KakaoPay’s ₩100 Billion Investment: What Happened?

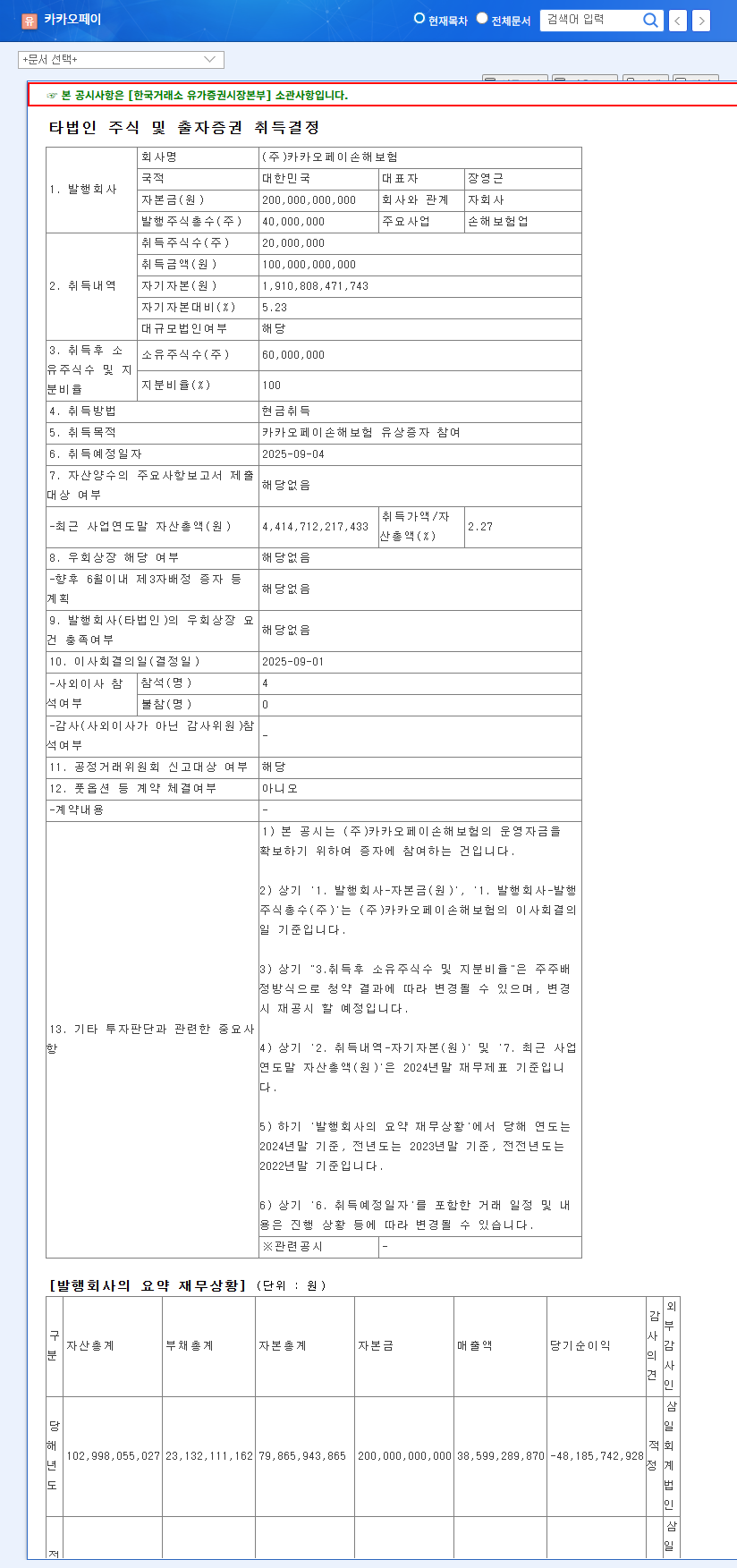

KakaoPay plans to acquire 100% ownership of KakaoPay Non-life Insurance through a ₩100 billion rights offering scheduled for September 4, 2025. This is interpreted as a strategic move to establish itself as a comprehensive financial platform.

What’s the Rationale Behind the Investment?

KakaoPay aims to strengthen its competitiveness and create synergy in the insurance sector through this investment. By making KakaoPay Non-life Insurance a wholly-owned subsidiary, KakaoPay anticipates expanding its insurance services and enhancing its platform competitiveness. This could serve as a crucial stepping stone for securing long-term growth momentum.

So, What’s the Investment Outlook?

Positive Aspects

- • Strengthened Insurance Business: Enhanced position as a comprehensive financial platform through synergy with KakaoPay Non-life Insurance.

- • New Revenue Streams: Potential for securing new growth engines by entering the insurance market.

Neutral/Potential Negative Aspects

- • Short-Term Financial Burden: Potential deterioration of short-term cash flow due to the ₩100 billion investment.

- • Business Performance Uncertainty: Uncertainty surrounding initial investment costs and profitability of the insurance business.

- • Market Conditions: Possibility of worsening macroeconomic conditions such as economic slowdown and interest rate hikes.

What Should Investors Do?

Investors should closely monitor the performance of KakaoPay’s insurance business and its efforts to improve profitability. It’s essential to make investment decisions from a long-term perspective, rather than being swayed by short-term stock price fluctuations. Continuous monitoring of macroeconomic changes and competitor trends is also necessary.

Frequently Asked Questions

What is KakaoPay Non-life Insurance?

KakaoPay Non-life Insurance is a subsidiary of KakaoPay that provides digital non-life insurance services.

How will this investment impact KakaoPay’s stock price?

In the short term, there is a possibility of a stock price decline due to the burden of the investment amount. However, in the long term, there is potential for stock price appreciation depending on the performance of the insurance business.

What is the future outlook for KakaoPay?

The success of the insurance business and the improvement of the parent company’s profitability are expected to determine KakaoPay’s future growth.

Leave a Reply