Amorepacific IR Event: Key Analysis

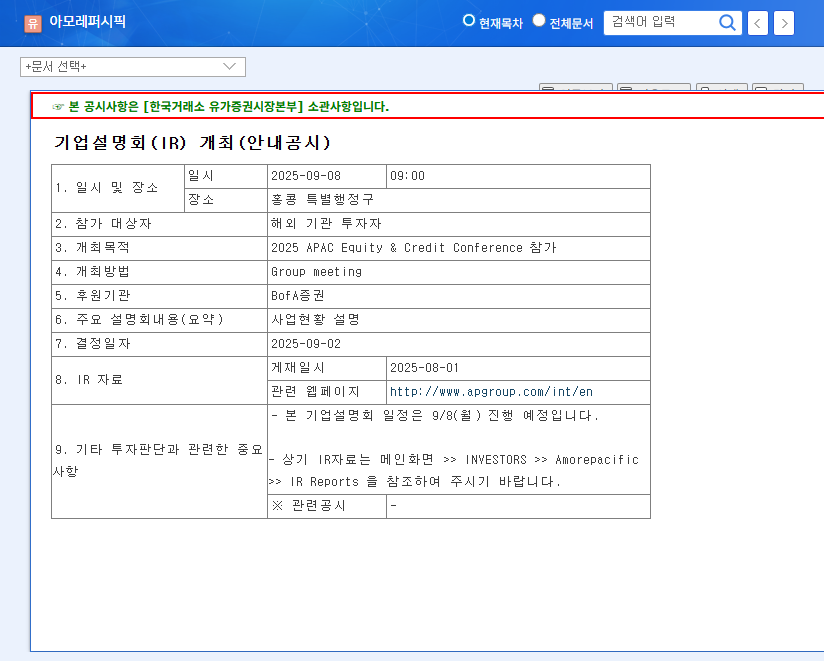

On September 8, 2025, Amorepacific will hold an IR session for investors at the APAC Equity & Credit Conference. The company will share its business strategies along with its first-half earnings results. We will take a close look at Amorepacific’s growth potential and investment strategies in the global beauty market.

Amorepacific’s Growth Drivers and Investment Opportunities

- Overseas Business Expansion: Demonstrating global competitiveness with a high growth rate of 26.6% in the Americas, EMEA, and Asia. The acquisition of Cosrx is expected to significantly contribute to portfolio diversification and synergy creation.

- Solid Domestic Business: Maintains steady growth of 5.1% through strengthening core brand competitiveness and new growth channel strategies.

- R&D Investment: An R&D investment of 3.33% of sales demonstrates efforts for continuous innovation and securing future growth engines.

- Robust Financial Structure: High retained earnings and a stable debt ratio ensure investment stability.

Risk Factors to Consider When Investing

- Delayed Recovery of the Chinese Market: The slow recovery of the Chinese market requires continuous monitoring and response strategies.

- Changes in the External Environment: Volatility in raw material prices and exchange rates can affect profitability.

- Intensifying Competition: Preparedness for intensifying competition in domestic and overseas markets is necessary.

Action Plan for Investors

The IR session will provide detailed information on overseas market growth strategies, plans to maximize Cosrx synergies, risk management strategies for the Chinese market, R&D investment results, and ESG management enhancement plans. Investors can gain insights needed for investment decisions based on this information. We recommend thoroughly reviewing the IR materials and paying close attention to the management’s presentations.

Frequently Asked Questions

What are Amorepacific’s main growth strategies?

Amorepacific is accelerating growth through overseas market expansion, particularly in the Americas and Asian markets. The company is also pursuing a strategy to diversify its brand portfolio and create synergy effects through the acquisition of Cosrx.

What is Amorepacific’s strategy in the Chinese market?

Amorepacific aims to expand its market share in the changing Chinese market by strengthening brand competitiveness and enhancing digital marketing. The company seeks to maintain growth momentum through careful analysis of the evolving market situation and flexible response strategies.

What is the status of Amorepacific’s ESG management?

Amorepacific carries out various activities for sustainable management and is enhancing corporate value through environmental protection, fulfilling social responsibilities, and establishing transparent corporate governance. Strengthening ESG management is a key strategy for long-term growth.

Leave a Reply