1. What Happened?: Decoding the Large Shareholding Report

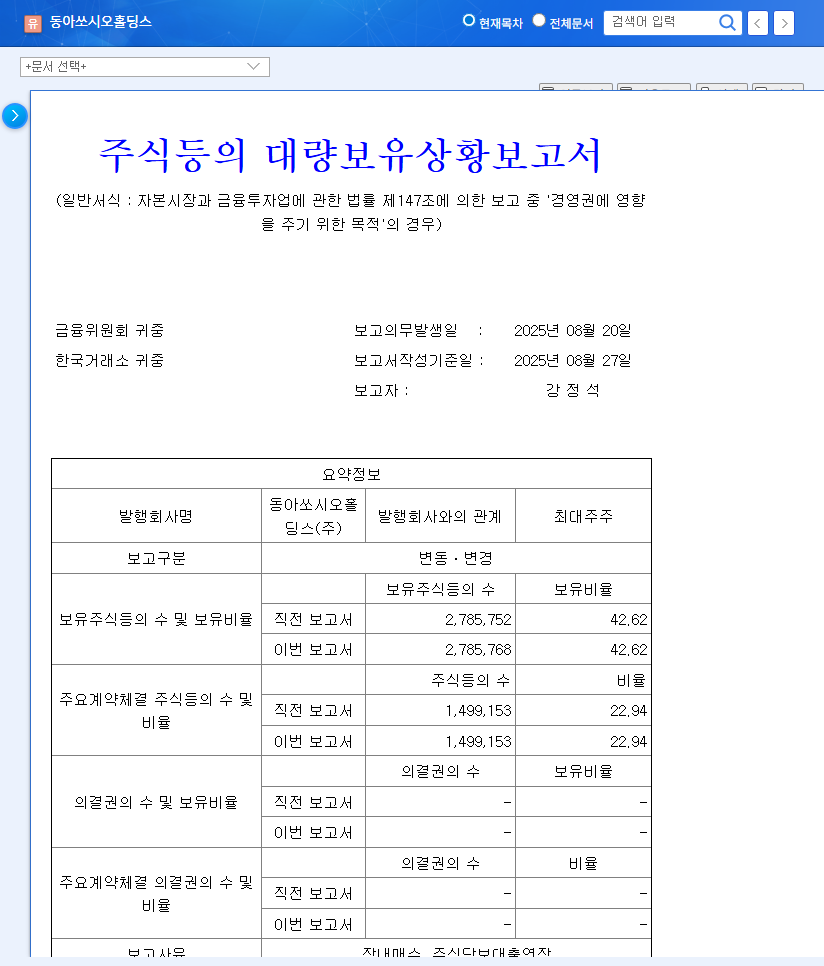

Chairman Kang filed the report, maintaining his existing 42.62% stake, citing ‘market purchases’ and ‘loan extensions on shares.’ While the small market purchases can be interpreted as a positive signal, their limited scale suggests a minimal short-term impact on the stock price. The loan extensions are likely due to funding needs, but require further risk management regarding collateral ratio changes. Crucially, the report states ‘influence on management rights’ as the purpose of holding the shares. This indicates Chairman Kang’s strong commitment to maintaining management control, raising expectations for management stability and enhanced corporate value.

2. Why It Matters: Fundamental and Market Analysis

Dong-A Socio Holdings is showing robust performance, driven by the explosive growth of biosimilars (Stellara biosimilar). The diversified business portfolio, including over-the-counter drugs, logistics, packaging, and bottled water, provides a stable growth foundation. Improved debt ratios are also positive. However, potential risks like the suspension of redemptions in certain funds, potential slowdown in the logistics sector due to global economic downturn, and macroeconomic variables such as exchange rate and interest rate fluctuations require continuous monitoring.

3. What Should You Do?: Investment Strategy

Considering the high growth potential of the bio division and the diversified business portfolio, Dong-A Socio Holdings can be viewed positively from a long-term investment perspective. However, careful examination of investment asset risks, the impact of macroeconomic variables, and fluctuations in the logistics sector’s profitability is necessary. Closely monitoring the sustainability of bio business growth and new pipeline acquisition strategies is crucial.

4. Investor Action Plan

- Short-term investors: A cautious approach is necessary considering the potential for increased stock price volatility. Focus on a mid-to-long-term investment strategy rather than short-term price fluctuations.

- Mid-to-long-term investors: Make investment decisions based on a comprehensive assessment of bio business growth potential and risk management capabilities. Consider a diversified investment strategy through gradual purchases.

Frequently Asked Questions

What does Chairman Kang’s market purchase signify?

Although a small amount, it can be interpreted as a positive signal, showing his intention to maintain management rights and defend the stock price.

Will the loan extension negatively affect the stock price?

Unless it leads to direct selling pressure, it is considered neutral. However, it is essential to monitor potential changes in collateral ratios and other factors.

What is the outlook for Dong-A Socio Holdings?

The growth of the bio sector and the diversified portfolio are positive, but investors should consider investment asset risks and macroeconomic variables.