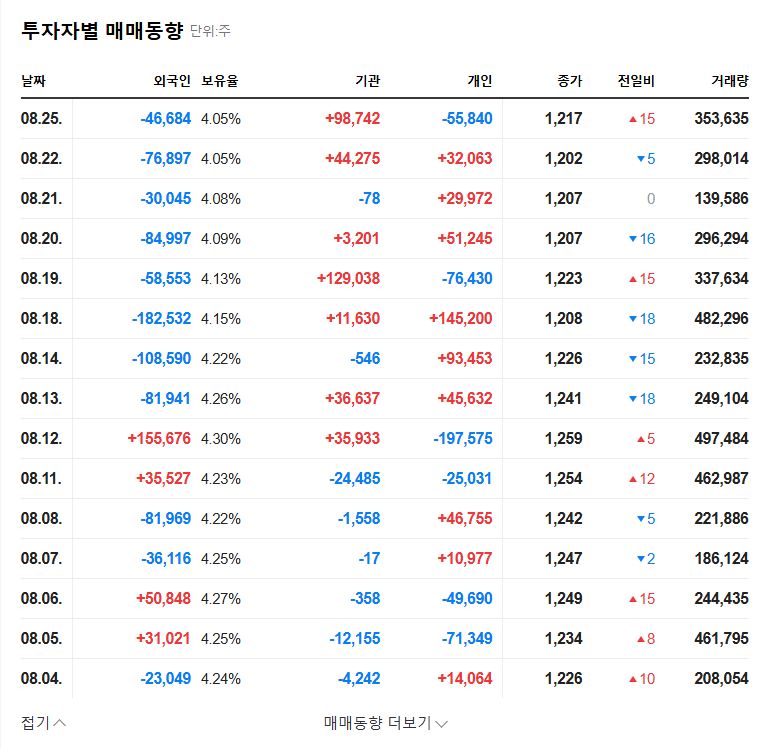

With rising interest rates and a prolonged real estate market downturn, Korea Land Trust has faced challenges, including operating losses in 2024. This IR call was a crucial opportunity to assess the company’s fundamentals, future growth strategies, and address market concerns.

3. Key Takeaways and Their Implications

- Positive Factors:

- Strong foundation with KRW 432 trillion in trust assets and maintained financial soundness.

- Securing new growth engines through expansion of urban redevelopment and REITs businesses.

- Negative Factors:

- Continued decline in profitability due to rising interest rates and the real estate market slump.

- Potential lack of clear solutions presented for the deteriorating market conditions.

4. What Should Investors Do? Review the IR and Monitor Performance

Investors should carefully review the IR materials and continuously monitor the company’s responsiveness and the success of its new business ventures. Pay close attention to the growth potential of urban redevelopment and REITs, as well as the company’s strategies for navigating the changing market dynamics.

Frequently Asked Questions

How did Korea Land Trust perform in Q2 2025?

While specific figures should be referenced from the IR materials, it appears that profitability continues to decline due to the impact of rising interest rates and the real estate market downturn.

What is the outlook for Korea Land Trust?

The growth potential of new businesses, such as urban redevelopment and REITs, is positive, but challenges are expected if the real estate market slump continues. Ongoing monitoring of the company’s strategies and market conditions is essential.

What are the key investment considerations?

Due to the high volatility of earnings based on macroeconomic indicators, investors should pay close attention to changes in market conditions, such as interest rates and the real estate market. Continuous monitoring of the success of new business ventures is also crucial.

Leave a Reply