What Happened?

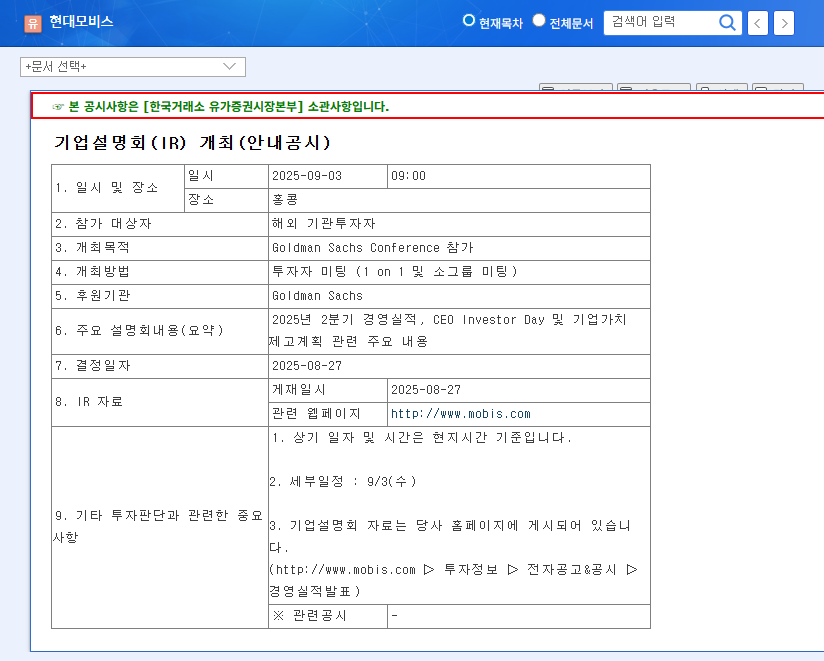

Hyundai Mobis will host an IR presentation at the Goldman Sachs Conference on September 3, 2025, announcing its Q2 2025 earnings and future growth strategies. The ‘corporate value enhancement plan’ announcement is expected to significantly impact the stock price.

Why Does It Matter?

This IR goes beyond a simple earnings announcement; it’s a platform for Hyundai Mobis to present its future vision. Strategies for strengthening competitiveness in the future mobility market, including autonomous driving and electrification, along with shareholder-friendly policies, can boost investor confidence and act as a catalyst for stock price increases.

What’s the Likely Outcome?

- Strong Performance: Hyundai Mobis reported strong H1 2025 results with revenue of KRW 30.68 trillion (up 7.6%) and operating profit of KRW 1.64 trillion (up 39.7%).

- Future Growth Drivers: Increased investment in future mobility technologies such as autonomous driving and electrification, coupled with the operation of a new North American plant, secures long-term growth potential.

- Shareholder Value Enhancement: The possibility of strengthened shareholder return policies, including share buybacks, is high, which can positively impact the stock price.

What Should Investors Do?

Investors should carefully review the announcements from the IR and reassess Hyundai Mobis’ future growth potential and investment value. Pay close attention to future mobility business strategies, shareholder return policies, and global market response strategies when making investment decisions. Given the positive outlook, close to a ‘Strong Buy’ recommendation, an active investment strategy is worth considering.

Frequently Asked Questions

What are Hyundai Mobis’ main businesses?

Hyundai Mobis focuses on manufacturing automotive modules and parts, and supplying A/S parts. The revenue proportions are 78.5% and 21.5%, respectively.

What are the key takeaways from this IR?

The key points to watch are the Q2 earnings announcement, future mobility business investment plans, and corporate value enhancement plans (including shareholder return policies).

What is the investment outlook for Hyundai Mobis?

Based on strong performance and future growth potential, a positive investment outlook is maintained. The announcements from this IR are likely to further strengthen the momentum for stock price appreciation.

Leave a Reply