1. What Happened?

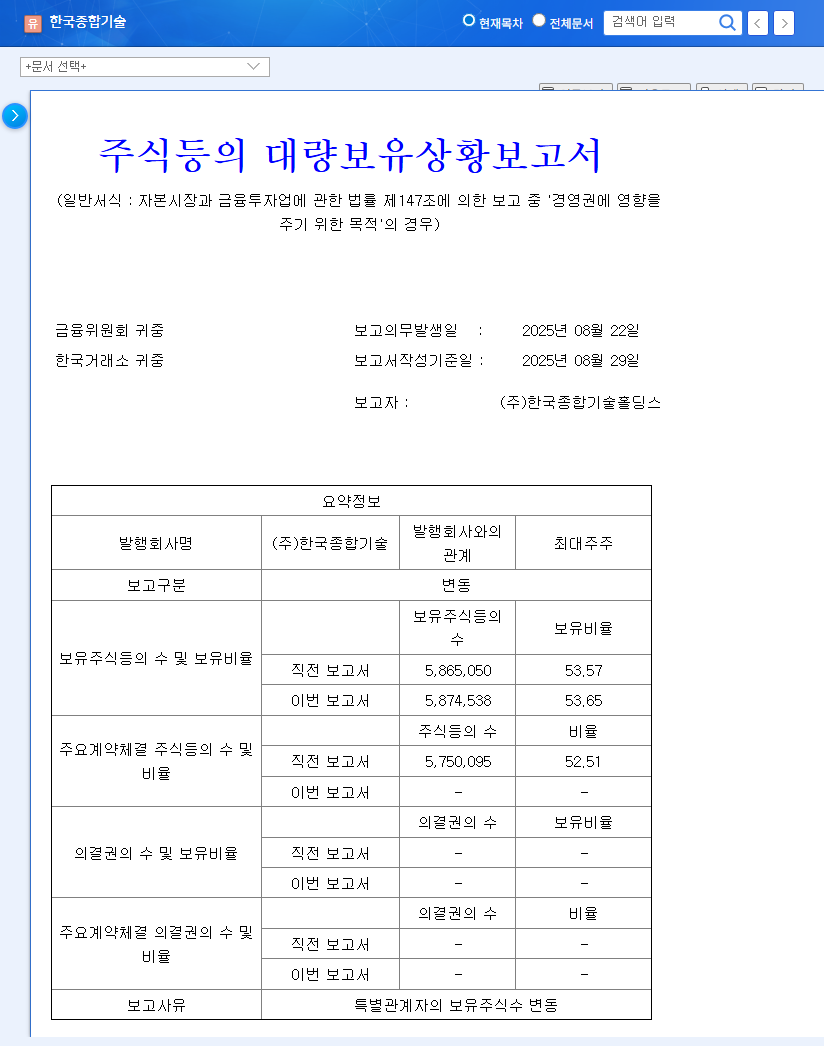

Korea Engineering Holdings slightly increased its stake in Korea Engineering Consultants Corp. from 53.57% to 53.65% through open market purchases by a related party, Kim Han-young. This change, aimed at influencing management control, is interpreted as a move to strengthen or maintain its control over the company.

2. Why Does it Matter?

Changes in the controlling shareholder’s stake are crucial indicators of a company’s stability and future direction. Given Korea Engineering Consultants Corp.’s current challenges with low profitability and high debt ratio, this stake change could spark hopes for management stabilization and fundamental improvement.

3. What’s Next?

In the short term, the direct impact on stock prices might be limited, but the signal of strengthened management control could positively influence investor sentiment. In the long term, a stable governance structure could lead to increased management efficiency and accelerated efforts to improve fundamentals. However, without substantial improvements in profitability and financial structure, the momentum for stock price increase will weaken.

4. Investor Action Plan

While this stake change can be seen as a positive signal, closely monitoring the company’s fundamental improvements is crucial. Investors should carefully consider their investment decisions while observing future earnings announcements and changes in management strategy.

Frequently Asked Questions

Will this stake change positively affect the stock price?

A positive short-term impact can be expected, but long-term stock price appreciation depends on the company’s fundamental improvements.

What is the main business of Korea Engineering Consultants Corp.?

Korea Engineering Consultants Corp. is a comprehensive construction engineering company, operating in various fields such as water and sewage, water resources, and urban planning. They are also expanding into renewable energy and environment/plant EPC businesses.

What is the current financial status of Korea Engineering Consultants Corp.?

The company faces challenges with low profitability and a high debt ratio. Management needs to focus on improving profitability and securing financial soundness.

Leave a Reply