1. L&K Bio’s IR: What was discussed?

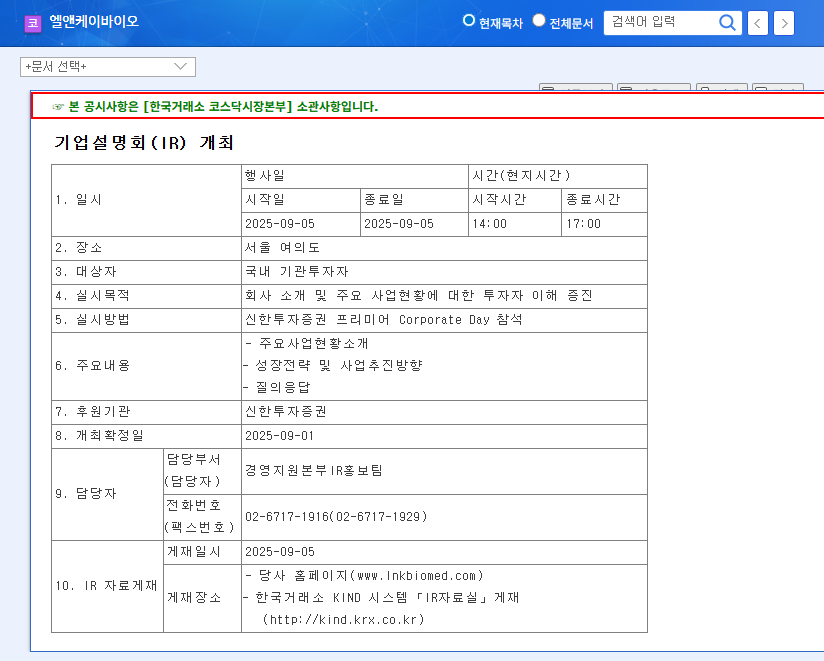

L&K Bio’s IR meeting on September 5, 2025, covered key business updates including the US market entry plan for its Pectus chest implant, strong overseas revenue growth, and R&D investment status. The company also addressed investor concerns regarding continued net losses, convertible bonds, and raw material price volatility.

2. Positive vs. Negative Factors: Where lies the investment opportunity?

2.1. Positive Factors: Growth Momentum

- Robust revenue growth: 97% of revenue from overseas markets demonstrates global competitiveness, particularly in the Americas, creating synergy expectations for Pectus’ US market entry.

- New business momentum: FDA approval for Pectus sets the stage for full-scale US market entry, a key driver of future revenue growth.

- Strong R&D capabilities: Continuous R&D investment reinforces technological competitiveness and fuels new pipeline development.

2.2. Negative Factors: Challenges to overcome

- Continued net loss: Increased R&D expenses contribute to the need for improved profitability.

- High volume of convertible bonds: Potential stock dilution and interest expense burden.

- Raw material price volatility: Requires effective cost management and supply stabilization strategies.

3. Post-IR: What should investors do?

The IR meeting highlighted both L&K Bio’s growth potential and risks. Investors should carefully review the presented plans for profitability improvement, convertible bond management, and new business performance. It’s crucial to monitor subsequent earnings announcements to confirm tangible improvements and assess the company’s strategies for navigating macroeconomic changes.

Frequently Asked Questions

What is L&K Bio’s main business?

L&K Bio develops, manufactures, and sells medical devices, including spinal and chest implants.

When will Pectus, the chest implant, launch in the US market?

Pectus is expected to launch in the US market in the second half of 2025.

What is L&K Bio’s financial status?

While the company is experiencing robust revenue growth, it continues to report net losses, requiring improvements in profitability. The large volume of convertible bonds also raises concerns about potential stock dilution.

Leave a Reply