1. What Happened?

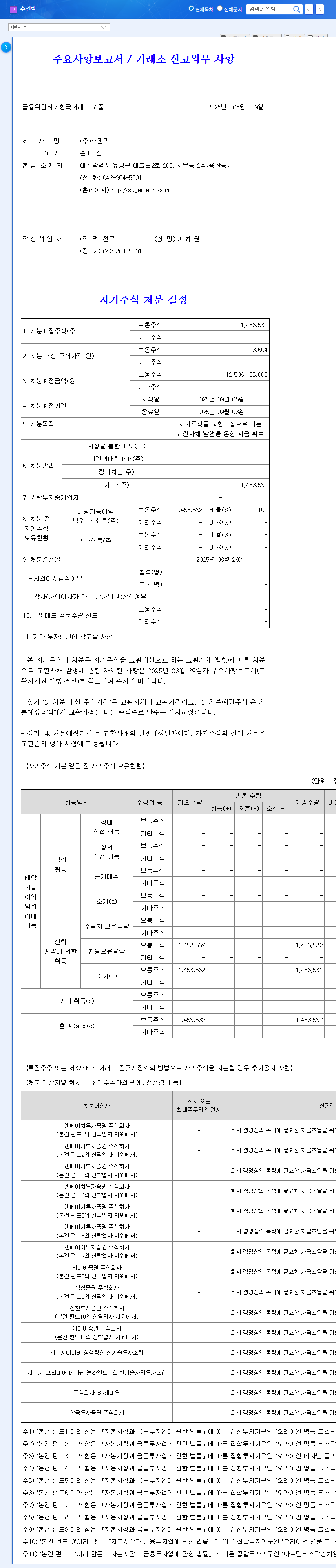

Sugentech announced the issuance of ₩12.5 billion in private convertible bonds on August 29, 2025. The conversion price is set at ₩8,604 (higher than the current price of ₩6,800 at the time of announcement), with Korea Investment & Securities and IBK Capital as the main investors.

2. Why the Convertible Bond Issuance?

Sugentech needs funding for business expansion, R&D, and entry into the femtech market, including strengthening its multiplex immunoblot assay, point-of-care testing (POCT), and digital healthcare platform. However, given the worsening profitability with a net loss of ₩8.4 billion in the first half of 2025, additional fundraising seems inevitable.

3. What are the Potential Impacts?

- Positive Impacts: Improved financial structure, increased investment in new businesses, potential for stock price momentum.

- Negative Impacts: Risk of stock price decline, increased financial burden, potential increase in future capital raising costs, concerns about raising capital during a period of net loss expansion.

Fluctuations in the KRW/USD exchange rate and the high-interest rate environment could also impact Sugentech’s financial status.

4. What Should Investors Do?

- Short-term Investment: Focus on the potential for short-term gains due to the discount of the current stock price compared to the conversion price, but carefully monitor profitability improvements.

- Mid- to Long-term Investment: The company’s technological competitiveness and growth potential are positive, but continued net loss expansion could raise concerns. Closely monitor R&D achievements and the success of new businesses.

- Risk Management: Consider potential equity dilution, stock price volatility, and the impact of exchange rate and interest rate fluctuations.

Q: What is the purpose of Sugentech’s convertible bond issuance?

A: Sugentech issued convertible bonds to secure funds for business operations, R&D, and investments in new businesses. They are expected to focus on entering the femtech market and strengthening their digital healthcare platform.

Q: How will the convertible bond issuance affect the stock price?

A: In the short term, expectations of corporate growth due to secured funding may create momentum for a stock price increase. However, in the long term, if the stock price fails to reach the conversion price, there is a risk of stock price decline due to abandoned conversions and potential equity dilution.

Q: What should investors be cautious about when investing in Sugentech?

A: Sugentech is currently experiencing an expanding net loss. Therefore, investors should carefully consider factors such as profitability improvement, the performance of new businesses, and fluctuations in exchange rates and interest rates before making investment decisions.

Leave a Reply