What Happened at HD Hyundai Marine Engine?

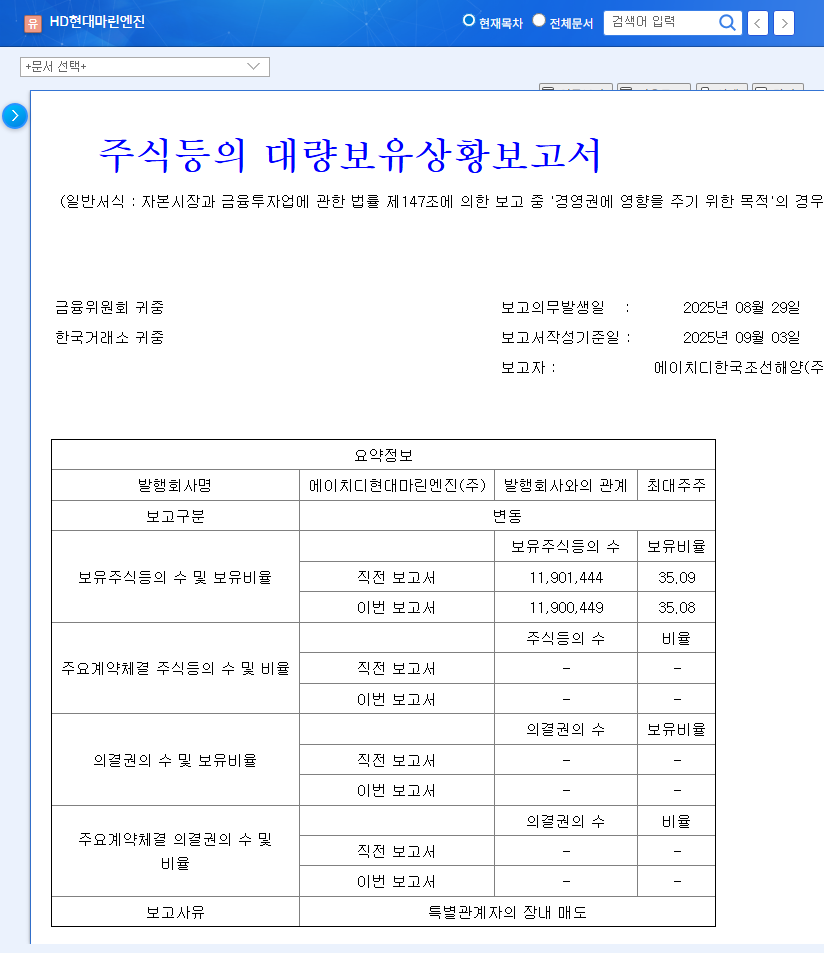

On September 3, 2025, the stake of HD Korea Shipbuilding & Offshore Engineering (including related parties), the largest shareholder of HD Hyundai Marine Engine, slightly decreased from 35.09% to 35.08%. This was due to the sale of 995 shares by a related party, Mr. Kim Seong-won.

Why are Stake Changes Important?

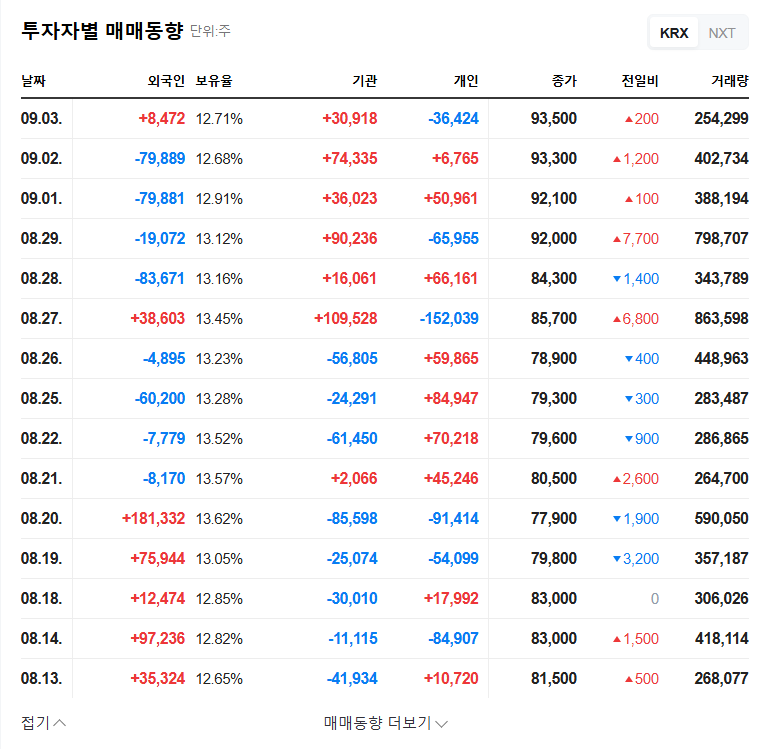

Changes in the largest shareholder’s stake can significantly impact stock prices as they suggest a potential shift in management control. However, this change is only 0.01%, and HD Korea Shipbuilding & Offshore Engineering still maintains a strong 35.08% stake. The possibility of a management change is low, and it is more likely a simple supply and demand transaction.

So, What’s the Stock Forecast?

In the short term, there is a possibility of a stock price decline due to the sale of shares, but the impact is expected to be limited due to the small volume. Instead, it’s important to focus on the company’s strong fundamentals (24% increase in sales in the first half of 2025, increasing demand for eco-friendly engines, and a high order backlog). The rising USD/KRW exchange rate is also a positive factor.

What Should Investors Do?

- Positive Factors: Growth of the eco-friendly marine engine market, synergy effects from joining the HD Hyundai Group, and a robust order backlog.

- Risk Factors: Operating rate of the Turbocharger business unit, concentration of major customers, and exchange rate volatility.

- Key Investment Strategy: Invest with a long-term perspective without being swayed by short-term volatility. Continuously monitor market share in eco-friendly engines, global shipbuilding market conditions, and exchange rate trends.

Frequently Asked Questions (FAQ)

What is HD Hyundai Marine Engine’s main business?

HD Hyundai Marine Engine’s main business is the manufacturing of marine engines and related parts. They are particularly focused on developing eco-friendly engine technology.

How much will this stake change affect the stock price?

The impact is expected to be limited in the short term due to the minimal change, but investors should proceed with caution.

What is the outlook for HD Hyundai Marine Engine?

Growth in the eco-friendly marine engine market and synergy from joining the HD Hyundai Group are expected.