1. What Happened?

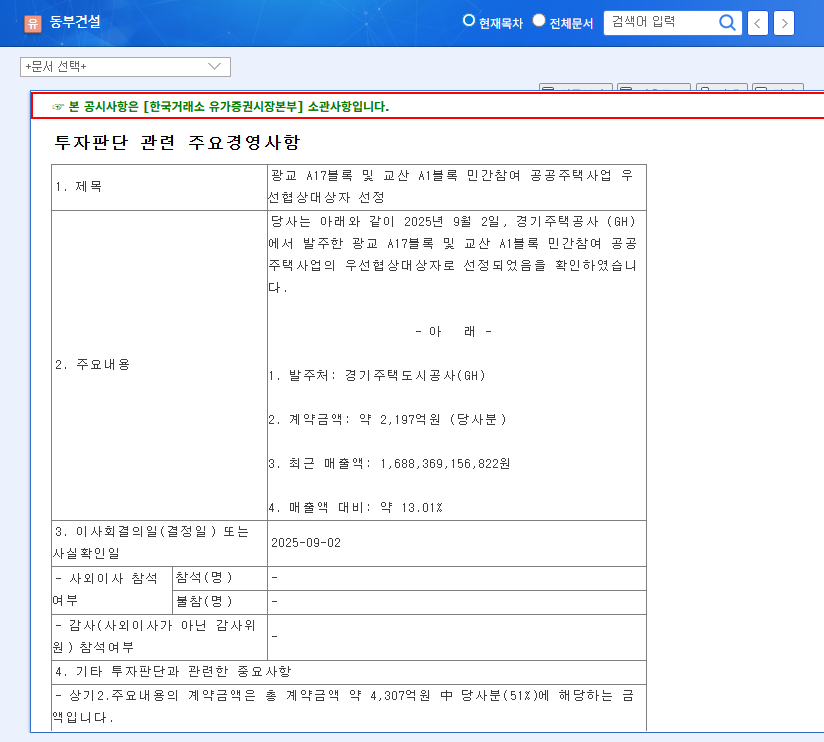

Dongbu Construction was selected as the preferred bidder for the Livestock Resources Development Division relocation project on September 16, 2025. The contract is worth approximately $1.3 billion (including VAT), representing 10.68% of the company’s 2024 annual revenue.

2. Why Does It Matter?

This contract is a significant catalyst that could further accelerate Dongbu Construction’s growth following its return to profitability in the first half of 2025. It is expected to not only boost sales but also enhance the company’s competitiveness in public sector bidding, increasing the likelihood of securing future contracts.

3. What’s the Impact?

Positive Impacts:

- Increased Revenue and Improved Financial Structure

- Enhanced Bidding Competitiveness and Public Sector Credibility

- Securing Future Growth Engines

Negative Impacts (Limited):

- Limited Impact on Resolving High Debt Ratio

- Risks of Rising Raw Material and Labor Costs

- Volatility in Interest Rates and Exchange Rates (Limited)

4. What Should Investors Do?

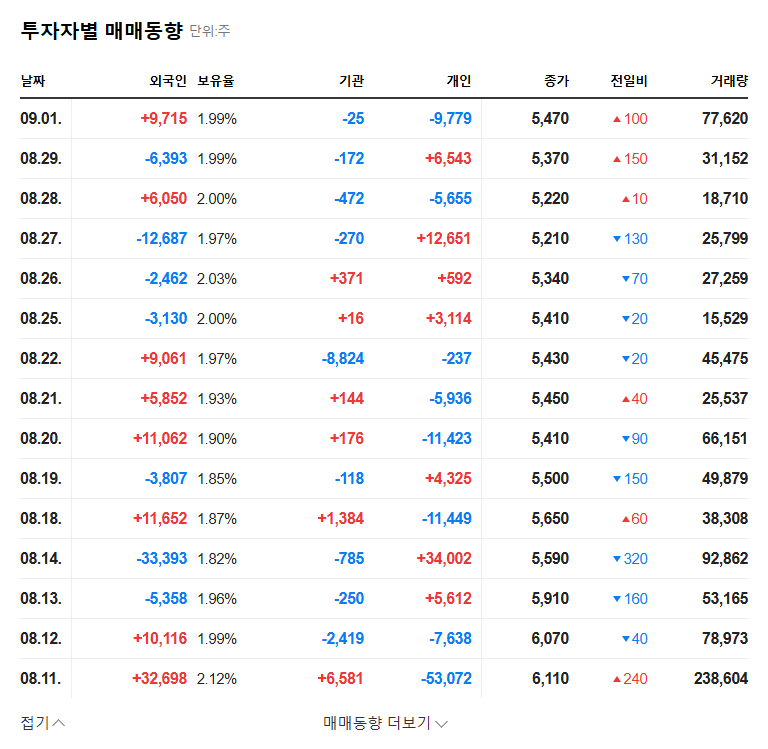

While there is potential for short-term stock price gains, investors should consider the risks associated with the company’s high debt ratio and PF contingent liabilities. For long-term investment, it is crucial to carefully assess the company’s efforts to improve its financial soundness, new order momentum, and ability to respond to changes in the macroeconomic environment. The current investment recommendation is “Hold”.

5. Factors to Monitor

- Progress and Profitability of this contract

- Visibility of efforts to improve financial structure

- Impact of Interest rate changes on debt burden

- Construction Market Conditions and Government Policy Changes

Frequently Asked Questions

Will this contract significantly improve Dongbu Construction’s financial structure?

While the $1.3 billion contract is positive, it is unlikely to single-handedly resolve Dongbu Construction’s high debt ratio. Continuous monitoring of their financial improvement efforts is necessary.

Is it a good time to invest in Dongbu Construction?

While there is potential for short-term stock price gains, a cautious approach is advised for long-term investment, considering the company’s financial soundness, new order momentum, and the macroeconomic environment. The current investment recommendation is “Hold”.

What is the outlook for Dongbu Construction’s stock price?

The future stock price will be influenced by various factors such as the construction market, interest rate changes, and government policies, in addition to this contract. Ongoing monitoring is recommended.