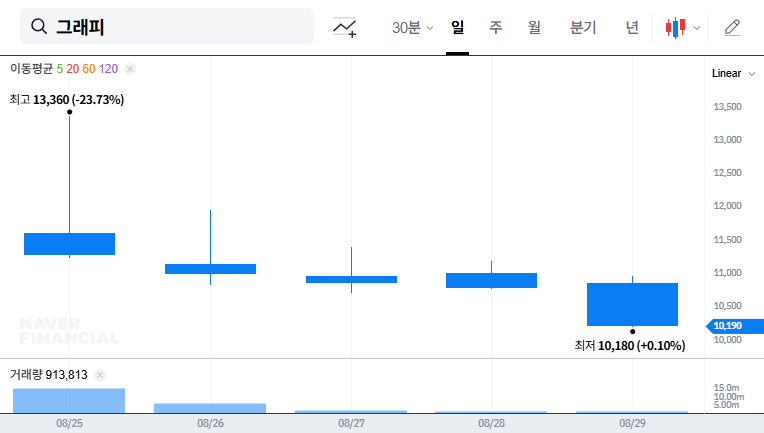

1. What Happened with Graphi?

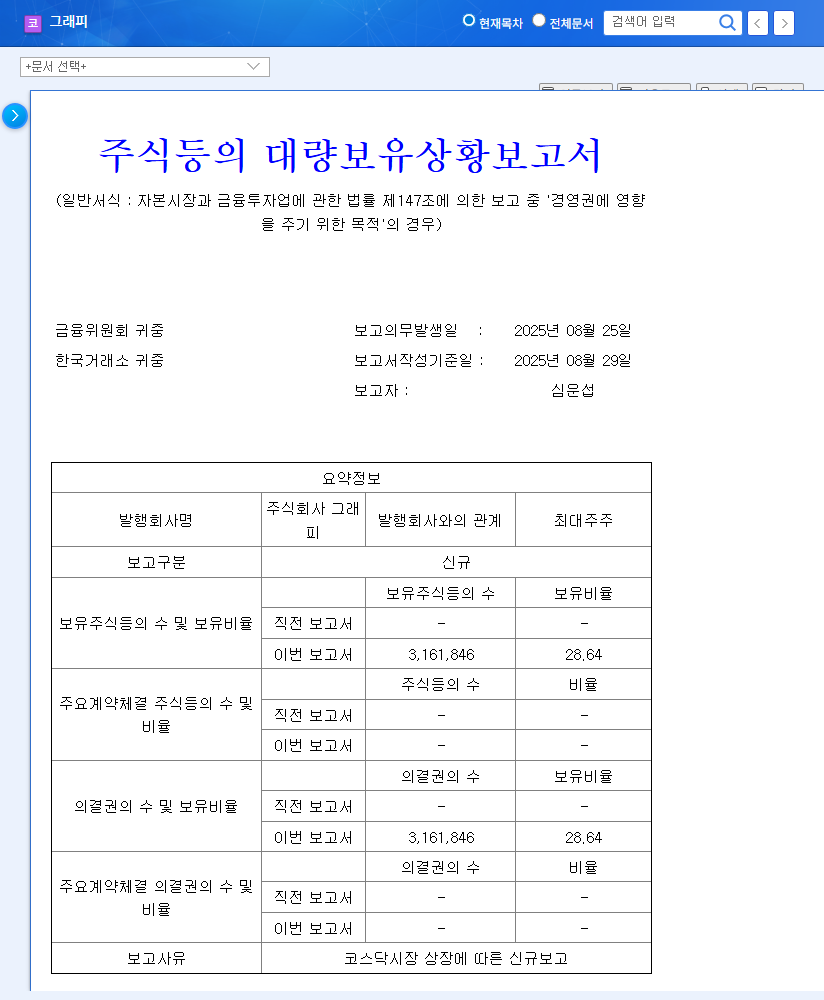

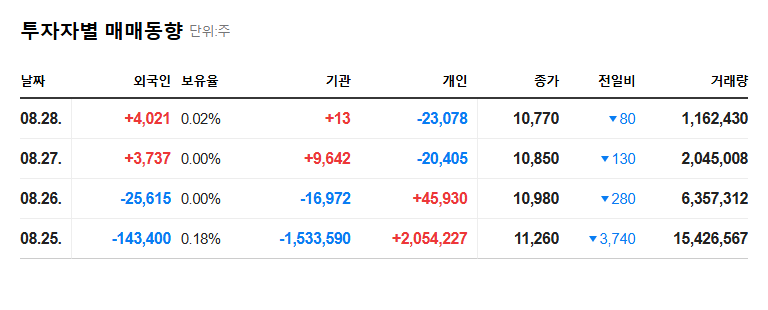

On August 29, 2025, Graphi’s CEO, Sim Un-seop, and other major shareholders disclosed a 28.64% stake in the company, reaffirming their commitment to maintaining control after the IPO.

2. Why Does it Matter?

While the shareholder disclosure signals management stability, the ₩29.25 billion raised through the IPO offers a potential lifeline for Graphi’s precarious financial situation. However, the company’s complete capital impairment, high debt ratio, and continuous operating losses revealed in the 2025 semi-annual report present significant challenges. Can the IPO proceeds effectively address these issues?

3. What Should Investors Do?

Graphi possesses innovative technology and growth potential, but its current financial difficulties cannot be ignored. Investors should look beyond the short-term IPO hype and carefully analyze the company’s fundamentals and financial health. Closely monitoring the use of IPO proceeds and tracking performance improvements is crucial.

- Key Checkpoints:

- Plan and feasibility of resolving capital impairment

- Debt ratio reduction trend

- Improvement in operating profit and cash flow

- Concrete results of new business ventures and overseas expansion strategies

4. Investor Action Plan

Investing in Graphi presents both high growth potential and considerable risk. Avoid impulsive decisions and prioritize thorough analysis and a cautious approach. Focus on evaluating the company’s long-term fundamentals and growth prospects rather than chasing short-term gains.

What is Graphi’s core technology?

Graphi has developed and commercialized the world’s first shape memory transparent orthodontic device (SMA). They also possess proprietary oligomer development and synthesis technology and 3D printing integrated solution capabilities.

What is Graphi’s financial status?

As of the first half of 2025, Graphi is completely capital impaired, with a high debt ratio and continuous operating losses. While they have raised capital through an IPO, their financial recovery remains uncertain.

Should I invest in Graphi?

Graphi has innovative technology, but its financial health is very weak. Carefully consider the financial status, operating performance improvement trends, and other factors before making an investment decision. A cautious approach is recommended.

Leave a Reply