1. What’s on the Agenda for Avaco’s IR?

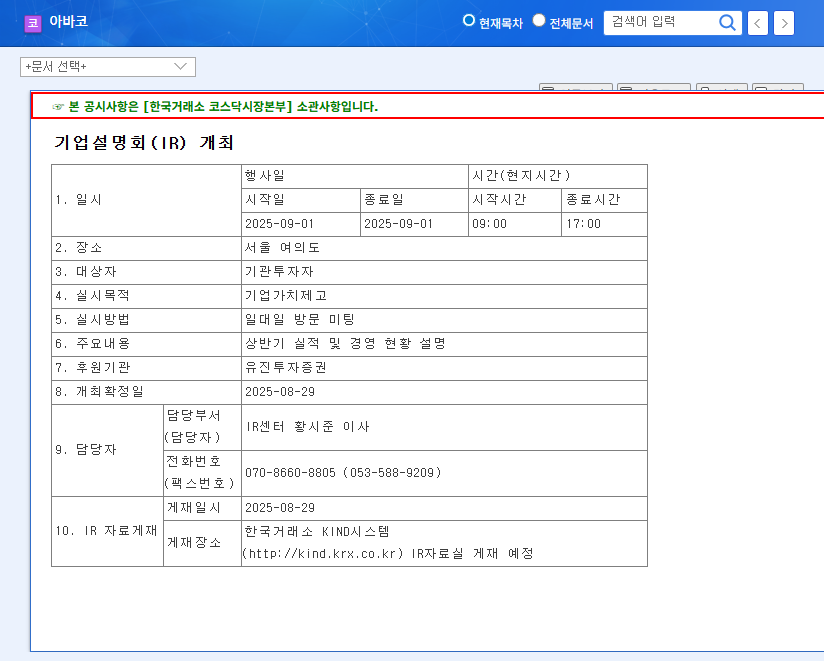

Avaco will announce its first-half 2025 financial results and business updates on September 1st. The presentation is expected to focus on the strong performance of their OLED and secondary battery equipment businesses and their efforts to secure new growth engines.

2. Why is this IR Important?

This IR presents a crucial opportunity for investors to assess Avaco’s fundamentals and future growth potential. This information is essential for adjusting investment strategies and forecasting stock price movements.

3. Key IR Analysis and Investment Takeaways

-

Positive Factors

- Strong Performance: Driven by increased demand for OLED equipment, Avaco achieved sales of KRW 185.13 billion and operating profit of KRW 16.02 billion (year-on-year growth).

- New Growth Drivers: Increasing sales contribution from secondary battery equipment and expansion into new businesses such as semiconductors, MLCC, and 3D printers.

- Solid Partnerships: Established relationships with global clients like LG Display, LG Energy Solution, and BOE.

- Sound Financials: Positive operating cash flow and low short-term debt.

-

Potential Risk Factors

- Global Economic Uncertainty: Risks associated with a potential economic downturn and foreign exchange fluctuations.

- Intensifying Competition: Increasing competition in the display and secondary battery equipment markets.

4. Action Plan for Investors

Carefully review the IR information and make investment decisions based on a comprehensive understanding of both positive and negative factors. Pay close attention to management’s explanations of future business strategies and risk management plans.

Frequently Asked Questions

What are Avaco’s main businesses?

Avaco primarily manufactures display and secondary battery equipment. They are currently diversifying into advanced equipment fields such as semiconductors, MLCC, and 3D printers.

What should investors focus on during this IR?

Pay close attention to the first-half results, future business strategies, specific plans for securing new growth drivers, and how the company plans to address potential risk factors.

Is Avaco a good investment?

Avaco has strong fundamentals and growth potential, but there are also risks, including global economic uncertainty and intensifying competition. Carefully analyze the IR materials and relevant information before making any investment decisions.