What Happened?

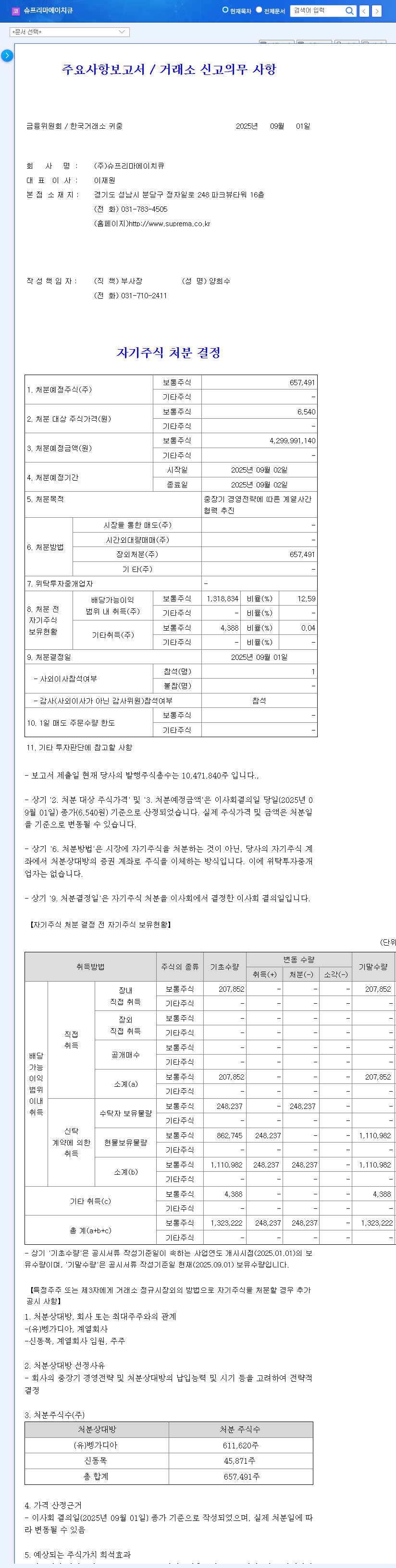

On September 5, 2025, Suprema HQ’s largest shareholder, Lee Jae-won, and related parties increased their stake from 41.67% to 47.95% through off-market purchases. This was done with the intention of influencing management control and involved the addition of related parties and the purchase of treasury stock.

Why is the Stake Increase Significant?

This stake increase signifies more than just an investment. The largest shareholder’s increased stake leads to stabilized management control and strengthened responsible management, positively impacting long-term growth momentum. Furthermore, the purchase of treasury stock is interpreted as a sign of willingness to boost stock prices and confidence in the company’s value.

Future Outlook and Investment Strategy

Positive Outlook

- • Stabilized management and reinforced corporate governance

- • Secured momentum for stock price increase

- • Synergistic effect with solid fundamentals

Investment Considerations

- • Short-term stock price volatility

- • Possibility of additional stake changes

- • Influence of macroeconomic variables (exchange rates, interest rates, etc.)

In conclusion, this stake increase is interpreted as a very positive signal for Suprema HQ, but thorough analysis and a cautious approach are necessary before making investment decisions.

Investor Action Plan

Investors should continuously monitor Suprema HQ’s business expansion plans, changes in financial soundness, management’s future vision, and establish an investment strategy accordingly. They should also pay attention to risk management according to changes in macroeconomic indicators and market conditions.

FAQ

Will this stake increase positively impact Suprema HQ’s stock price?

Yes, generally, an increase in the largest shareholder’s stake is interpreted as a positive signal indicating management stability and willingness to boost stock prices.

What are the investment considerations?

Short-term stock price volatility, the possibility of additional stake changes, and macroeconomic variables should be considered. It is also important to continuously monitor the company’s fundamentals and changes in business strategy.

What is the business outlook for Suprema HQ?

The outlook remains positive, in line with the growth of the biometric security market. However, continuous observation of external factors, such as exchange rate fluctuations and financial market conditions, is necessary.