Saltlux Warrant Exercise: What Happened?

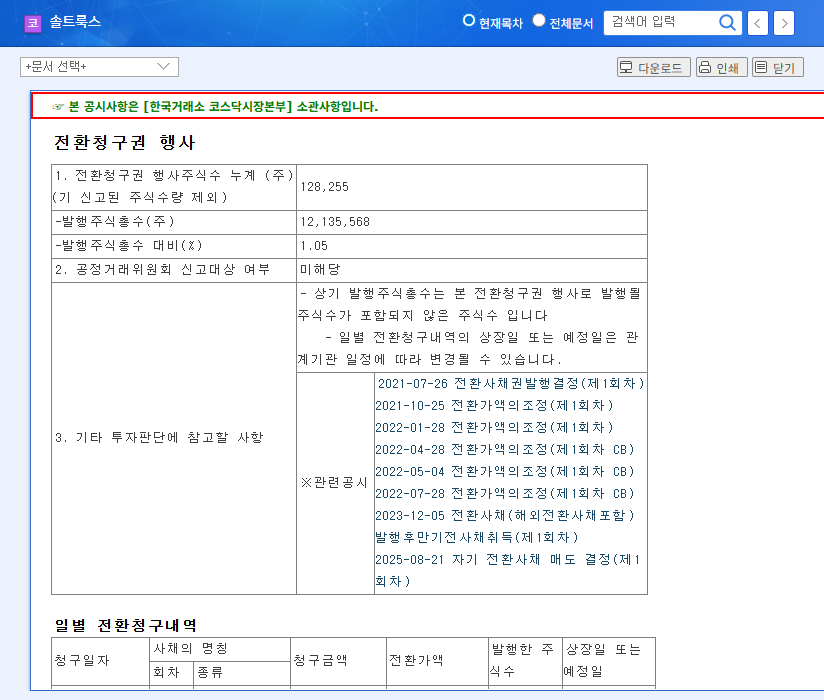

On September 5, 2025, Saltlux announced a warrant exercise amounting to approximately KRW 1.5 billion. 128,255 shares will be converted at an exercise price of KRW 12,120, with the new shares listed on September 25th. This represents about 0.39% of the company’s market capitalization.

Why is the Warrant Exercise Important?

This warrant exercise is expected to contribute to improving Saltlux’s financial structure and capital increase. As convertible bonds are converted into stocks, the debt ratio will decrease, and the secured funds can be used for R&D investment and new business expansion. However, the potential dilution of existing shareholders’ stakes due to the issuance of new shares should also be considered.

So, What Will Happen to the Stock Price?

- Short-term Impact: The direct impact on the stock price is expected to be limited due to the small size of the exercise. However, temporary volatility may occur on the new share listing date.

- Long-term Impact: While financial structure improvement can be a positive factor, Saltlux’s ultimate stock price direction depends on strengthening its AI technology competitiveness, improving profitability, and successfully expanding into the global market.

What Should Investors Do?

Instead of reacting to short-term price fluctuations, investors should focus on Saltlux’s core business performance and long-term growth potential. The warrant exercise can be interpreted as a positive signal, but investment decisions should be made cautiously after thoroughly analyzing the company’s fundamentals.

Frequently Asked Questions

What is Saltlux’s warrant exercise?

A warrant is a right to convert into company shares at a predetermined price (exercise price) within a specified period. This warrant exercise by Saltlux means that convertible bond holders are exercising their right to acquire shares.

How does the warrant exercise affect the stock price?

Generally, a warrant exercise can lead to the dilution of existing shareholders’ stakes due to the increase in the number of shares from the new share issuance. However, in the case of Saltlux, the size of the exercise is negligible compared to the market capitalization, so the short-term impact on the stock price is expected to be limited. In the long term, the effect of improving the financial structure can be positive.

What should investors be aware of?

Investors should focus on Saltlux’s AI technology competitiveness, profitability improvement, and global market expansion strategy, rather than short-term price volatility. These factors will be the key drivers in determining long-term investment value.

Leave a Reply