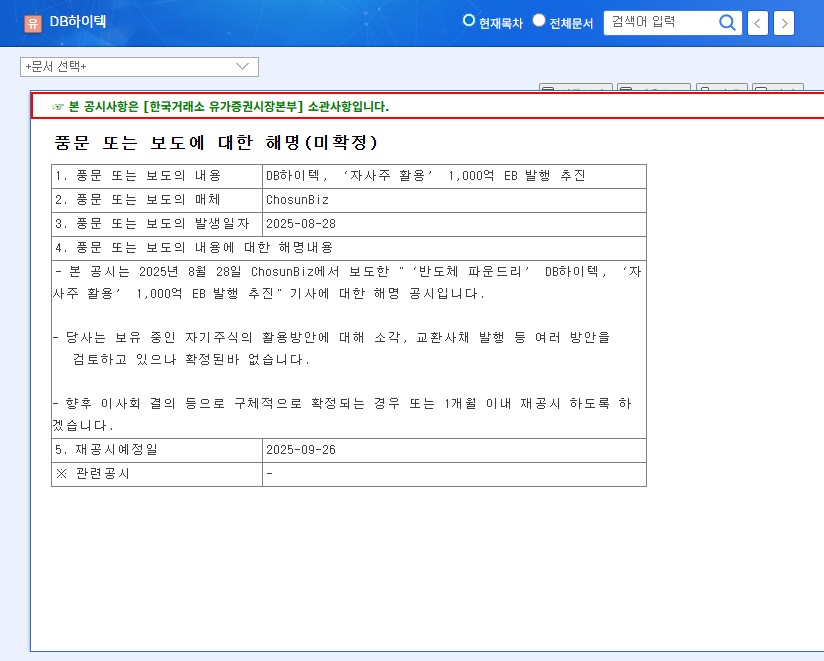

1. What’s Happening? DB Hitek Explores EB Issuance

On August 28, 2025, news broke that DB Hitek is considering issuing exchangeable bonds (EBs) worth 100 billion KRW using its treasury stock. While not yet finalized, the potential move has investors on alert.

2. Why the EB Issuance? Understanding the Rationale

DB Hitek is evaluating various options for utilizing its treasury stock, including cancellation and EB issuance. The funds raised through the EB issuance are expected to be used for improving financial structure, investing in new businesses, and strengthening R&D. This is interpreted as a strategic move to secure funding for new growth engines amidst intensifying competition in the 8-inch foundry industry.

3. What’s the Potential Impact? Analyzing the Implications

- Positive Aspects: Improved capital structure, enhanced financial flexibility, securing investment funds for new businesses.

- Negative Aspects: Redemption burden at maturity, increased interest expenses, uncertainty stemming from the undetermined outcome of treasury stock utilization.

Macroeconomic factors such as the global economic slowdown, semiconductor market uncertainty, and fluctuations in interest rates and exchange rates should also be considered.

4. What Should Investors Do? Investment Strategies

As the EB issuance is currently under review, it is advisable to await the company’s official announcement rather than making hasty investments. Carefully analyze DB Hitek’s fundamentals, the terms of the EB issuance, the planned use of funds, and manage risks associated with changes in macroeconomic conditions. With a re-disclosure expected within a month, prudent investors should thoroughly review the disclosed information before making any investment decisions.

Frequently Asked Questions (FAQ)

What are Exchangeable Bonds (EBs)?

Exchangeable bonds (EBs) are bonds with an embedded option to exchange them for a predetermined number of shares of a company’s common stock or other assets. Investors can receive interest payments until maturity or opt to exchange the bonds for shares, potentially profiting from stock price appreciation.

Will DB Hitek’s EB Issuance Positively Impact its Stock Price?

The impact of the EB issuance on DB Hitek’s stock price is uncertain. Various factors, including the terms of the issuance, the purpose of the funds raised, and market conditions, can influence stock price movements. Favorable terms and efficient use of funds could boost the stock price, while the opposite could negatively impact it.

What are the Key Investment Considerations?

Before investing, thoroughly analyze DB Hitek’s financial status, business outlook, and competitive landscape. Managing risks related to macroeconomic volatility, interest rate changes, and currency fluctuations is also crucial. Regularly monitor the company’s disclosures and consider seeking advice from financial professionals.

Leave a Reply