1. Share Buyback and Cancellation: What Happened?

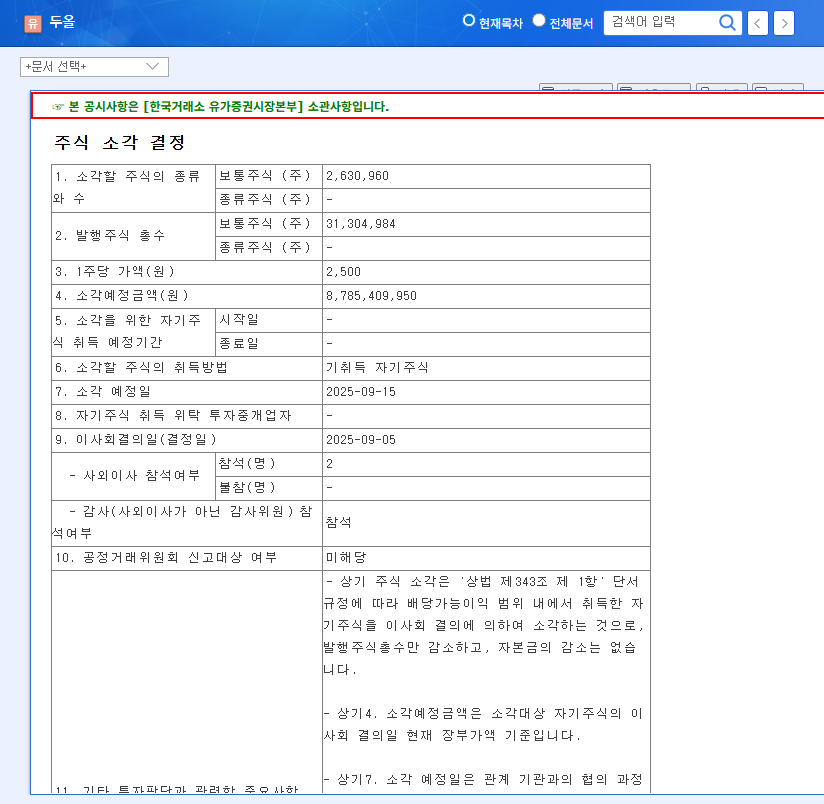

On September 5, 2025, Doowon announced its decision to buy back and cancel 2,630,960 common shares, equivalent to approximately KRW 8.8 billion. The cancellation is scheduled for September 15th and utilizes previously acquired treasury shares.

2. Why Does Share Buyback Matter? (Analyzing Positive and Negative Impacts)

- Positive Impacts:

- Increase in Earnings Per Share (EPS) and Book Value Per Share (BPS)

- Reinforced Shareholder Return Policy (Expected Stock Price Boost)

- Improved Capital Efficiency

- Potential Negative Impacts:

- Short-term Decrease in Liquidity

- Reduced Future Growth Investment Capacity (However, Doowon is currently continuing R&D investments)

3. What is Doowon’s Current Situation? (Corporate Fundamentals Analysis)

Doowon recorded consolidated revenue of KRW 404 billion (5% YoY growth) and operating profit of KRW 29.8 billion (19.6% YoY growth) in the first half of 2025, demonstrating growth. Its credit rating has also been upgraded to A-, and the company continues to invest in R&D for eco-friendly materials. However, risks such as exchange rate and raw material price volatility, potential global economic slowdown, and declining sales in separate legal entities need to be monitored.

4. What Should Investors Do? (Investment Strategy)

While share buybacks can positively affect stock prices in the short term, long-term investment decisions should consider the company’s fundamentals and external environment changes. Continuous monitoring of Doowon’s future performance, shareholder return policies, and risk management capabilities is crucial.

FAQ

What is a share buyback?

It refers to a company repurchasing its own shares and removing them from circulation. This reduces the number of outstanding shares, increasing the value per share.

How does a share buyback affect the stock price?

Generally, it positively impacts the stock price due to increased value per share. However, the effect can vary depending on market conditions and the company’s fundamentals.

Is Doowon’s share buyback decision positive?

It can be interpreted positively in terms of strengthening shareholder return policy and increasing capital efficiency. However, when making investment decisions, comprehensive consideration of the company’s financial situation and external environmental factors is necessary.

Leave a Reply