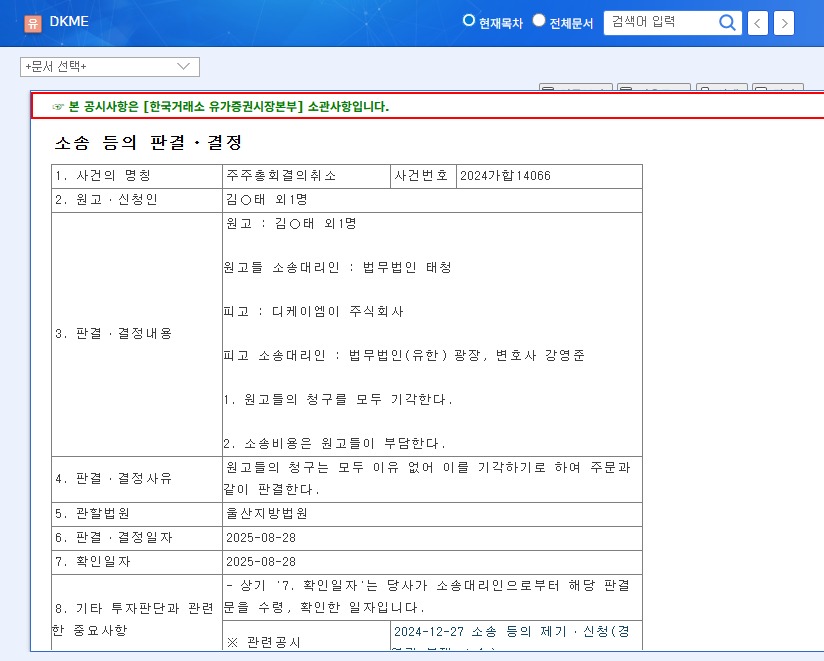

What Happened? : Victory in Shareholder Meeting Cancellation Lawsuit

DKEMI recently won a lawsuit filed in the Ulsan District Court regarding the cancellation of a shareholders’ meeting resolution. The plaintiff’s claims were dismissed, and they were ordered to bear the legal costs.

Why It Matters? : Reduced Legal Risks and Improved Investor Sentiment

This victory is expected to positively impact DKEMI in several ways. Most importantly, it reduces concerns about management transparency and stability, potentially improving investor sentiment.

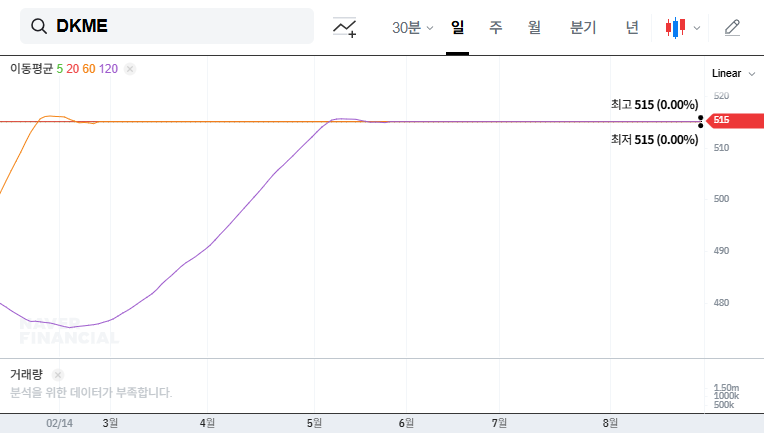

What’s Next? : Improved Fundamentals and Potential Stock Momentum

- Reduced legal risks: Resolution of uncertainty and potential restoration of investor confidence.

- Improved investor sentiment: Combined with positive fundamentals, this could create upward momentum for the stock.

- Hope for delisting recovery: Increased possibility of escaping delisting.

However, challenges remain, including a net loss for the current period and an increase in accounts receivable.

Investor Action Plan

While the lawsuit outcome is positive, investors should consider the following:

- Delisting issue: The lawsuit victory doesn’t guarantee the avoidance of delisting.

- Financial status: Net loss and increased accounts receivable require careful consideration.

- Market conditions and company challenges: A comprehensive analysis is crucial for sound investment decisions.

Frequently Asked Questions

Will this lawsuit outcome prevent DKEMI’s delisting?

While the victory is a positive sign, the delisting decision depends on other factors. It’s too early to be certain.

How is DKEMI’s financial health?

While sales and operating profit have improved, there are concerns like net loss and increased accounts receivable.

Should I invest in DKEMI?

Investment decisions are personal. Use the information in this article and other resources to make an informed decision.