1. J.ESTINA’s Treasury Stock Disposal: What’s Happening?

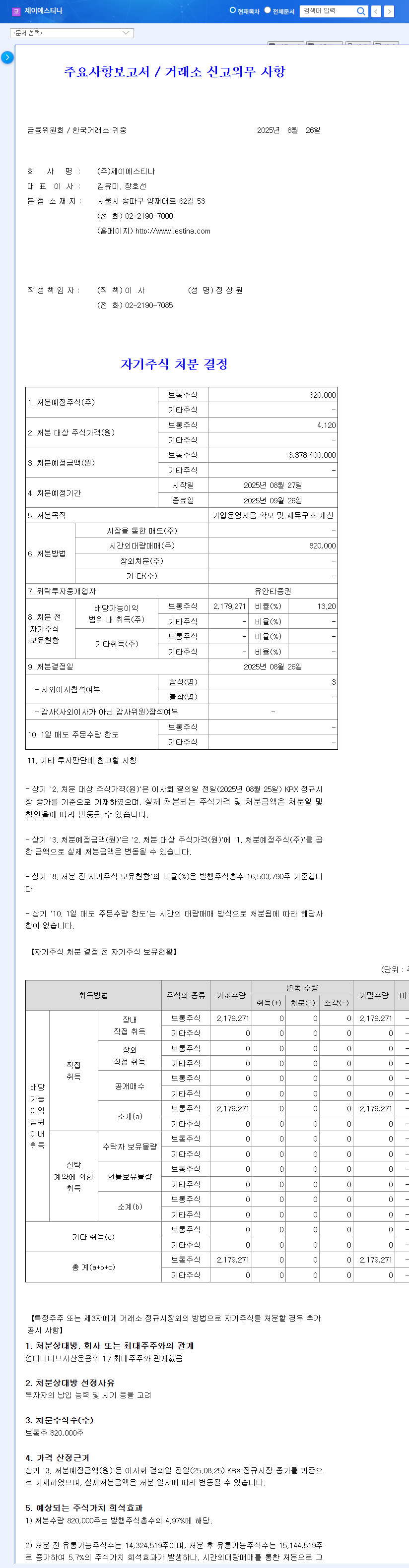

On August 26, 2025, J.ESTINA announced its decision to dispose of 820,000 common shares (4.97% of total outstanding shares). The estimated value of the disposal is approximately ₩3.4 billion, aimed at securing operating funds and improving the company’s financial structure.

2. Why the Treasury Stock Disposal?

J.ESTINA has faced challenges, including a 7.3% year-on-year decrease in sales in Q2 2025. The funds secured through the treasury stock disposal are intended to address operating fund shortages and strengthen financial soundness. However, the stated purpose of ‘securing operating funds’ may suggest current cash flow difficulties.

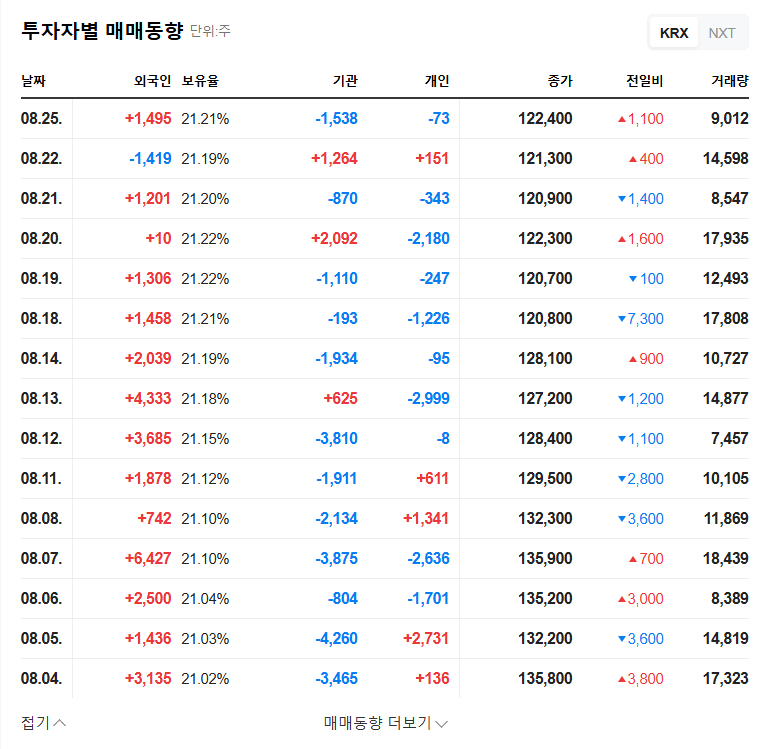

3. What Does This Mean for the Stock Price?

- Positive Impact: Improved financial structure can enhance corporate stability and contribute to short-term stock price stabilization.

- Negative Impact: The increase in outstanding shares can exert downward pressure on the stock price, and the disposal’s purpose might raise concerns about the company’s financial situation.

Ultimately, the treasury stock disposal may introduce short-term stock price volatility. The long-term stock performance depends on factors such as sales recovery, inventory management, the success of new brands, and further financial improvement efforts.

4. What Should Investors Do?

Investors should closely monitor the progress of the treasury stock disposal, the disposal price, and the company’s performance improvements. They should also consider the growth potential of new brands and management strategies when making investment decisions.

What is treasury stock disposal?

It refers to a company selling its own repurchased shares.

How does treasury stock disposal affect the stock price?

The positive aspect is improved financial structure, while the negative aspect is the potential for stock price decline due to increased outstanding shares.

What is the outlook for J.ESTINA?

Key factors include sales recovery, inventory management, and the success of new brands.