1. What Happened?

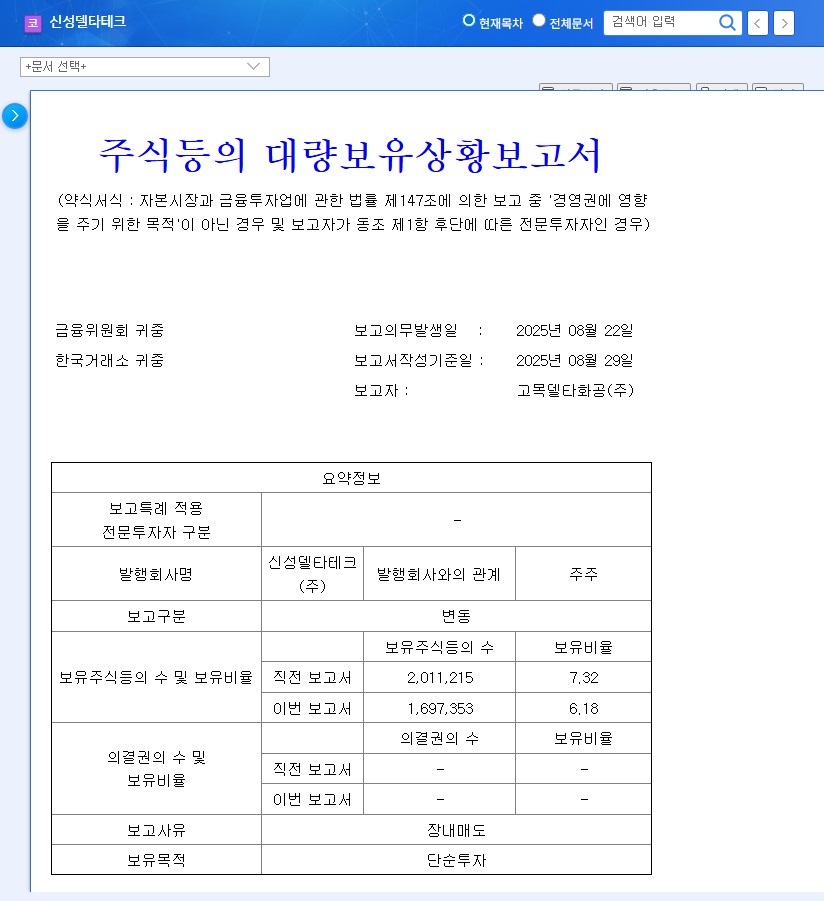

Gomoku Delta Chemical (Japan), a major shareholder of Shinsung Delta Tech, sold off a portion of its stake between August 7 and August 25, 2025. This reduced Gomoku Delta Chemical’s stake from 7.32% to 6.18%.

2. Why the Divestment?

The official reason for the sale has not been disclosed. It could be profit-taking, a change in investment strategy, or other reasons. Understanding the motivation behind the sale and the potential for further divestment is crucial.

3. How Will This Impact the Stock Price?

- Short-term Impact: The divestment could lead to negative investor sentiment, putting downward pressure on the stock price.

- Long-term Impact: Given Shinsung Delta Tech’s solid fundamentals (stable growth in the home appliance sector, expansion into the North American market for secondary batteries/auto parts, and entry into the robotics industry), a recovery after a short-term decline is possible. However, continued large-scale selling could prolong negative sentiment.

4. What Should Investors Do?

- Stay Calm: This event doesn’t directly damage the company’s fundamentals. Avoid overreacting to short-term market fluctuations and maintain an objective perspective.

- Focus on Fundamentals: Continuously monitor the stable performance of the home appliance sector, growth momentum in the secondary battery/auto parts sector, progress in new businesses (robotics), and evaluate the intrinsic value of the company.

- Monitor Further Sales: Keep an eye on whether Gomoku Delta Chemical continues to sell its stake and if any new investors are entering.

Frequently Asked Questions

Why did Gomoku Delta Chemical sell its stake?

The official reason hasn’t been disclosed. It could be profit-taking, a change in investment strategy, or other factors.

Is this divestment bad news for Shinsung Delta Tech?

While short-term negative investor sentiment and downward pressure on the stock price are expected, the direct impact on the company’s fundamentals is likely limited.

How should investors react?

Investors should avoid emotional reactions to short-term price fluctuations and focus on analyzing the company’s fundamentals, making investment decisions based on a long-term perspective.

Leave a Reply