Daechang Solution IR: What’s it about?

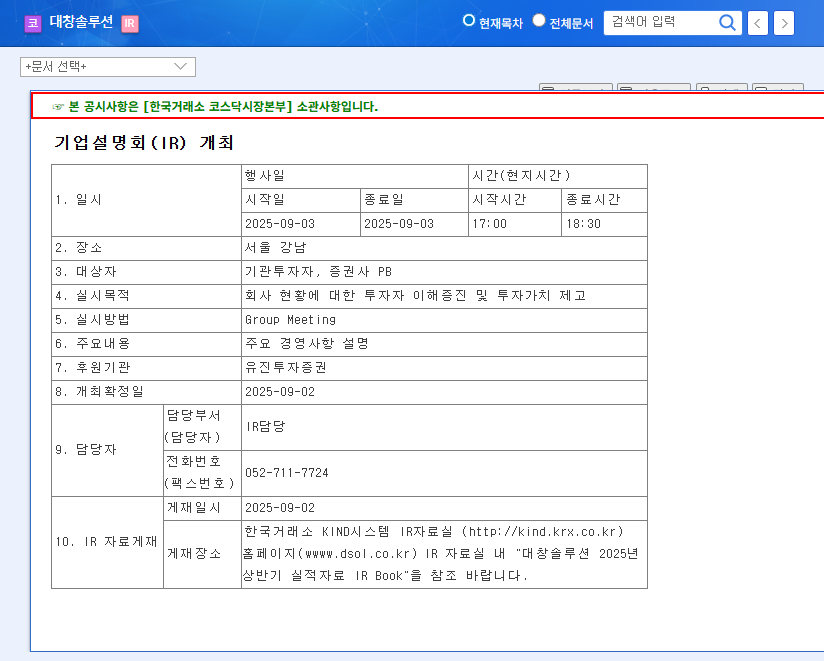

Daechang Solution is holding an IR session for investors on September 3rd. The main purpose is to address investor questions about the growth momentum in the shipbuilding equipment business and the company’s financial difficulties.

Why is Daechang Solution holding an IR?

The shipbuilding industry is booming due to stricter IMO environmental regulations and increased orders for LNG-powered vessels. Although Daechang Solution is also showing solid growth in the shipbuilding equipment sector, its profitability is deteriorating due to sluggish performance in the power generation equipment and nuclear waste sectors, along with high financing costs. It is crucial for the company to transparently disclose its current status and future strategies through this IR and restore investor confidence.

Key IR Content and Investment Points

- Positive factors: Continued growth momentum expected due to the shipbuilding boom.

- Negative factors: Deteriorating financial structure, increasing financing costs, and sluggish performance in some business segments.

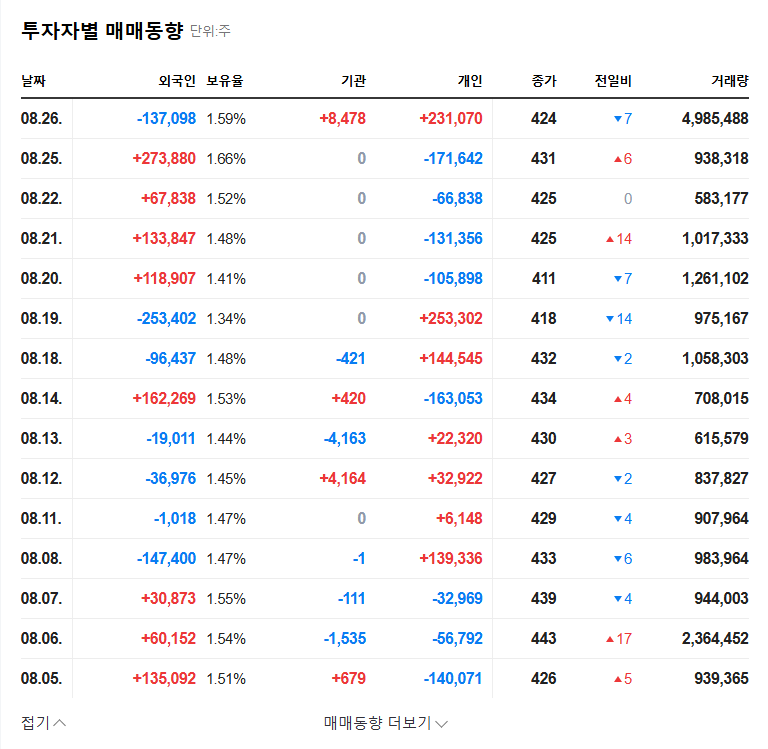

- Investor action plan: Carefully review the financial structure improvement plan, business diversification strategy, and stock price volatility management measures that will be presented at the IR. In particular, whether a concrete roadmap for reducing financing costs and debt ratio is presented will be an important criterion for investment decisions.

Financial Indicators Analysis

| Indicator | 2022.12 | 2023.12 | 2024.12 (E) | 2025.12 (E) |

| Revenue (KRW Billion) | 1,284 | 928 | 928 | 982 |

| Operating Profit (KRW Billion) | 115 | -66 | -131 | 30 |

| Net Income (KRW Billion) | 21 | -75 | -125 | -18 |

| Debt Ratio (%) | 129.55 | 154.89 | 197.95 | – |

Frequently Asked Questions

What are Daechang Solution’s main businesses?

Daechang Solution operates in shipbuilding equipment, power generation equipment, and nuclear waste treatment businesses. Growth in the shipbuilding equipment sector is expected due to the recent shipbuilding boom.

What should investors be aware of when investing in Daechang Solution?

Investors should pay close attention to the high debt ratio and the increasing trend of financing costs. It is important to carefully consider the feasibility of the financial structure improvement plan presented at the IR.

What is the future outlook for Daechang Solution?

The shipbuilding boom is a positive factor, but whether or not the financial structure improves is expected to significantly impact future earnings and stock prices. It is important to check the management’s vision and strategy presented at the IR.

Leave a Reply