1. Key Takeaways from the IR

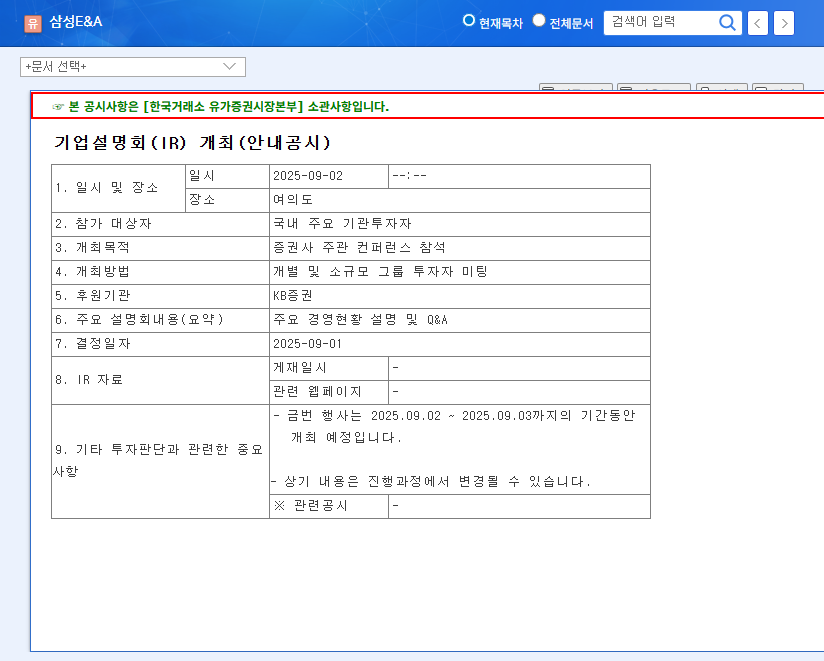

Samsung E&A presented its current business status and future plans at a conference hosted by securities firms. Here are the key takeaways:

- Business Report Corrections: Enhanced transparency by supplementing information on the progress and future plans of individual sales and supply contracts.

- Clarification of No Unreceived Projects: Confirmed the absence of unreceived projects for all ongoing contracts.

- Business Performance and Future Outlook: Presented the latest business performance, business plans, and growth outlook.

- Profitability Improvement Plan: Announced strategies to improve the sluggish financial performance of 2023 (operating profit: -6.6 billion KRW, net profit: -7.5 billion KRW).

- Major Business and Investment Strategies: Shared information on new orders, overseas business, and new growth engines.

- Q&A with Investors: Addressed various investor questions and clarified uncertainties.

2. Impact Analysis of the IR

This IR is expected to positively impact investor sentiment and resolve information asymmetry. However, continued sluggish performance, uncertainty surrounding future growth engines, and macroeconomic volatility can act as potential risks.

3. Investment Strategy Recommendations

Investors should carefully analyze the IR content, monitor order backlog and new order trends, and keep an eye on macroeconomic indicators. A cautious investment approach is necessary. Continuous monitoring of order achievement rates, overseas business strategies, cost reduction efforts, and responses to interest rate/raw material price fluctuations is particularly crucial.

FAQ

What were the key announcements from the Samsung E&A IR?

Key announcements included enhanced transparency through business report corrections, confirmation of no outstanding unreceived projects, updates on current business performance and future outlook, profitability improvement plans, and major business and investment strategies.

What investment strategies should be considered after the IR?

A cautious approach is recommended, including careful analysis of the IR content, monitoring of order trends, and observation of macroeconomic indicators. Investors should pay close attention to order achievement rates, overseas business strategies, and cost reduction efforts.

What is the outlook for Samsung E&A?

While the IR presented a positive outlook for future growth, potential risks remain, including continued poor performance, uncertainty about future growth drivers, and macroeconomic volatility. A comprehensive consideration of the IR content and market conditions is essential for making investment decisions.

Leave a Reply