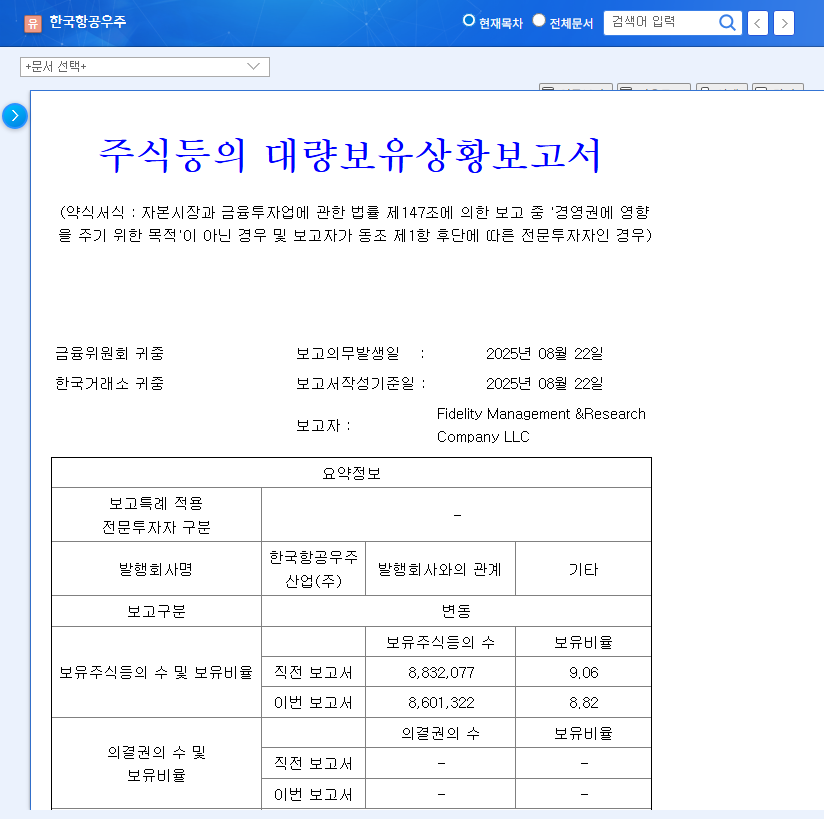

1. Fidelity’s KAI Stake Adjustment: What Happened?

Fidelity net bought KAI shares from August 1st to 22nd, but its overall stake decreased slightly from 9.06% to 8.82%. This change is due to the addition of managed funds, and Fidelity maintains its investment objective as ‘simple investment.’ While the 0.24%p change is not substantial, movements by large institutional investors like Fidelity can send important signals to the market.

2. KAI’s Fundamentals: Are They Solid?

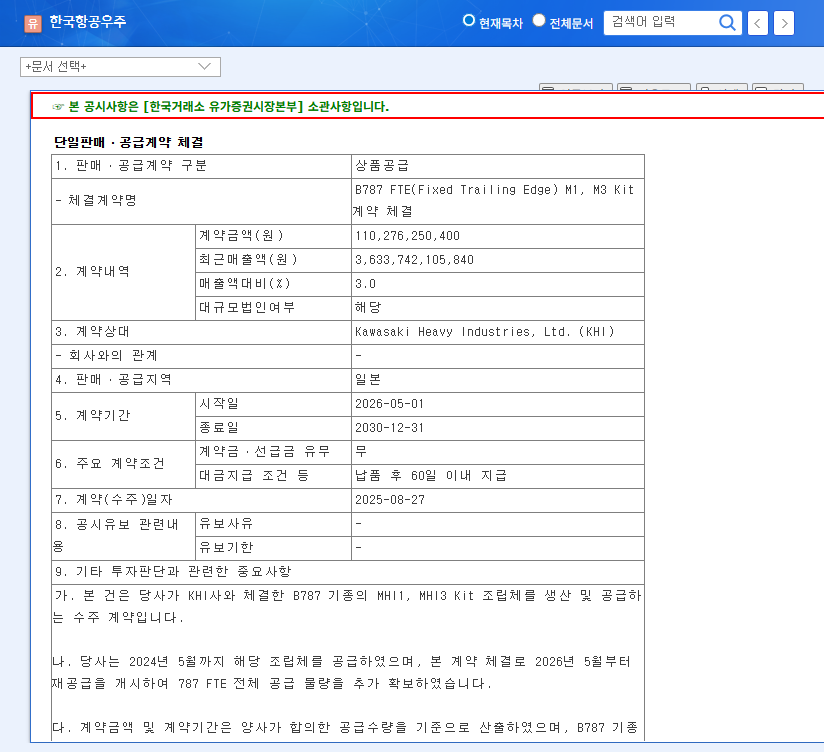

Korea Aerospace Industries maintains stable growth based on a solid order backlog exceeding 26 trillion won. Positive factors include strong exports of fixed-wing aircraft like the KF-21 and FA-50, and growth potential in the space business sector. However, high debt ratio and exchange rate volatility could pose risks.

- Strengths: Solid order backlog, strong fixed-wing aircraft performance, growth potential in space business, robust credit rating (AA-)

- Weaknesses: High debt ratio, sensitivity to exchange rate fluctuations

3. Impact of Fidelity’s Stake Change on KAI’s Stock Price

This stake adjustment is not a factor that directly impacts KAI’s fundamentals. However, Fidelity’s net buying can be interpreted as a reflection of a positive market evaluation of KAI and could positively influence investor sentiment. Short-term stock price movements are likely to be driven by market conditions and the company’s earnings announcements.

4. Investor Action Plan: Should You Invest in KAI Now?

KAI is a company with solid fundamentals and future growth potential. It is considered an attractive investment from a long-term perspective, but investors should also consider risk factors such as exchange rate volatility and global economic uncertainty. Before making an investment decision, it’s crucial to continuously monitor the progress of key projects like the KF-21 and the signing of export contracts.

Frequently Asked Questions

Does Fidelity’s stake change negatively impact KAI’s stock price?

No. The change in stake is not significant and the investment objective remains as ‘simple investment,’ thus the direct negative impact is expected to be limited. The net buying can be seen as a positive sign.

What are the key considerations when investing in KAI?

Investors should consider factors such as exchange rate volatility, global economic uncertainty, and KAI’s debt ratio. Continuous monitoring of the progress of key projects and earnings announcements is essential.

What is the future growth outlook for KAI?

Given the potential expansion of exports in the defense sector with the KF-21 and FA-50, and the growth potential in the space business, KAI has a high potential for long-term growth.