1. What Happened?

Doosan Fuel Cell signed a 20-year and 7-month LTSA with Ulsan Enerute No. 2, extending until March 2046, for the maintenance of its fuel cell systems.

2. Why Does It Matter?

This agreement signifies more than just a contract; it holds significant weight for Doosan Fuel Cell’s future.

- Stable Revenue Stream: The long-term contract ensures a predictable and stable service revenue stream. Service revenue typically carries higher margins than product sales, potentially boosting profitability.

- Strengthened Customer Relationships: A long-term partnership fosters trust with clients, increasing the likelihood of future contracts.

- Enhanced Cash Flow Predictability: The extended contract duration improves cash flow predictability, aiding in financial planning.

3. What’s Next?

While positive, the contract comes with considerations:

- Undisclosed Contract Value: The exact financial details remain undisclosed, making it difficult to fully assess the impact on profitability.

- Long-Term Maintenance Costs: The 20+ year timeframe necessitates careful consideration of potential technological advancements and fluctuations in maintenance costs.

4. What Should Investors Do?

Investors should focus on the long-term impact on the company’s fundamentals rather than short-term stock fluctuations. A comprehensive investment decision requires considering Doosan Fuel Cell’s financial health, the hydrogen economy’s growth prospects, and government policies. Monitoring the release of the contract’s details and future earnings reports will be crucial for informed investment strategies.

Frequently Asked Questions

Will this contract help Doosan Fuel Cell improve its losses?

While the long-term service revenue is expected to contribute to improved profitability, the undisclosed contract value makes it challenging to determine the precise impact.

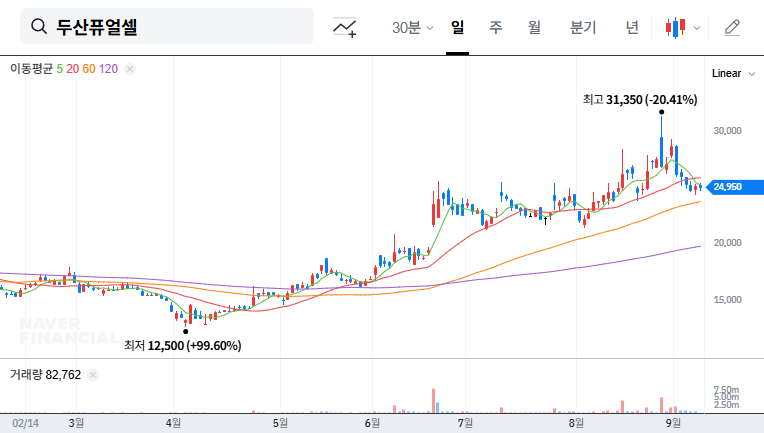

What is the outlook for Doosan Fuel Cell’s stock price?

Short-term stock price predictions are difficult. However, this contract can be viewed as a positive factor in the long run. Overall market conditions and company fundamentals should be considered.

What should investors be cautious about?

Investors should closely monitor details of the contract, future earnings reports, and changes in hydrogen economy-related policies. Caution and thorough research are advised before making investment decisions.

Leave a Reply