1. What’s happening with Hanwha Aerospace?

Hanwha Aerospace delivered solid results in the first half of 2023, driven by strong performance in the marine and defense sectors. The marine sector saw significant growth thanks to increasing demand for eco-friendly vessels, while the defense sector benefited from strong exports of K9 self-propelled howitzers.

2. What are the positives and negatives?

Positives:

- • Robust growth in marine and defense sectors

- • R&D investments for future growth drivers

- • Efforts to strengthen financial health through capital increase

Negatives:

- • High debt-to-equity ratio (278%)

- • Short-term investment burden in the aviation sector

- • Potential risks related to legal disputes and sanctions

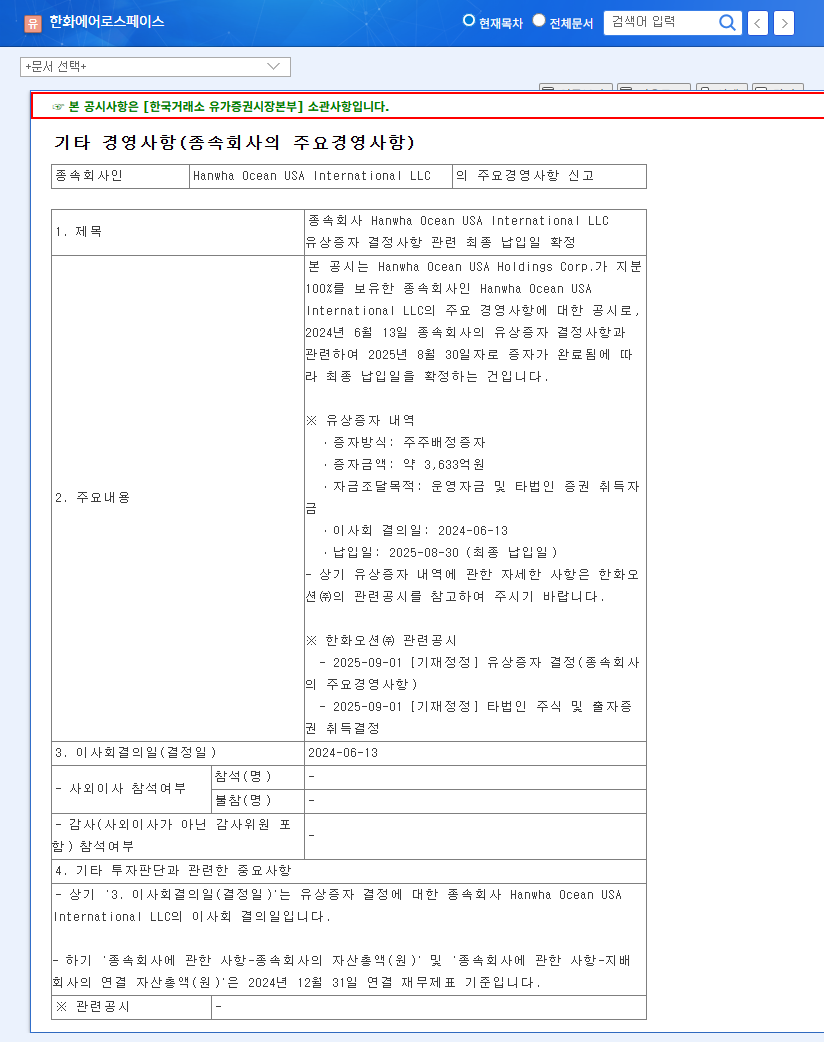

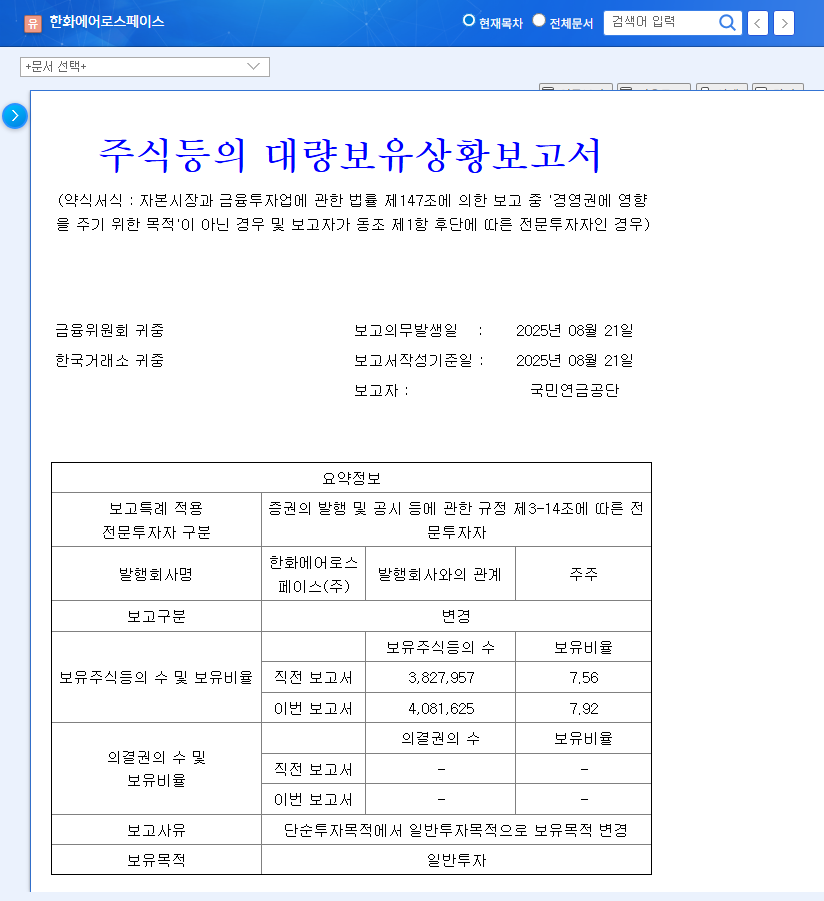

- • Cash outflow due to subsidiary’s rights offering

3. So, is it a good time to invest?

The current investment opinion is ‘Neutral’. While the growth potential is evident, factors such as high debt ratio, external uncertainties, and legal risks require careful consideration.

4. Investor Action Plan

Before making an investment decision, carefully consider the following:

- • Sustainability of growth in marine and defense sectors

- • Investment performance and profitability improvement in the aviation sector

- • Financial risk management strategies

- • Resolution of legal disputes and performance of new businesses

A long-term investment perspective and continuous monitoring of risk factors are crucial.

Frequently Asked Questions

What are Hanwha Aerospace’s main businesses?

Hanwha Aerospace focuses on marine, defense, and aviation sectors. As of H1 2023, the revenue breakdown is: marine 61.91%, defense 31.55%, and aviation 9.82%.

Is it a good time to invest now?

The investment opinion is ‘Neutral’. While there’s growth potential, financial risks and external uncertainties need to be considered. Thorough analysis is crucial before investing.

What are the key investment risks?

Key risks include high debt ratio, investment burden in the aviation sector, legal disputes, and macroeconomic fluctuations. The cash outflow and potential financial structure changes due to the subsidiary’s rights offering should also be monitored.