What Happened?

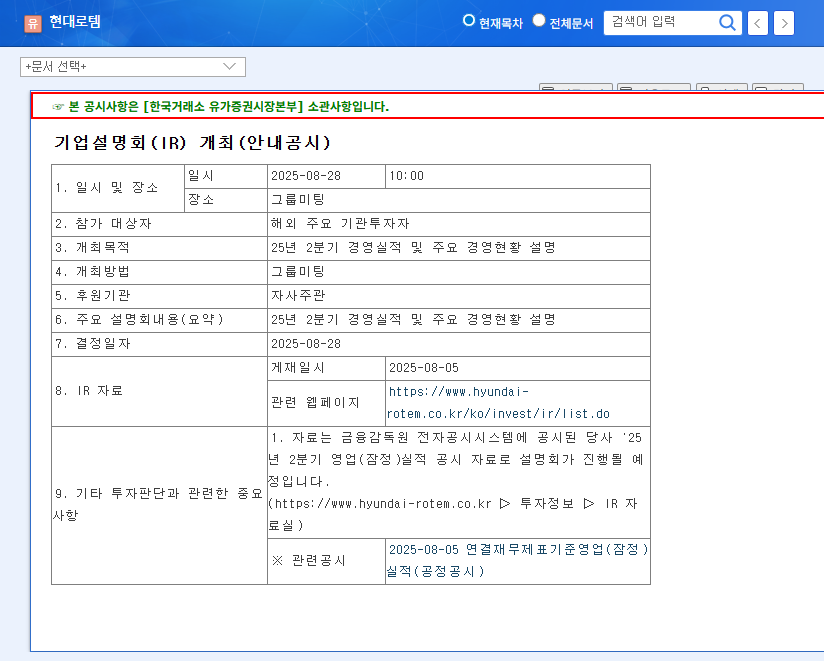

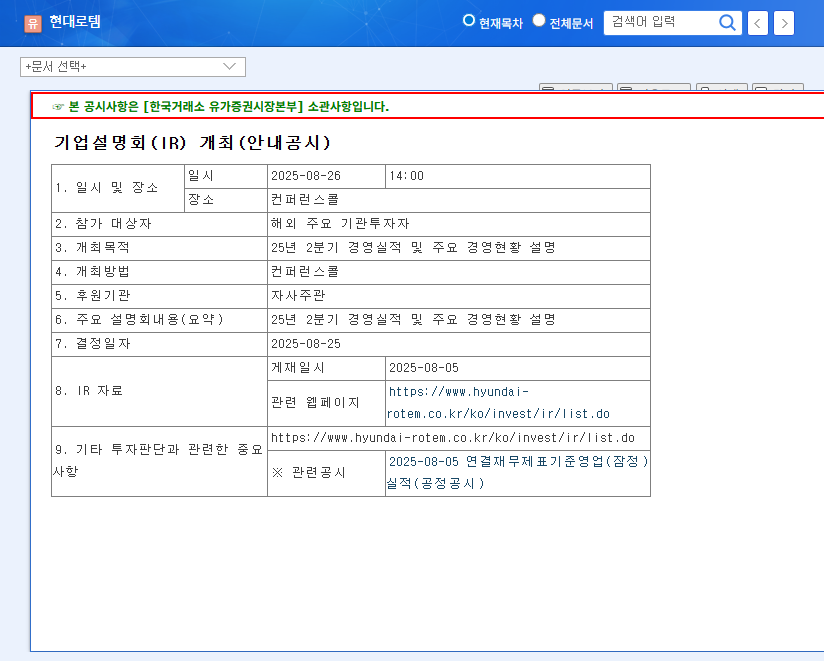

Hyundai Rotem announced its Q2 2025 earnings and key management plans on September 2, 2025. The company showed positive results in its core businesses: defense (K2 tank, wheeled armored vehicles), railway (GTX, high-speed rail), and eco-plant (hydrogen infrastructure, smart logistics).

Why the Positive Results?

The key drivers are strong fundamentals, secured growth engines, and a favorable market environment. Hyundai Rotem demonstrated financial strength with increased assets, decreased debt ratio, higher sales and operating profit, and record-high order backlog. Stable growth in defense and railway, coupled with the booming hydrogen economy, further strengthened its growth momentum.

So, What About the Stock Price?

While significant short-term volatility is not expected, the mid-to-long-term outlook is positive. The announcement of concrete business plans for future growth engines and overseas expansion strategies is expected to boost investor confidence. We maintain a ‘Buy’ or ‘Positive Outlook’ rating.

Action Plan for Investors

- Review IR Materials: Carefully examine the details of overseas export contracts, hydrogen project pipelines, etc.

- Consult Experts: Minimize risks by consulting with financial professionals before making investment decisions.

- Maintain a Long-Term Perspective: Focus on the long-term growth potential rather than short-term fluctuations.

Frequently Asked Questions

What are Hyundai Rotem’s main businesses?

Defense (Defense Solutions), Railway (Rail Solutions), and Eco-Plant (hydrogen infrastructure and smart logistics) are the main business areas.

What are the key takeaways from this IR presentation?

The key takeaways are the announcement of strong Q2 2025 earnings and strategies for securing future growth engines.

What should investors consider when investing in Hyundai Rotem?

Investors should consider factors such as the global economic slowdown, geopolitical risks, and the growth rate of new businesses.