KAI Signs $83M Deal with Kawasaki Heavy Industries

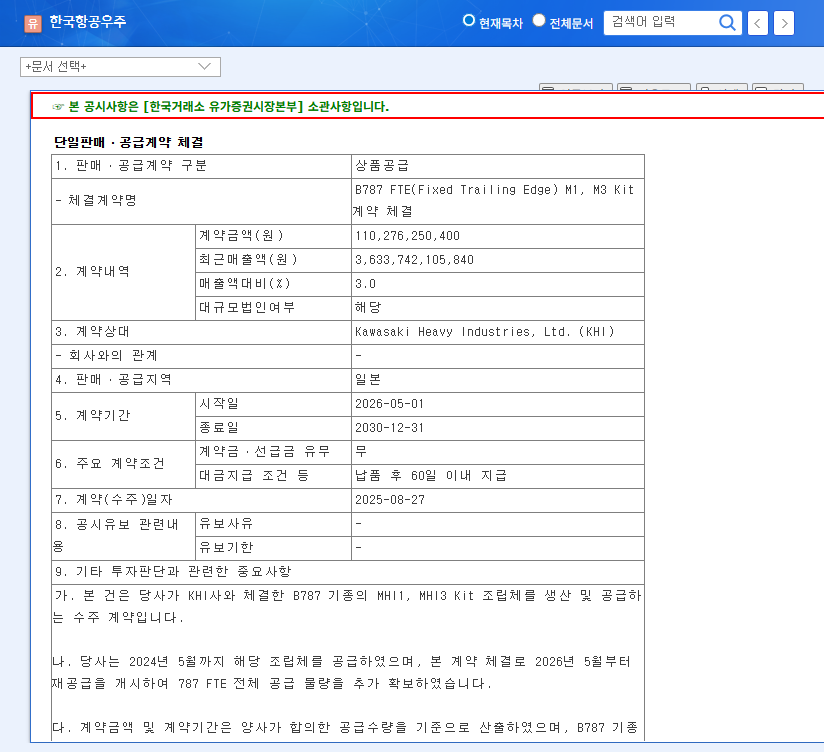

Korea Aerospace Industries (KAI) has inked an $83 million contract with Kawasaki Heavy Industries (KHI) to supply B787 FTE (Fixed Trailing Edge) M1 and M3 Kit parts. The contract spans from May 1, 2026, to December 31, 2030, covering a period of four years and eight months. This represents 3.0% of KAI’s projected revenue for 2026.

Deal Significance: Expanding Commercial Aircraft Business and Global Partnerships

This contract signifies more than just increased revenue for KAI. By supplying critical parts for the Boeing 787 Dreamliner, KAI gains recognition for its technological prowess and competitiveness in the global commercial aircraft market. It also strengthens KAI’s collaborative relationship with Boeing, a leading aircraft manufacturer, and provides a foothold for stable entry into the global supply chain. This is a crucial step that increases the likelihood of future orders. Moreover, the diversification from the existing defense-centric business into the commercial aircraft parts business will contribute to building a stable portfolio.

KAI Stock Outlook: Limited Short-Term Impact, Long-Term Growth Expected

In the short term, the contract’s size relative to market capitalization may limit its impact on the stock price. However, the growth potential of the commercial aircraft business and the strengthening of global partnerships can be perceived as positive signals, positively influencing investor sentiment. In the long run, successful performance and demonstration of technological capabilities in the commercial aircraft parts business can be expected to drive KAI’s corporate value upward.

Investor Action Plan: Consider Investment Value from a Long-Term Perspective

Investors should consider risk factors such as KAI’s high debt ratio and the possibility of interest rate hikes. However, this contract is viewed positively in terms of KAI’s business diversification and strengthening of global competitiveness. Therefore, it is crucial to assess the investment value from a long-term perspective.

What is the contract value between KAI and Kawasaki Heavy Industries?

$83 million.

What is the expected impact of this contract on KAI’s stock price?

The short-term impact may be limited, but a positive long-term impact is expected.

What are KAI’s main business areas?

Fixed-wing aircraft, airframes, and new businesses (satellites, UAVs, MRO, UAM/AAV, etc.).

Leave a Reply