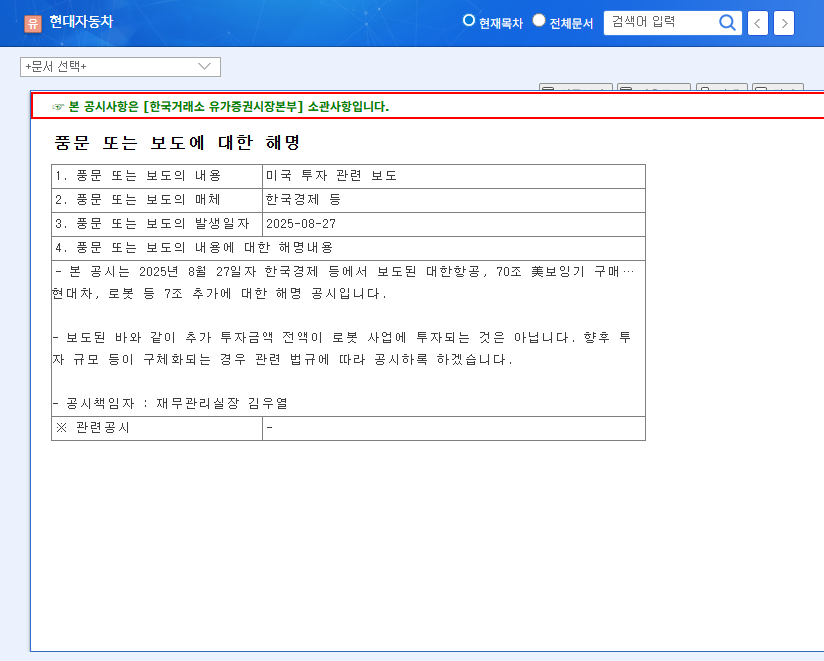

1. What Happened? : Hyundai Motor Strike Overview

From September 3rd to 5th, 2025, Hyundai Motor halted production at all its plants, including its main Ulsan factory, due to a partial strike related to collective bargaining. This resulted in a production loss of 790.6 billion won (45.12% of sales), causing partial production disruptions across all vehicle models. The date for resumption of production remains uncertain.

2. Why the Strike? : Background and Key Issues

The strike stemmed from disagreements between labor and management during the collective bargaining process. While the specific points of contention haven’t been publicly disclosed, it’s believed that wage increases and improvements in working conditions are the primary factors.

3. What’s the Impact? : Short-Term & Long-Term Effects

- Short-Term Effects:

- Production disruptions and decreased sales

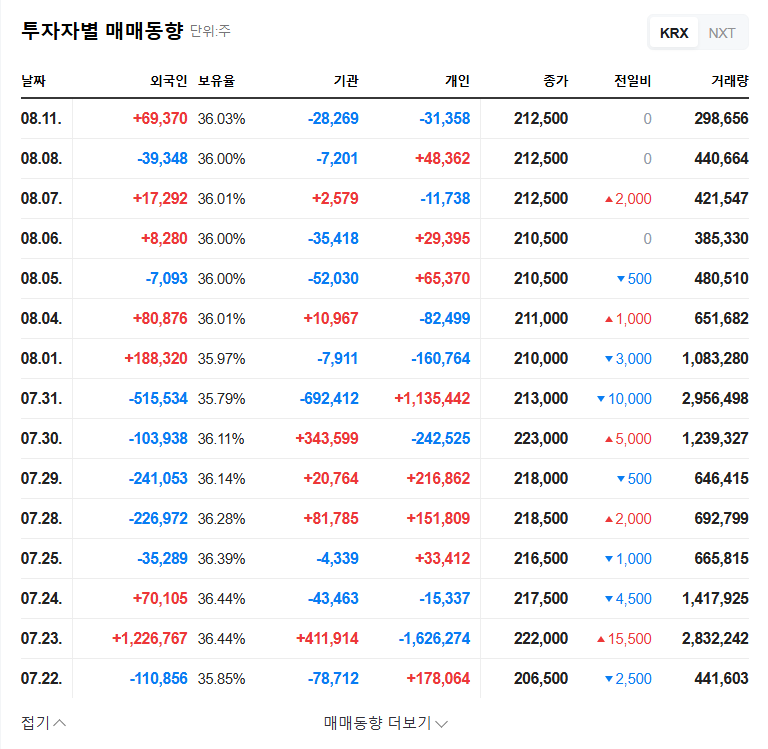

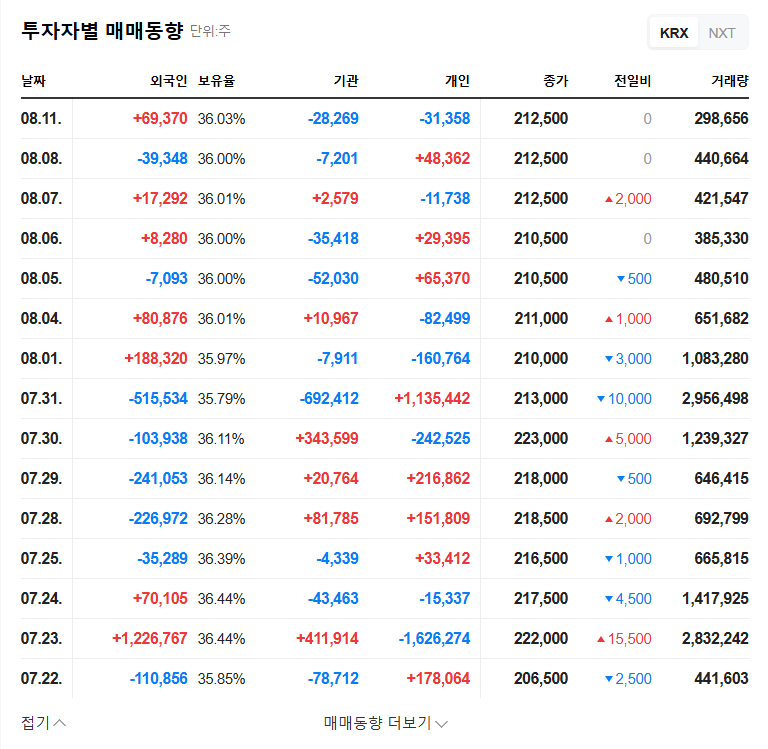

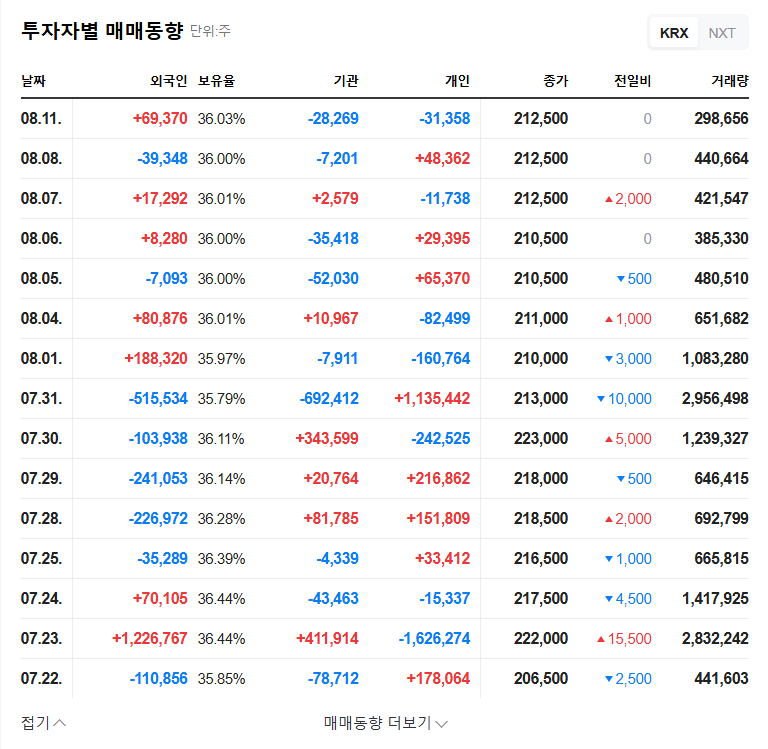

- Increased stock volatility

- Potential downward revisions of market expectations

- Long-Term Effects:

- Delayed profit recovery

- Impact on financial stability and shareholder return policy

- Damage to labor relations and corporate image

- Disadvantage in a competitive landscape

4. What Should Investors Do? : Action Plan

Investors should closely monitor the strike’s progress and the company’s response. Pay close attention to the possibility of a prolonged strike, the timing of production normalization, and any changes in future earnings forecasts. Thorough analysis of information and a cautious approach are crucial for making informed investment decisions.

Frequently Asked Questions (FAQ)

What are the main causes of the Hyundai Motor strike?

Disagreements between labor and management regarding wage increases and improvements in working conditions during collective bargaining are believed to be the primary causes.

What is the estimated financial loss for Hyundai due to the strike?

The estimated production loss is approximately 790.6 billion won, which accounts for 45.12% of Hyundai’s sales.

How will the strike affect Hyundai’s stock price?

In the short term, it could put downward pressure on the stock price due to weakened investor sentiment. If the strike is prolonged, volatility could increase.

How should investors react to this strike?

Investors should closely monitor the strike’s progress, the timing of production normalization, and any changes to future earnings forecasts. It is essential to analyze all available information thoroughly and make cautious investment decisions.