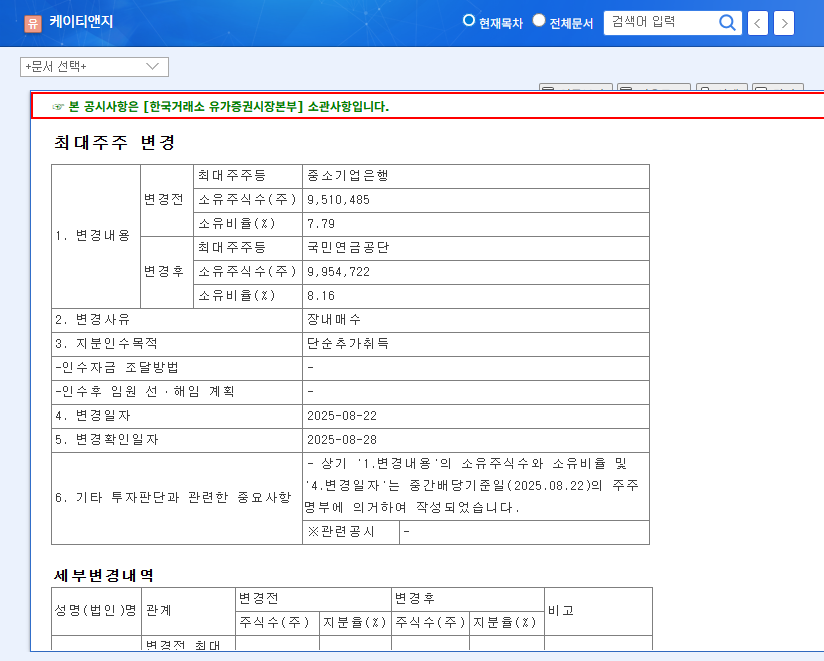

What Happened? : Change in KT&G’s Largest Shareholder

The NPS acquired an 8.16% stake in KT&G through open market purchases, surpassing the previous largest shareholder, the Industrial Bank of Korea (7.79%). While the NPS stated the acquisition was for ‘simple additional purchase,’ the market is speculating about the underlying reasons and potential consequences.

Why Does It Matter? : The Significance of NPS Investment

The NPS is not just an ordinary investor; it’s a major institutional investor representing national interests. Its investment decisions carry significant weight and are often seen as a positive signal for a company’s management transparency and stability. Given NPS’s focus on ESG and shareholder return, this investment could be a positive indicator for KT&G’s future direction.

What’s Next? : Stock Outlook and Investment Strategies

In the short term, positive investor sentiment and improved supply and demand dynamics could boost the stock price, but volatility should be considered. For the mid-to-long term, investment decisions should be based on a comprehensive analysis of KT&G’s fundamentals (tobacco business, health functional foods, real estate, etc.), NPS’s shareholder activities, ESG management, and shareholder return policies.

Investor Action Plan

- Short-term investment: Potential short-term gains due to improved supply and demand, but caution is advised due to potential volatility.

- Mid-to-long-term investment: Carefully analyze KT&G’s core business competitiveness, future growth drivers, and the direction of NPS’s shareholder activism before making investment decisions.

Frequently Asked Questions

Will NPS becoming KT&G’s largest shareholder positively impact the stock price?

While short-term positive sentiment and improved liquidity are possible, the long-term stock performance depends on KT&G’s earnings and business outlook.

What is the purpose of NPS’s investment?

Although NPS stated it was a ‘simple additional acquisition,’ market analysts interpret it as a strategic move for stable dividend income and long-term growth potential.

What are the key factors to consider when investing in KT&G?

Investors should consider factors such as intensifying competition in domestic and international tobacco markets, regulatory changes, and macroeconomic uncertainties. Thorough analysis is crucial before making investment decisions.

Leave a Reply