1. What’s Happening?: Potential Sale of Yeosu NCC Plant No. 2

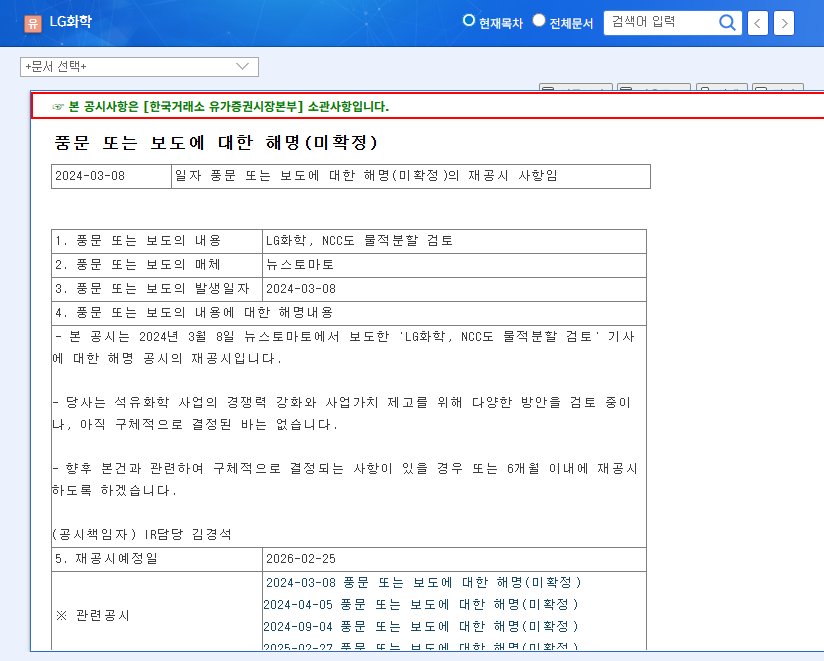

LG Chem officially confirmed the possibility of selling its Yeosu NCC Plant No. 2 in a regulatory filing on August 26, 2025. While not yet finalized, the sale is being considered as a strategic option to enhance the competitiveness and value of its petrochemical business.

2. Why?: Addressing Petrochemical Struggles and Securing Future Growth

LG Chem’s petrochemical business has been facing prolonged challenges due to the global economic slowdown and oversupply. The potential sale of the NCC plant is interpreted as a strategic move to streamline assets, improve financial structure, and redirect resources towards future growth engines like battery materials, life sciences, and advanced materials.

3. What’s Next?: Analyzing Potential Scenarios

- Positive Scenario: A successful sale could improve LG Chem’s financial health, enabling increased investment in future growth areas and driving higher corporate value.

- Negative Scenario: Delays or failure to sell the plant could prolong the struggles in the petrochemical business and hinder investment in key growth sectors.

4. What Should Investors Do?: Short-Term and Long-Term Strategies

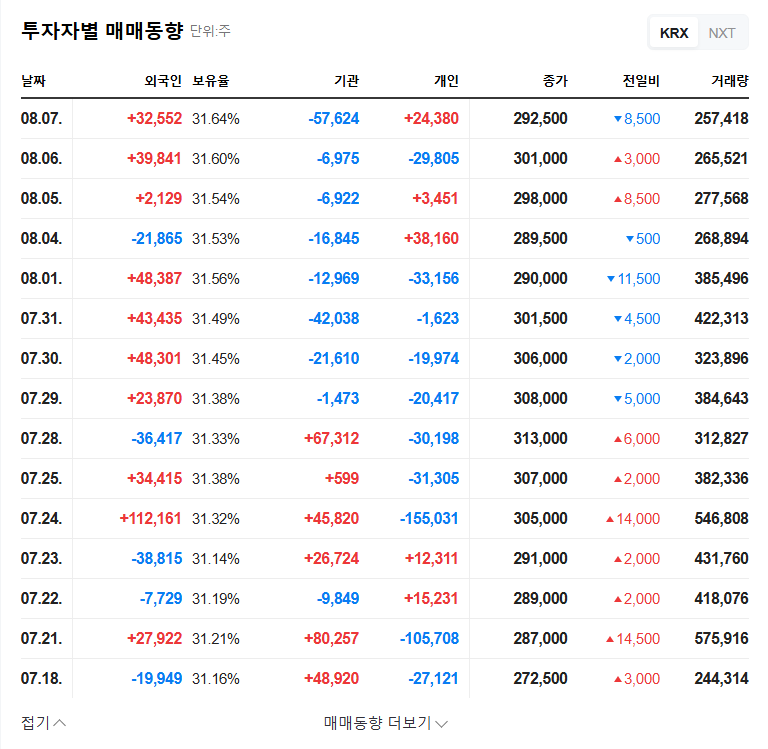

- Short-Term Strategy: A cautious approach is recommended until uncertainties surrounding the sale are resolved. Investors should closely monitor related news and filings, adapting their strategies to market changes.

- Long-Term Strategy: Focus on the competitiveness of LG Chem’s high-growth sectors like LG Energy Solution, life sciences, and advanced materials, while observing the restructuring process in the petrochemical business to identify long-term investment opportunities.

FAQ

Is the sale of LG Chem’s Yeosu NCC Plant No. 2 confirmed?

No, the sale is not yet finalized. LG Chem has stated that it is exploring the sale as one of the options to strengthen its business competitiveness.

How will the sale affect LG Chem’s stock price?

The impact on stock price will depend on whether the sale is successful and the terms of the deal. A successful sale could boost the stock price by improving financial health and enabling investment in growth areas. However, delays or failure to sell could create uncertainty and negatively impact the stock.

How should investors respond?

In the short term, investors should remain cautious until the uncertainties surrounding the sale are resolved. In the long term, they should monitor LG Chem’s portfolio changes and growth strategies to identify investment opportunities.

Leave a Reply