1. What Happened to E-TRON?

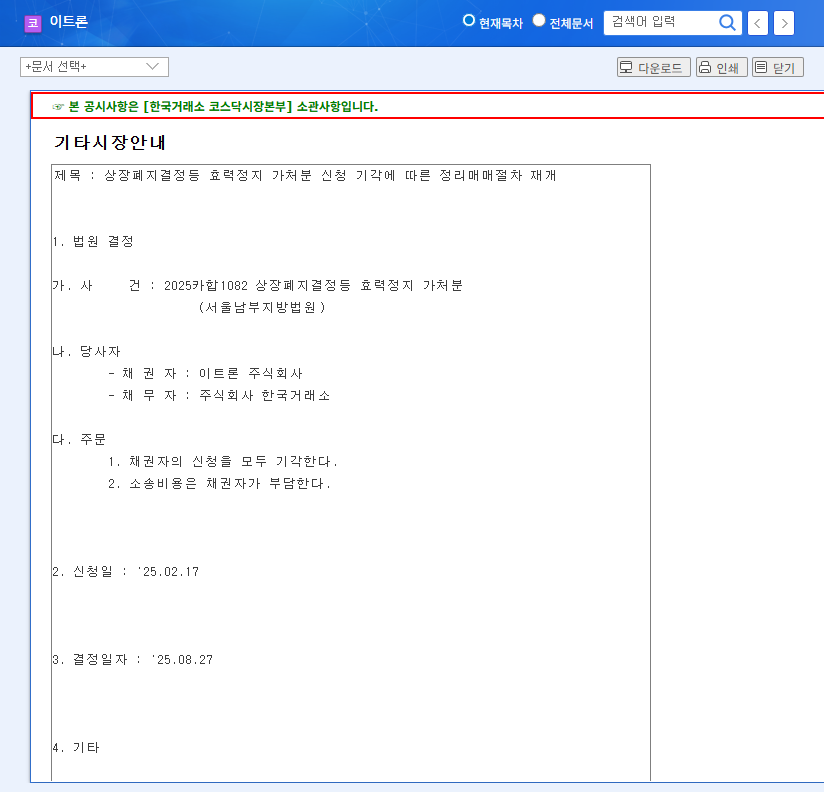

E-TRON faced severe financial difficulties and management issues, leading to its delisting. The company’s semi-annual report revealed declining sales, continuous operating losses, and a disclaimer of audit opinion. The court’s dismissal of the injunction against delisting solidified the process, initiating liquidation trading from September 1st to 9th.

2. Why Did This Happen?

E-TRON’s struggles stemmed from a combination of declining sales in core business segments, postponement of new business ventures, and the sale of its virtualization division. The company’s fundamentals are extremely weak, with little prospect of a turnaround.

3. Liquidation Trading: What Should Investors Do?

Extreme price volatility is expected during the liquidation trading period. The risk of principal loss is substantial, demanding cautious decision-making. Experts generally advise against participating in liquidation trading. If you hold E-TRON shares, the best course of action may be to sell them as soon as possible.

- Participating in liquidation trading is highly risky. Sharp price swings can lead to significant losses.

- Selling existing shares may be the best option. Consider selling quickly to mitigate further losses.

- Make investment decisions carefully. Seeking professional advice is recommended.

4. Investor Action Plan

Approach the situation rationally and avoid emotional investing. Prioritize minimizing further losses by promptly selling your shares.

Frequently Asked Questions

When is the liquidation trading period for E-TRON?

The liquidation trading period for E-TRON is from September 1st to September 9th, 2023.

Can I buy E-TRON stock during the liquidation trading period?

Buying E-TRON stock during liquidation trading is extremely risky. Due to extreme price volatility and the impending delisting, investment is not recommended.

What happens after E-TRON is delisted?

After delisting, E-TRON stock will no longer be tradable. Investors may recover some assets through the company’s liquidation process, but significant losses are expected.