1. What Happened?

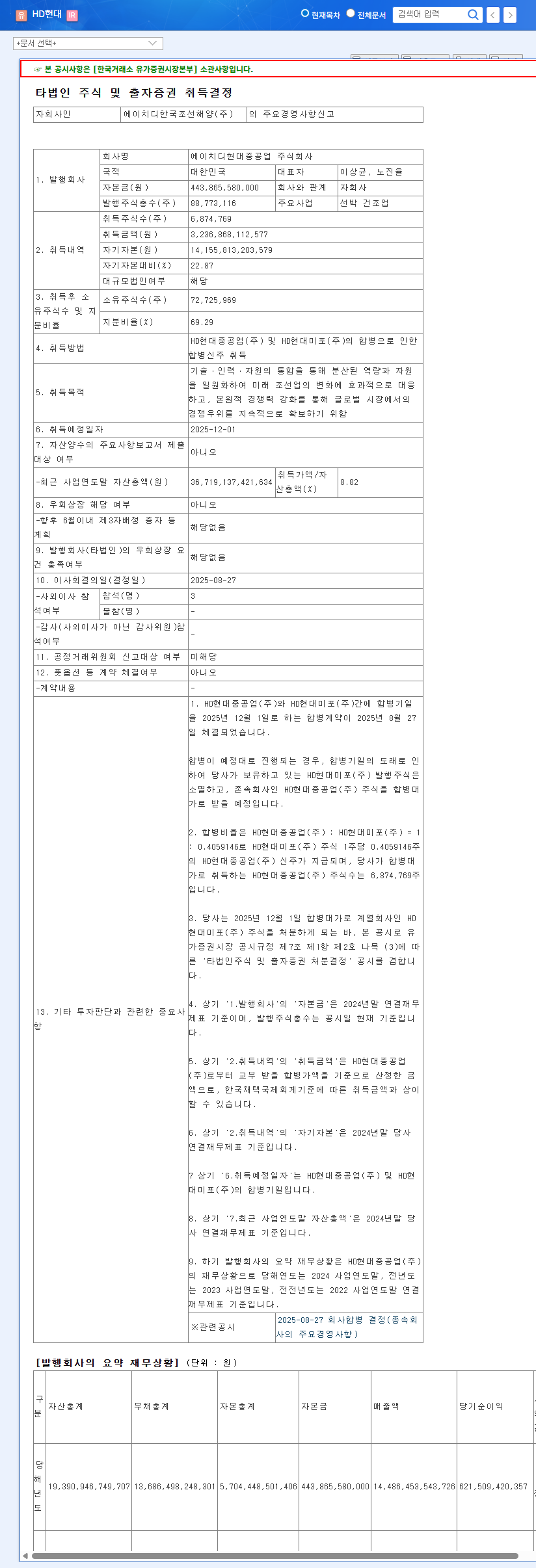

HD Hyundai announced its decision to merge HD Hyundai Heavy Industries and HD Hyundai Mipo Dockyard through its subsidiary, HD Korea Shipbuilding & Offshore Engineering. This move consolidates ownership of both companies under HD Korea Shipbuilding & Offshore Engineering. The merger is scheduled for December 1, 2025, with a total acquisition cost of ₩32.369 trillion.

2. Why Merge?

HD Hyundai aims to strengthen its competitiveness and adapt to future industry trends by consolidating technologies, workforce, and resources. The goal is to achieve economies of scale, maximize synergies, and secure a competitive edge in the global market.

3. What’s Next?

a. Positive Impacts

- Synergies: Reduced redundant investments, increased operational efficiency, and economies of scale.

- Enhanced Competitiveness: Accelerated development of future technologies like eco-friendly vessels and smart ships.

- Improved Governance: Enhanced decision-making efficiency and strengthened strategic direction for the group.

b. Potential Risks

- Financial Burden: Potential deterioration of financial health due to the substantial investment.

- Merger Uncertainties: Possibility of unforeseen issues and delays during the integration process.

- External Factors: Impact of external factors such as global economic slowdown and exchange rate fluctuations.

4. What Should Investors Do?

In the short term, investors should monitor market reactions to the merger’s uncertainties and financial impact. In the medium to long term, investment decisions should be made based on an analysis of synergy effects and HD Korea Shipbuilding & Offshore Engineering’s performance improvements. Continuous monitoring of HD Hyundai’s financial health management and capital procurement plans is crucial.

Frequently Asked Questions

How will this merger affect HD Hyundai’s stock price?

Short-term volatility is possible due to uncertainties, but the merger’s synergies could positively impact the stock price in the medium to long term.

What will HD Hyundai’s financial structure look like after the merger?

The large investment may increase debt-to-equity ratios, but improved operating profit margins and ROE are expected to maintain financial soundness.

When will the synergies from the merger become apparent?

Synergies are expected to materialize in the medium to long term after the merger’s completion and integration process.

Leave a Reply