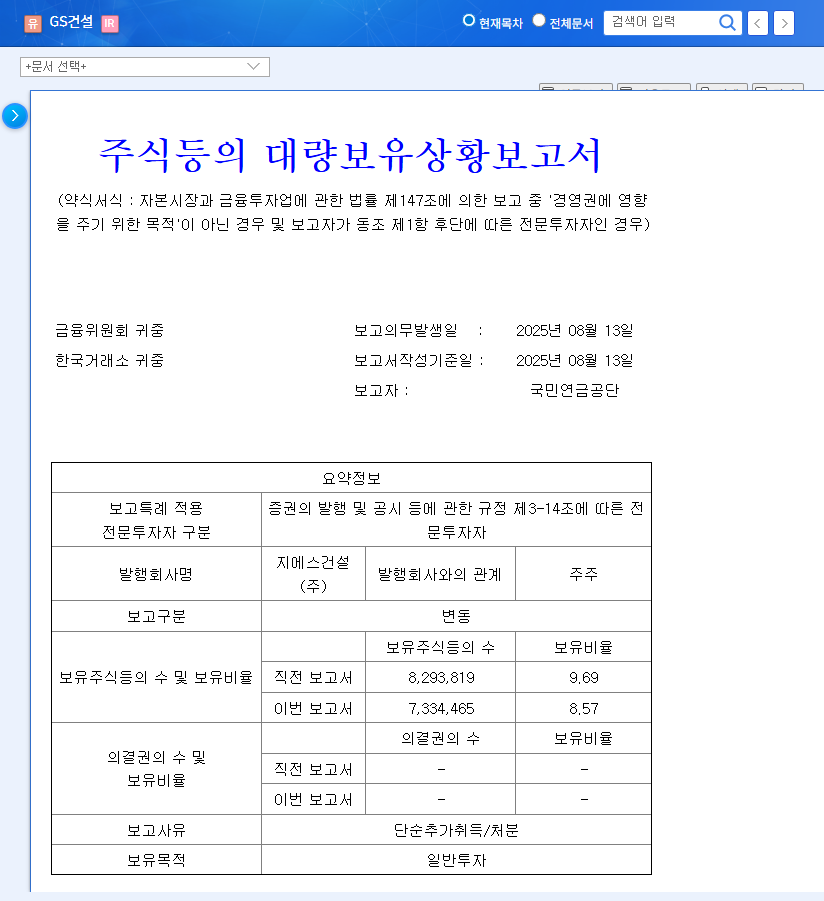

1. What Happened? : NPS Reduces GS E&C Stake to 8.57%

The NPS decreased its stake in GS E&C from 9.69% to 8.57%, a 1.12%p reduction. This could exert downward pressure on the stock price in the short term and potentially dampen investor sentiment.

2. Why Did This Happen? : Reasons Behind the Divestment and Hidden Implications

While the NPS stake reduction could be a simple portfolio adjustment, it may also reflect concerns about GS E&C’s fundamentals. The company currently faces uncertainties such as a slowdown in the construction industry, fluctuating raw material prices, and lawsuits related to the Incheon Geomdan apartment collapse.

3. Is GS E&C Really in Crisis? : Fundamental Analysis and Positive Factors

Despite the challenges, GS E&C has positive aspects, including stable long-term contracts, investments in new businesses (modular housing, water treatment, etc.), and strengthened ESG management. The expansion of the North American/European Prefab housing business and the enhancement of competitiveness in the water treatment business are expected to be future growth drivers.

- Strengths: Stable contract base, new business and ESG strengthening, efforts for financial soundness, business portfolio diversification

- Weaknesses: Construction market volatility, unstarted projects and delayed payments, uncertainty related to lawsuits, exchange rate volatility, raw material price fluctuations

4. What Should Investors Do? : Action Plan for Investors

While the NPS stake reduction can be a short-term negative factor, the long-term growth potential of GS E&C should be considered. Before making investment decisions, it’s crucial to comprehensively analyze the reasons for the NPS sale, the construction market outlook, raw material price and exchange rate trends, and the progress of new businesses.

Frequently Asked Questions

How will the NPS stake reduction affect GS E&C’s stock price?

In the short term, increased selling pressure and dampened investor sentiment could lead to a decline in stock price. However, the long-term impact will depend on GS E&C’s fundamentals and market conditions.

Is it advisable to invest in GS E&C?

This report does not include investment recommendations. Investment decisions should be made at the investor’s own discretion and responsibility. Carefully consider GS E&C’s fundamentals, market conditions, and risk factors before making any investment decisions.

How do you assess GS E&C’s future growth potential?

GS E&C possesses positive aspects such as a stable contract base, new business investments, and strengthened ESG management. However, comprehensive analysis is necessary as there are also risk factors such as construction market volatility and ongoing litigation.

Leave a Reply