1. ITCEN CTS Increases Stake: What Happened?

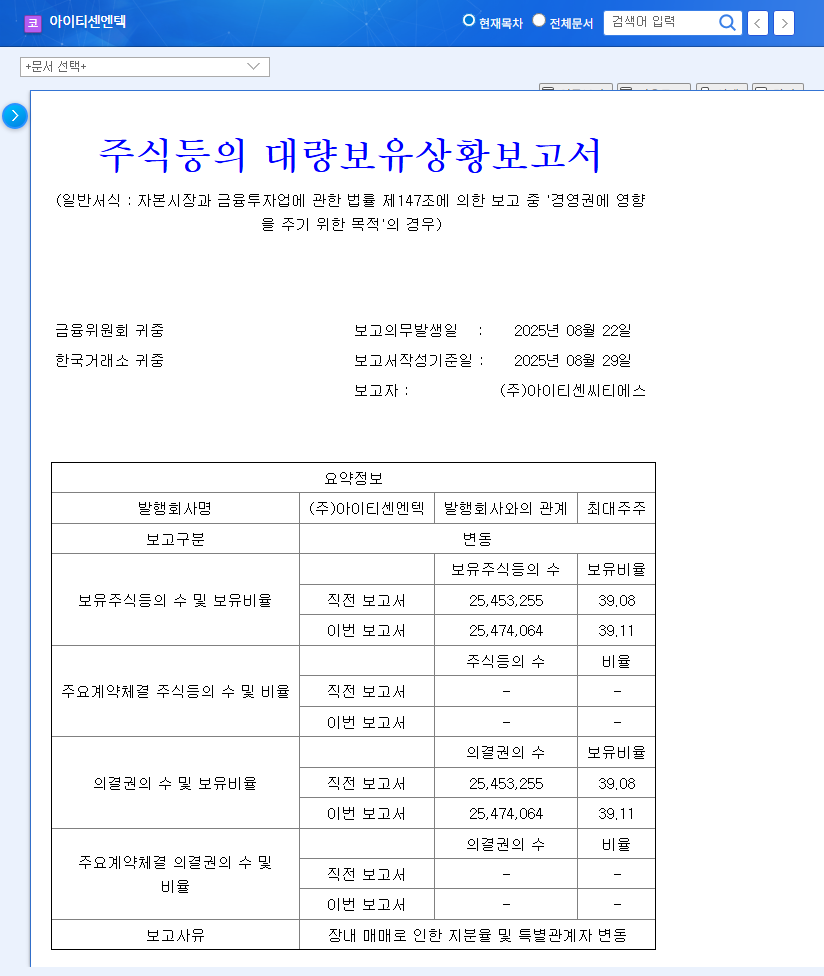

ITCEN CTS slightly increased its stake in ITCEN ENTEC from 39.08% to 39.11% through market purchases. This is interpreted as a move to strengthen and stabilize management control.

2. Why Increase the Stake Now?

The stake increase appears to be a strategic move to solidify management control and bolster future strategic execution. However, it also seems to be an attempt to alleviate market concerns about recent poor performance.

3. So, What’s the Future of ITCEN ENTEC?

In the short term, the negative impact of poor earnings is likely to outweigh the positive effects of the ownership change on the stock price. In the medium to long term, management’s efforts to improve profitability and stabilize the financial structure will be crucial. The key lies in translating the growth of new businesses, such as cloud services, into profits, resolving uncertainties in the construction business, and managing litigation risks.

4. What Should Investors Do?

Rather than simply reacting to the news of the ownership change, investors should focus on the company’s fundamentals. Carefully monitor the specifics of profit improvement plans, changes in financial soundness indicators, and the visibility of new business growth before making investment decisions.

What are ITCEN ENTEC’s main businesses?

ITCEN ENTEC provides IT services, including financial SI, ITO, cloud services, AI transformation (AX), and embedded solution transformation (EX). The cloud services sector has been growing rapidly recently, driven by increasing demand for digital transformation.

How has ITCEN ENTEC performed recently?

While sales increased by more than 60% year-on-year in the first half of 2025, the company recorded a net loss of KRW 43.24 billion on a consolidated basis. Increased financial expenses and investment-related costs were the main factors.

What should investors be aware of when investing in ITCEN ENTEC?

There are risks such as deteriorating profitability, financial soundness issues, uncertainties related to construction contracts, and litigation risks. Investors should carefully consider these risk factors before investing.