What Happened?

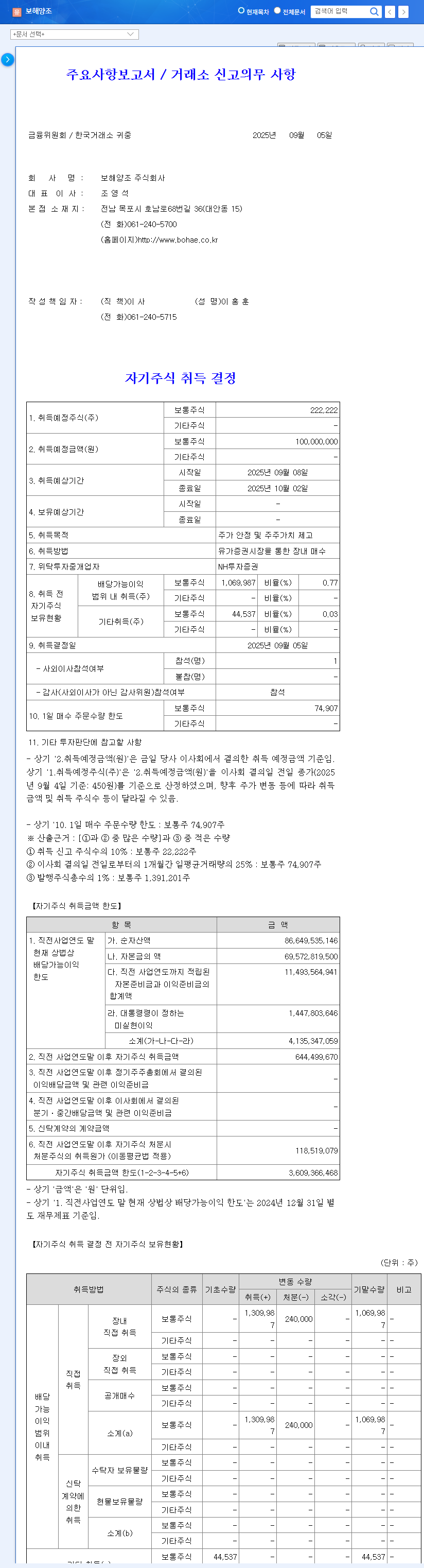

Bohae Brewery has decided to repurchase KRW 100 million worth of its common stock (222,222 shares) through the open market to stabilize stock prices and enhance shareholder value.

Why the Buyback?

Despite a decline in sales in the first half of 2025, Bohae Brewery posted solid results with significant increases in operating profit and net income. The share buyback decision, under these circumstances, demonstrates confidence in the company’s growth potential and its commitment to boosting stock prices.

What’s the Impact?

- Positive Impacts:

- Stock price stabilization and improved investor sentiment

- Potential for re-evaluation of corporate value

- Potential Risks and Considerations:

- Limited impact due to the small buyback size

- No fundamental change in the business

- Influence of market conditions and overall investor sentiment

Investor Action Plan

The investment recommendation is ‘Hold.’ While the buyback is a positive signal, its limited scale and the volatile market conditions warrant caution. Investors should carefully consider future buyback progress, changes in macroeconomic indicators, and competitive analysis before making investment decisions.

FAQ

How does a share buyback affect stock price?

Share buybacks typically reduce the number of outstanding shares, increasing earnings per share (EPS) and potentially driving up the stock price. However, in Bohae’s case, the small size of the buyback is likely to have more of a psychological stabilizing effect than a significant short-term price surge.

What is the outlook for Bohae Brewery?

While the improved financial performance in the first half of 2025 is positive, macroeconomic uncertainties, such as concerns about an economic downturn, still exist. Therefore, it’s crucial to closely monitor future earnings trends and market conditions.

What precautions should investors take?

While the share buyback can be a positive sign for corporate value, it shouldn’t be the sole basis for investment decisions. Investors should consider the company’s fundamentals, market conditions, and competitive landscape comprehensively before investing.