What Happened? – 5% Stake Acquisition Reported

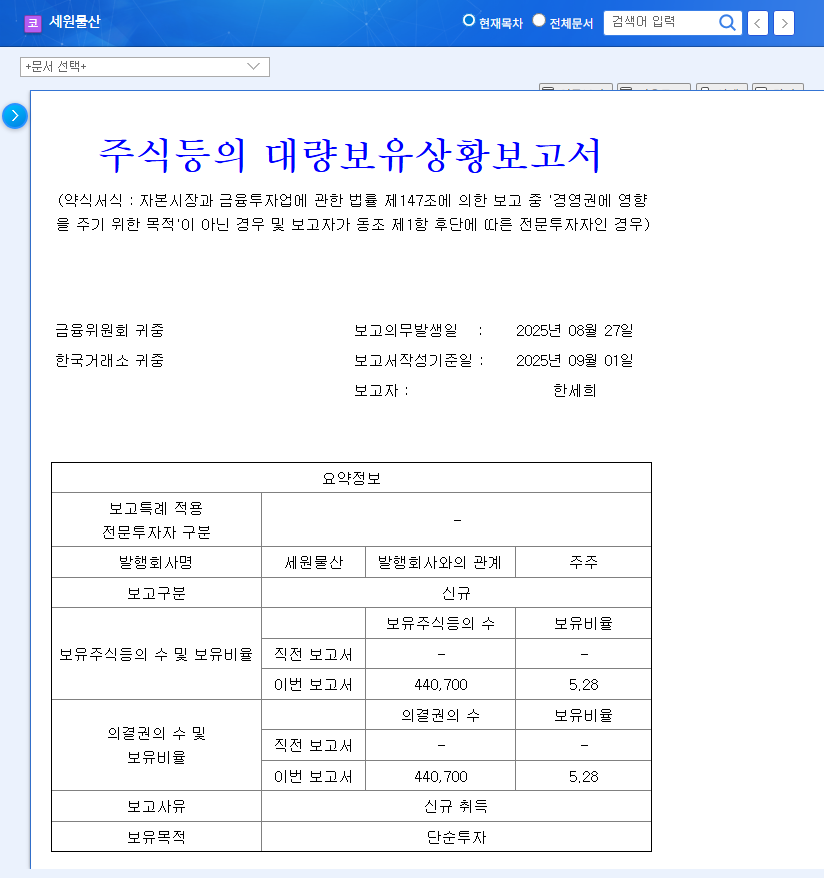

Han Se-hee acquired 5.28% of Sewon Corporation’s shares, according to a recently disclosed large holding report (simplified). The stated purpose of the acquisition is ‘simple investment.’

Why Does This Matter? – Analyzing the Impact

Positive Aspects

- • Acquiring over 5% stake can be interpreted as a positive signal regarding the company’s future value.

- • It may provide momentum for stock price increase and suggests the possibility of further acquisitions.

- • Sewon’s recent return to profitability and increased net income reinforce these expectations.

Negative/Cautionary Aspects

- • The possibility of future management disputes cannot be ruled out.

- • The ‘simplified’ report lacks detailed information on the acquisition’s intent and future plans.

What Should Investors Do? – Investment Strategies

Short-Term Strategy

- • Invest cautiously, being mindful of short-term price volatility.

- • Monitor further stake changes and announcements regarding management participation.

Mid- to Long-Term Strategy

- • Observe the company’s continuous improvement in fundamentals (sales recovery, profit stabilization, etc.).

- • Analyze the automotive industry outlook and the performance of major client companies.

- • Consider the impact of exchange rate fluctuations and other macroeconomic indicators.

Frequently Asked Questions

Why is the 5% stake acquisition significant?

Holding over 5% of shares allows shareholders to participate in major decision-making, including exercising proposal rights at shareholder meetings, making it a potentially significant change that could influence management.

What is the outlook for Sewon Corporation?

While the company has recently returned to profitability, its future performance depends on various factors such as the automotive industry climate, the performance of major clients, and the actions of the major shareholder, requiring continuous monitoring.

What precautions should investors take?

While the stated purpose is ‘simple investment,’ uncertainties remain, including the possibility of future management disputes. Therefore, investors should approach investment decisions with caution.

Leave a Reply