What Happened?

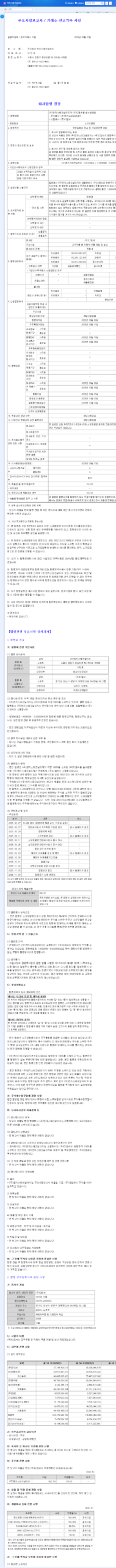

NGSTech has decided to merge with its subsidiary DMC (a developer and manufacturer of rubber parts and other automotive components) at a 1:1 ratio. The merger date is set for October 31, 2025. NGSTech’s stock is currently suspended from trading.

Why the Merger?

The official purpose is to improve management efficiency and strengthen business competitiveness. With automotive parts (HIM and DMC divisions) already accounting for over 86% of NGSTech’s revenue, the merger aims to maximize synergy by fully integrating DMC. It is also expected to improve profitability through the elimination of redundant functions and cost reduction.

What Will Happen?

The merger is expected to strengthen NGSTech’s competitiveness in its core automotive parts business. It is anticipated to increase overall business efficiency in R&D, production, and marketing. Direct incorporation of DMC’s performance is also expected to boost revenue. However, the high debt-to-equity ratio (91.51%) resulting from the DMC acquisition remains a risk factor. Post-merger financial restructuring efforts are essential. The stagnant growth of the Automotive Solution division also needs to be addressed.

- Positives: Strengthened core business, increased management efficiency, potential financial improvement

- Risks: High debt-to-equity ratio, sluggish Automotive Solution division, past stock issues

What Should Investors Do?

While the merger presents a significant growth opportunity for NGSTech, risks exist. Investors should carefully monitor the detailed merger terms, DMC’s actual performance, management of the merged entity’s financial soundness, and the Automotive Solution division’s growth strategy, and make prudent investment decisions.

What is the merger ratio between NGSTech and DMC?

It’s a 1:1 merger.

Which company will be the surviving entity?

NGSTech will be the surviving entity, and DMC will cease to exist.

When is the merger date?

October 31, 2025.

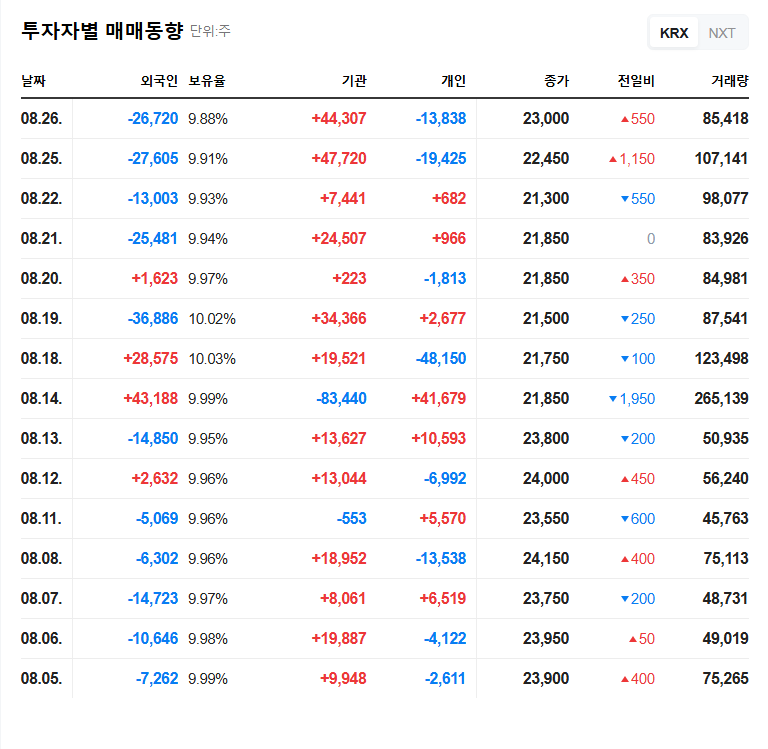

What is the impact of the merger on the stock price?

Trading is currently suspended. The stock price may fluctuate significantly depending on the merger approval and the announcement of detailed conditions. In the mid to long term, the stock’s direction will likely depend on the synergy effect of the merger.

Leave a Reply