1. What Happened?

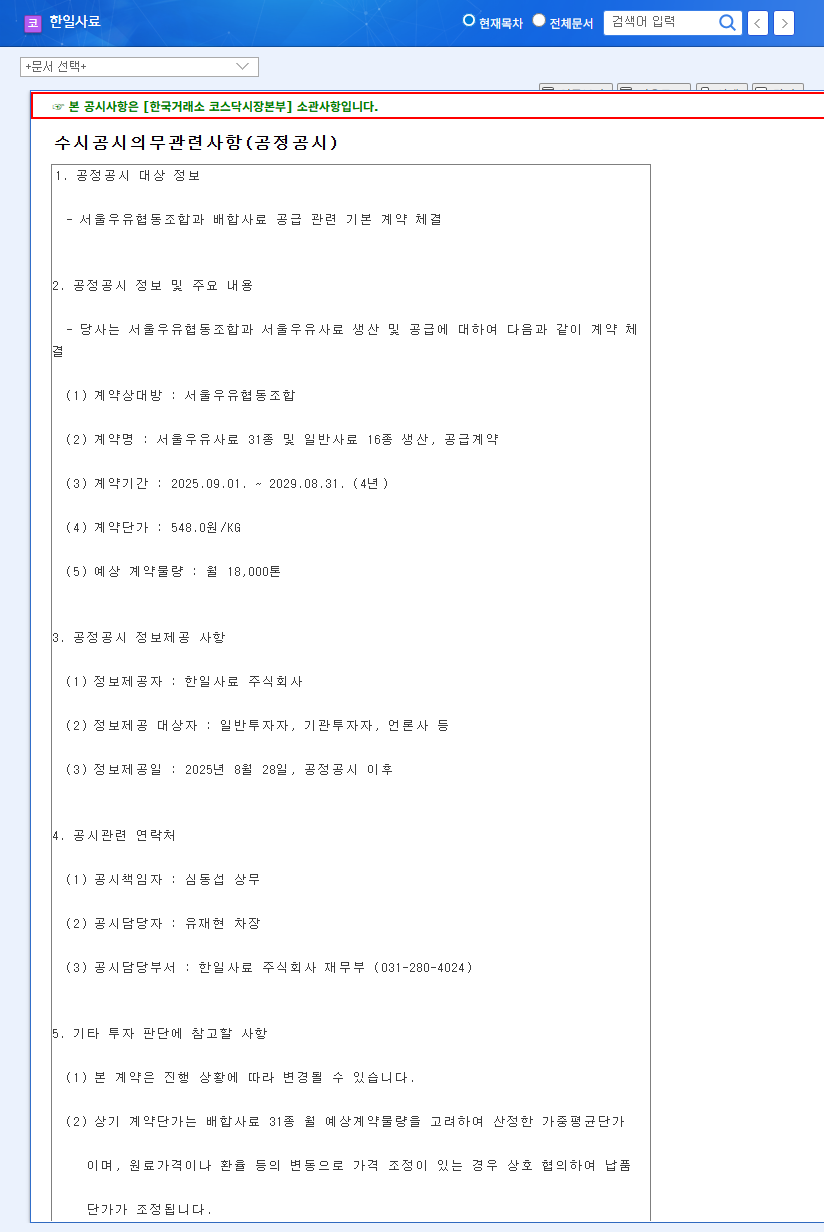

Hanil Feed Co., Ltd. signed a 4-year feed supply contract with Seoul Milk Cooperative on August 28, 2025. The contract volume is set at 18,000 tons per month, a 35% increase compared to the average of the past four years. This is expected to contribute significantly to the sales stability of Hanil Feed’s feed division.

2. Why is it Important?

The feed division accounts for approximately 35% of Hanil Feed’s total sales and has recently faced challenges due to intensifying competition and price declines. This contract offers an opportunity to overcome these difficulties and secure growth momentum by securing a stable sales outlet. In particular, the close cooperative relationship with Seoul Milk Cooperative is expected to positively impact the brand value of ‘Magic Feed’.

3. So, What’s Next?

- Positive Effects: Secured sales stability, driving external growth, enhancing brand credibility, potential for profitability improvement

- Risk Factors: Uncertainty in profitability due to fluctuations in raw material prices and exchange rates, increased transportation and production costs, potential changes in actual supply volume

The contract price is set at 548.0 KRW/KG but is subject to adjustments based on fluctuations in raw material prices and exchange rates. Therefore, investors should closely monitor raw material market trends and exchange rate fluctuations.

4. What Should Investors Do?

While this contract is expected to provide positive momentum for Hanil Feed’s mid-to-long-term growth, potential risk factors also exist. Investors should make prudent investment decisions by comprehensively considering these factors.

What are the key details of this contract?

Hanil Feed signed a contract to supply 18,000 tons of feed per month to Seoul Milk Cooperative for four years. This represents a 35% increase compared to the average supply volume over the past four years.

Will this contract positively impact Hanil Feed?

Yes, positive effects such as secured sales stability, external growth, and enhanced brand credibility are expected. However, attention should be paid to risk factors such as raw material price fluctuations and exchange rate changes.

What should investors be aware of?

Investors should carefully monitor raw material prices, exchange rate volatility, and market competition and make investment decisions by comprehensively considering these factors.

Leave a Reply