1. What is the Stock Buyback?

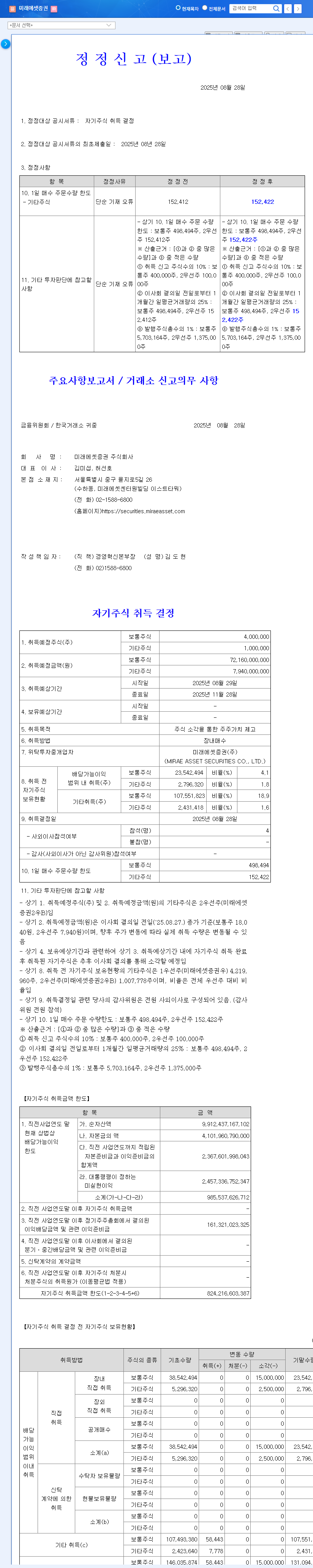

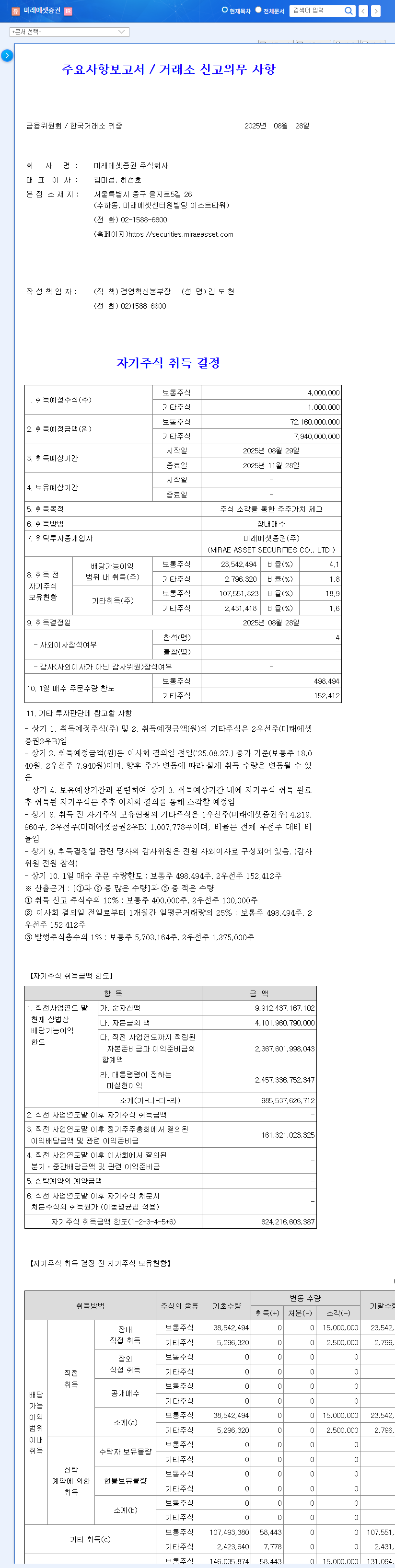

Mirae Asset Securities announced on August 28, 2025, that it would repurchase 4 million common shares (approximately KRW 72.2 billion) and 1 million preferred shares (approximately KRW 7.9 billion). This represents about 0.7% of the total market capitalization, and the goal is to enhance shareholder value through stock cancellation.

2. Why the Buyback?

While ostensibly a decision to enhance shareholder value, it also reflects the intention to defend against recent stock price declines due to poor performance and to alleviate investor concerns. Stock cancellation reduces the number of outstanding shares, which has the effect of increasing earnings per share (EPS) and book value per share (BPS).

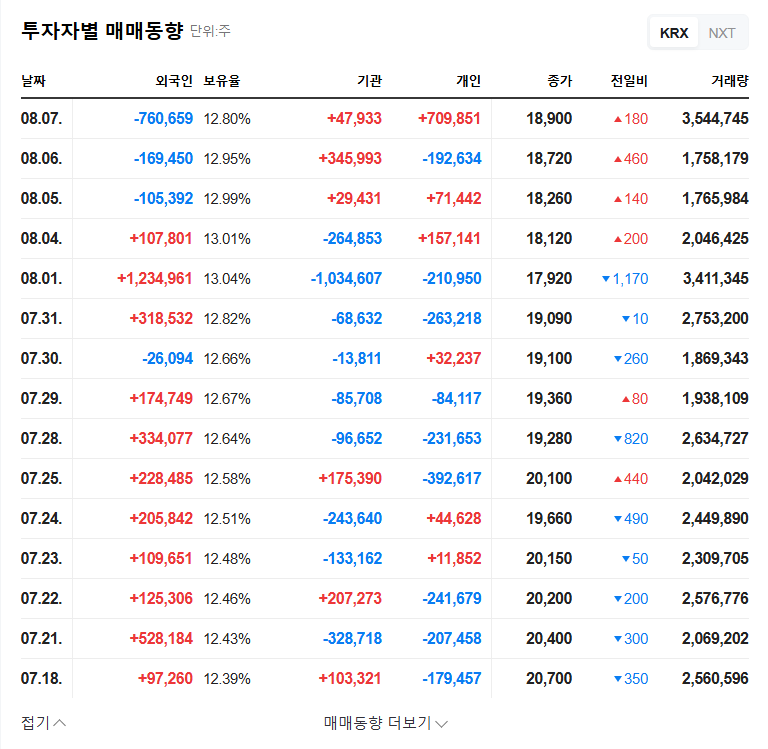

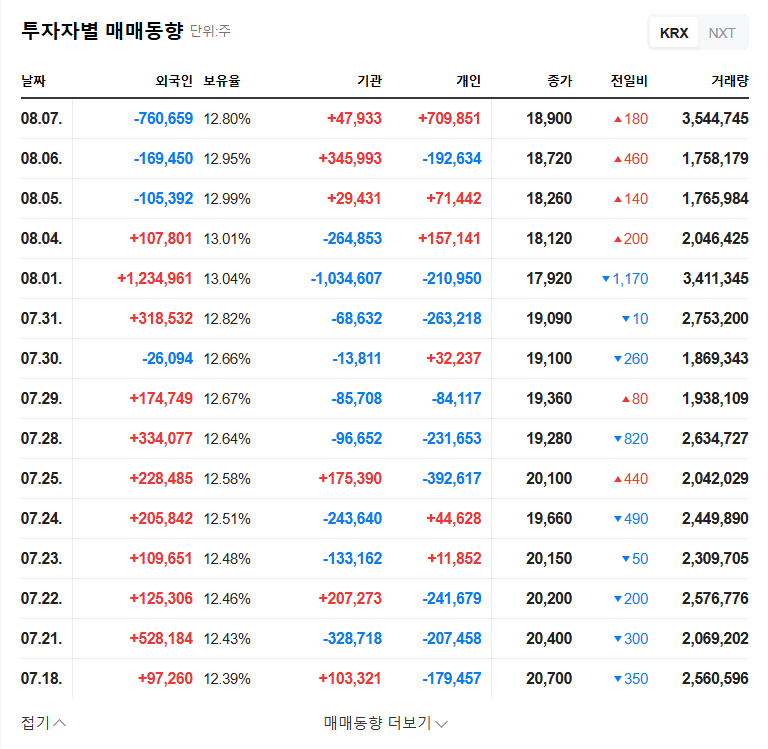

3. Market Impact of the Buyback

- Short-term impact: The announcement of a stock buyback generally has a positive impact on stock prices. However, given the current sluggish performance, the extent of the increase may be limited.

- Mid- to long-term impact: If Mirae Asset Securities succeeds in improving its earnings, the stock buyback could act as a momentum for stock price increases. Conversely, if the poor performance continues, this stock buyback is likely to have only a temporary effect.

4. What Should Investors Do?

Investment decisions should not be made based solely on the stock buyback. It is necessary to comprehensively consider the macroeconomic situation and Mirae Asset Securities’ future earnings outlook. In particular, it is crucial to carefully analyze how factors such as interest rate hikes, exchange rate fluctuations, and a global economic slowdown will affect Mirae Asset Securities’ performance.

Frequently Asked Questions

What is a stock buyback?

A stock buyback is when a company repurchases its own shares. It is used for various purposes such as enhancing shareholder value and stabilizing stock prices.

What is stock cancellation?

Stock cancellation is the process of eliminating repurchased shares. This reduces the number of outstanding shares, increasing the value per share.

Will Mirae Asset Securities’ stock buyback positively affect the stock price?

It may have a positive impact in the short term, but the mid- to long-term stock price trend depends on whether the company’s earnings improve.