What Happened?

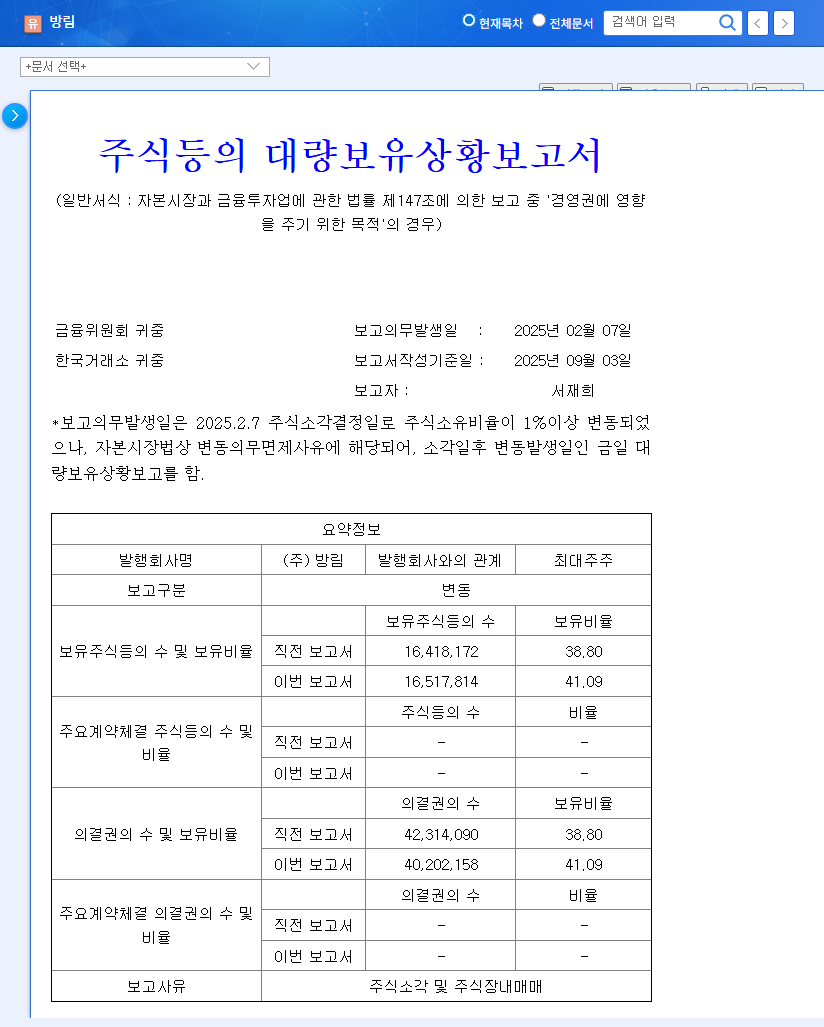

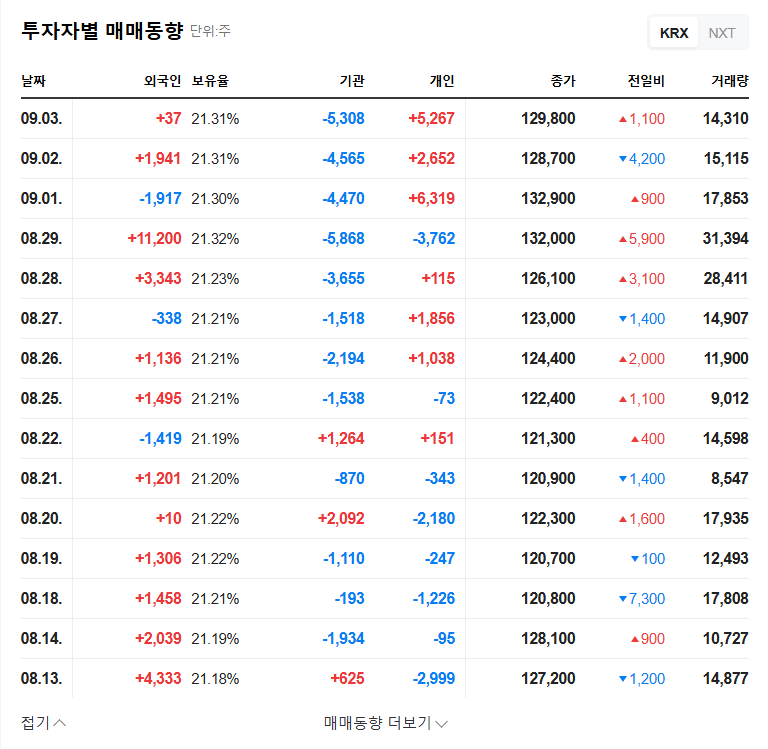

On September 3, 2025, BangRim’s CEO Jaehee Seo increased his stake from 38.80% to 41.09%, as disclosed in a major shareholder report. The stake increase was achieved through share cancellations and open market purchases. Concurrently, Sungwook Seo sold 6,000 common shares.

Why Does It Matter?

This stake increase is a significant signal of CEO Seo’s commitment to strengthening his control over BangRim. Management stability can positively impact a company’s long-term growth. However, the simultaneous sale by Sungwook Seo suggests potential changes in the relationships between major shareholders and warrants further analysis.

What’s the Impact on the Stock Price?

- Positive Factors: Management stability, Q3 turnaround, share cancellation

- Negative Factors: Underperforming Vietnam subsidiary, declining operating cash flow, challenging cotton industry

While analyzing market expectations is difficult due to the lack of analyst reports, changes in management control can influence stock price and trading volume. Surpassing the 40% stake threshold particularly highlights management stability. However, careful monitoring of fundamental improvements and market conditions is crucial.

What Should Investors Do?

Investors should be mindful of potential short-term stock price volatility and focus on BangRim’s long-term fundamentals and CEO Seo’s management capabilities. Close attention should also be paid to changes in the macroeconomic environment, especially fluctuations in exchange rates. Investment decisions should always be made based on one’s own judgment and responsibility.

FAQ

How was BangRim’s Q3 performance?

While revenue increased and operating profit turned positive, the underperformance of the Vietnam subsidiary and declining operating cash flow are concerns.

Why is CEO Jaehee Seo’s stake increase important?

It’s interpreted as a positive signal, demonstrating commitment to management stability and long-term growth.

Should I invest in BangRim?

This report is not investment advice. Investment decisions should be made based on your own judgment and responsibility.