1. What Happened?

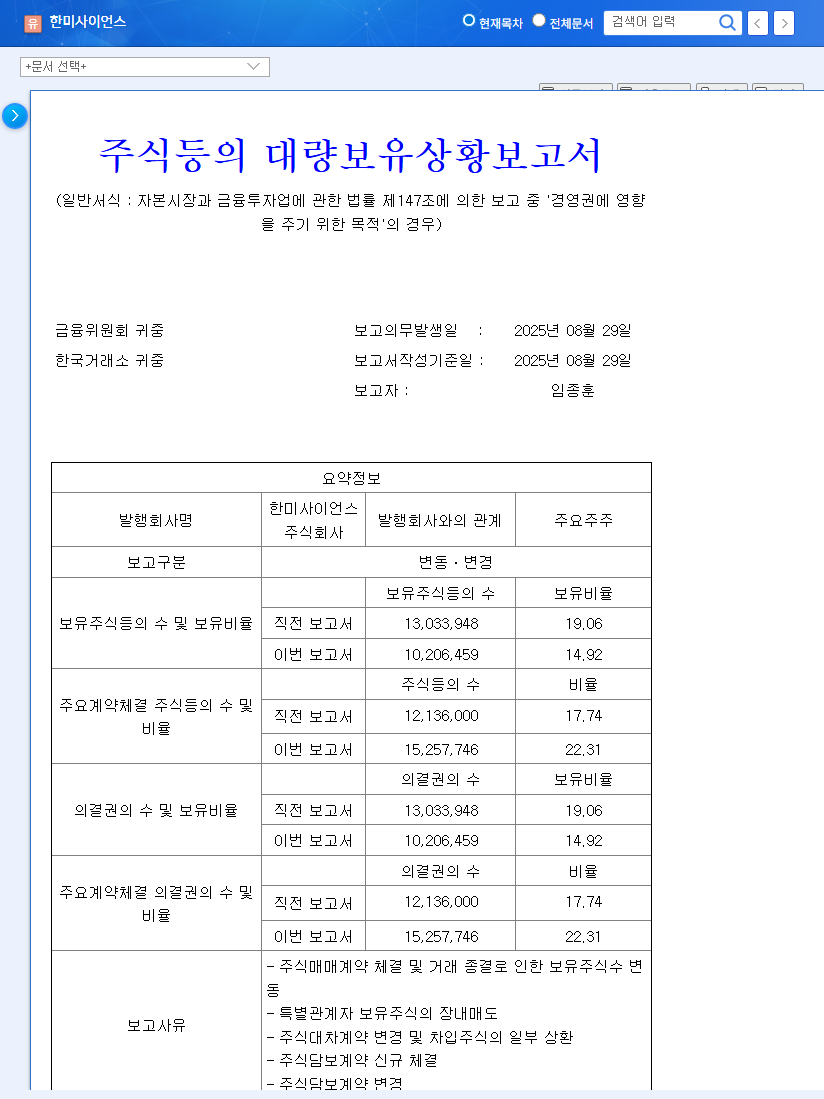

Hanmi Science’s representative reporter, Jong-Hoon Lim, and related parties reduced their stake from 19.06% to 14.92%, a decrease of 4.14%. This was due to a combination of factors including stock sales agreements, on-market sales, and changes in stock lending agreements. Notably, a significant portion of the shares was sold off-market to Cori Pohang by Mr. Lim and related parties.

2. Why Did This Happen?

The exact reasons for the sale have not yet been disclosed. Typically, large shareholder divestments can occur for various reasons, such as investment recovery, new business ventures, or personal financial needs. We await official announcements from the company for further clarification.

3. What’s the Potential Impact?

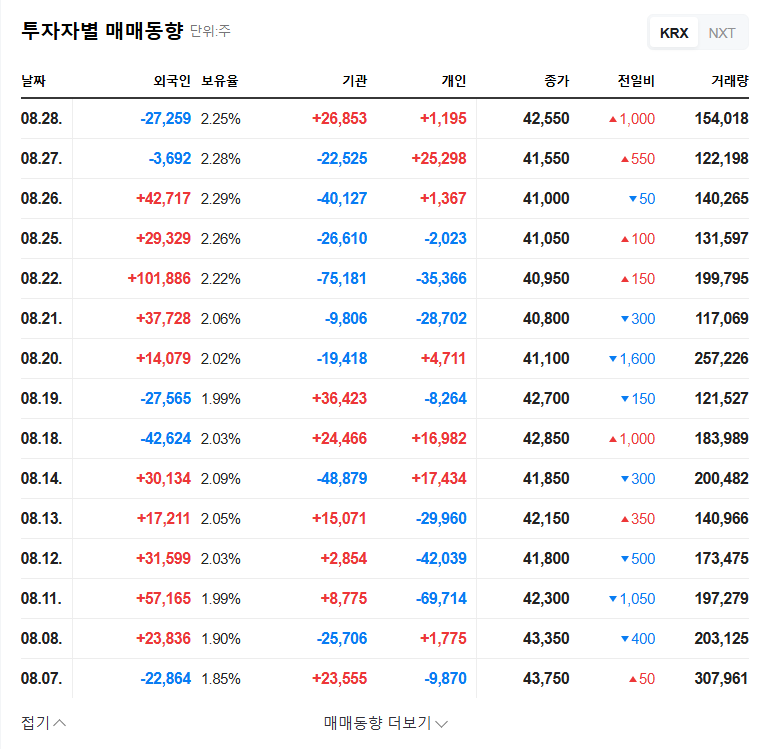

- Short-term Price Drop: A large sell-off can flood the market with shares, potentially putting downward pressure on the stock price.

- Investor Sentiment: This move could create uncertainty and negatively impact investor confidence.

- Management Stability: The decreased stake raises concerns about potential management changes and overall stability.

4. What Should Investors Do?

- Cautious Investment: Exercise caution with new investments until more information is released.

- Stay Informed: Closely monitor official company announcements and relevant news for updates.

- Long-Term Perspective: Focus on the company’s fundamentals and long-term growth potential, rather than short-term price fluctuations.

Q: Does a major shareholder selling their stake always lead to a price drop?

A: Not necessarily. The market reaction depends on various factors, including the reasons for the sale, the company’s fundamentals, and the overall market conditions.

Q: What’s the outlook for Hanmi Science’s stock price?

A: It’s difficult to predict at this time. The future price will depend on the reasons for the sale, management’s future plans, and market conditions.

Q: What information should investors pay attention to?

A: Investors should watch for official statements from the company regarding the reasons for the sale, future business plans, and any further explanations from management.