What Happened at SGA?

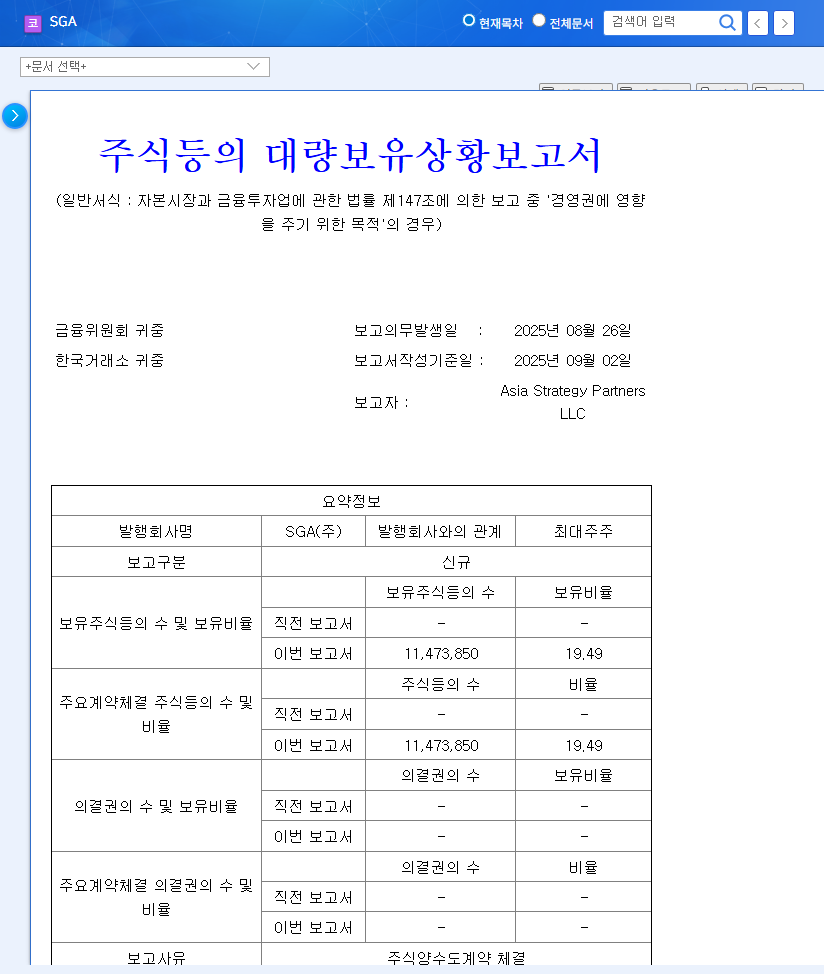

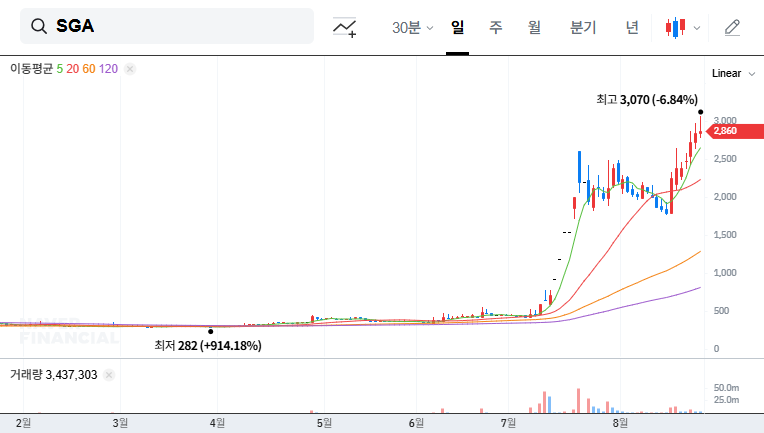

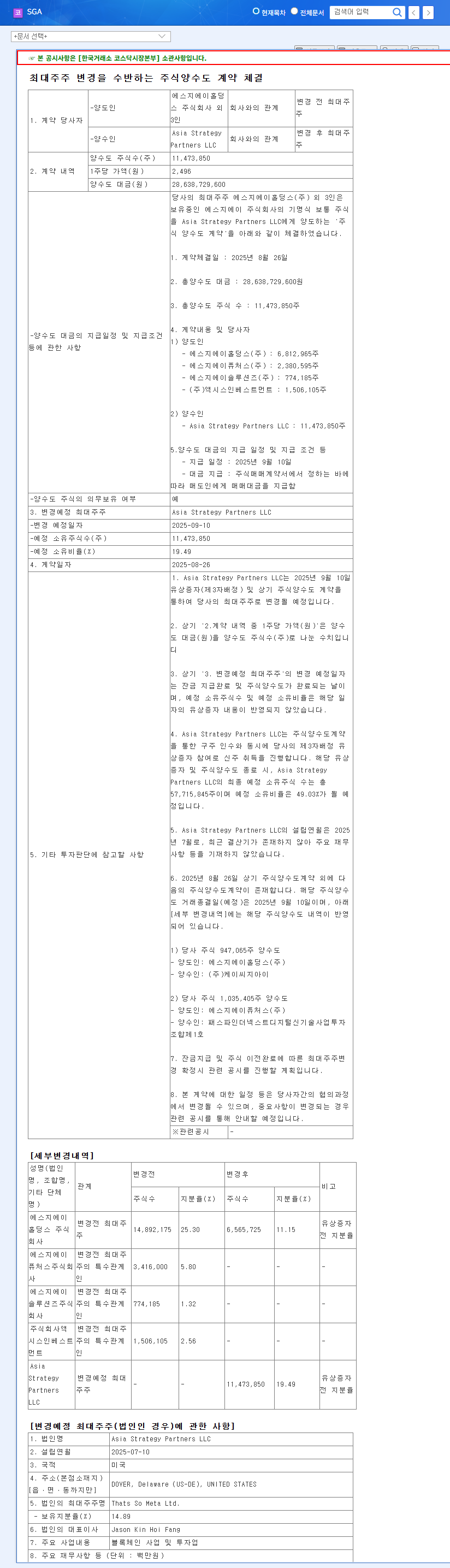

Asia Strategy Partners LLC acquired a 19.49% stake in SGA through an off-market purchase, becoming the largest shareholder and poised to take control. SGA is an IT services company with a strong presence in the public and education sectors, but it has recently been experiencing poor performance.

What is SGA’s Current Situation?

SGA is facing a triple whammy of declining sales, deteriorating profitability, and worsening cash flow. While seeking breakthroughs through new project acquisitions, the situation remains challenging.

- Sales and Profitability: SGA’s sales in the first half of 2025 decreased significantly year-over-year, and operating losses and net losses continue.

- Cash Flow: Operating cash flow is negative, and cash outflows from investing and financing activities have led to a decrease in cash and cash equivalents.

- Financial Structure: Despite efforts to liquidate assets, the financial improvement has been minimal.

New Management: Opportunity or Threat?

The change in major shareholder presents both opportunities and threats for SGA.

- Opportunities: Positive changes can be expected, including new investments, improved financial structure, and business expansion possibilities. The new major shareholder’s financial resources and management capabilities will be key to SGA’s turnaround.

- Threats: Increased uncertainty in management strategy, lack of synergy with existing businesses, and short-term stock price volatility should also be considered.

What Should Investors Do?

Despite the potential for short-term stock price gains, SGA’s fundamentals remain weak. Investors need a cautious approach and should closely monitor the following:

- Announcement of the new major shareholder’s specific management plan

- Plans for utilizing funds from the capital increase and whether performance improves

- Financial statements for the second half of the year and the status of new project acquisitions

Frequently Asked Questions

What is SGA’s main business?

SGA provides IT services, including system integration (SI), system management (SM), and IT infrastructure construction. They primarily operate in the public and education sectors.

How will the change in major shareholder affect SGA?

There are both positive and negative potential impacts. Positive impacts include financial restructuring, new investments, and business expansion. Negative impacts include increased management uncertainty and lack of synergy. The future management’s strategy and execution will determine SGA’s future.

Should I invest in SGA?

SGA is currently in a difficult financial situation, and a cautious approach to investment is necessary. It’s advisable to make investment decisions after confirming the new management’s plans and performance improvements.