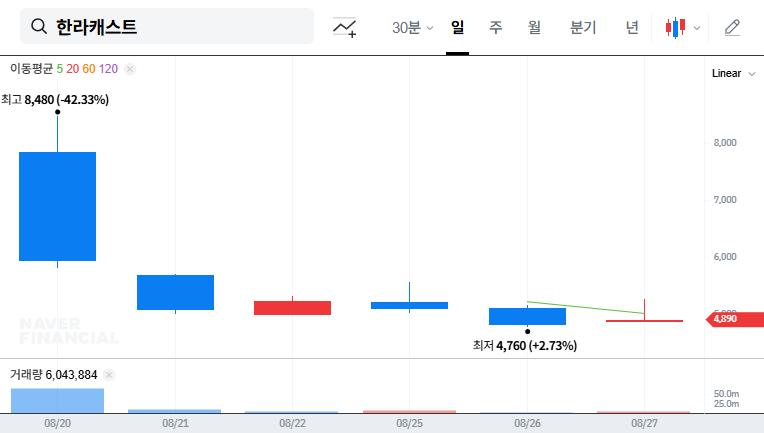

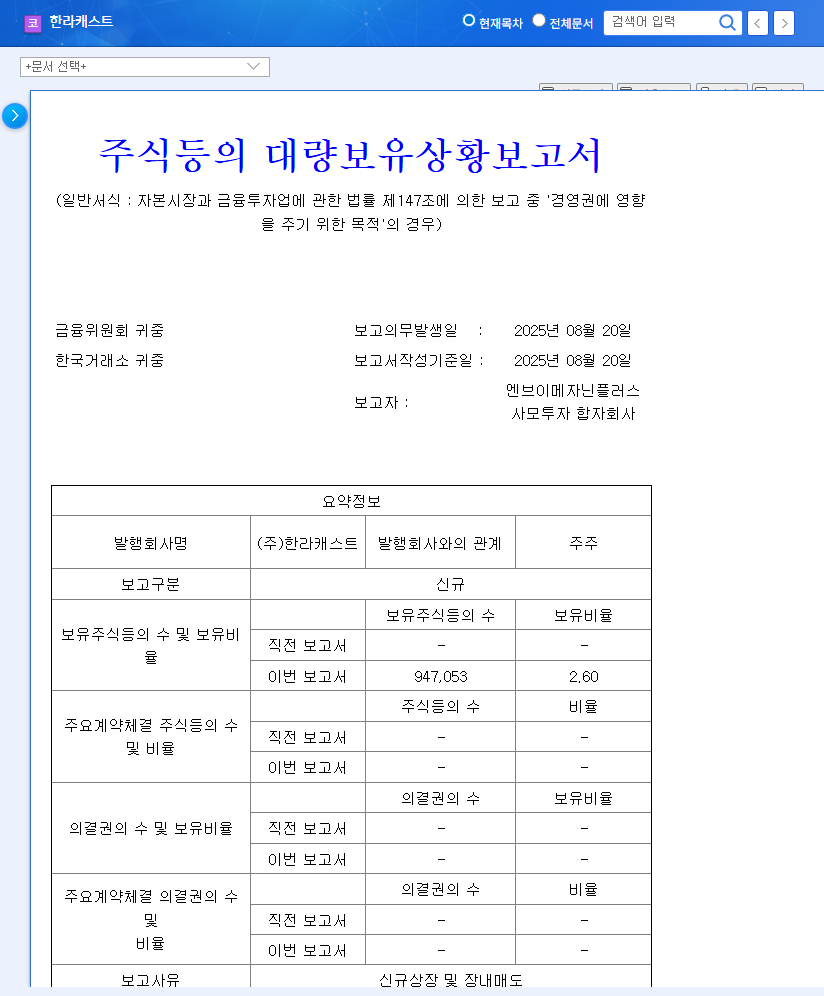

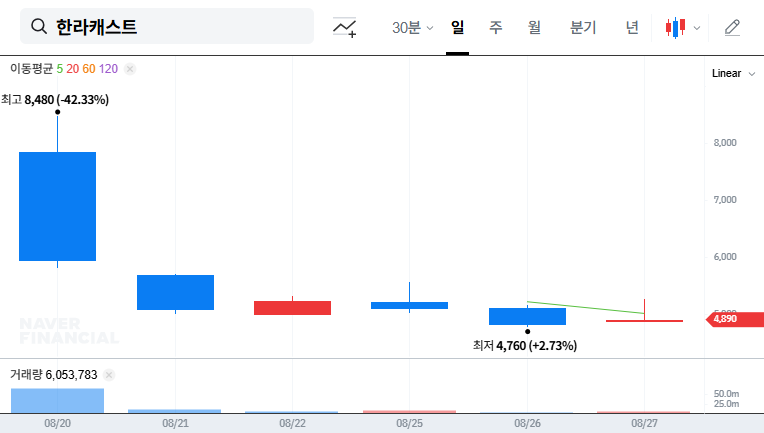

1. What Happened?: IBK PE Acquires 4.72% Stake in Hallacast

On August 27, 2025, IBK PE acquired a 4.72% stake in Hallacast, coinciding with the company’s IPO. While stating the investment is for general purposes, the market is interpreting this move in various ways.

2. Why It Matters: Growth Potential vs. Profit-Taking Potential

Stake acquisition by institutional investors like IBK PE can be interpreted as a positive sign, recognizing the company’s growth potential. Hallacast’s focus on future growth engines such as secondary battery materials, future car parts, and robot parts makes it particularly noteworthy. However, a stake change immediately after an IPO suggests the possibility of profit-taking, which can lead to increased stock volatility.

3. What’s Next?: Short-Term Volatility, Long-Term Growth Potential

In the short term, investors need to consider the possibility of IBK PE selling its stake and the volatility inherent in newly listed companies. However, in the long term, the growth potential remains valid due to factors like growth in the future car market and expansion of the secondary battery materials business. Sustainable growth will hinge on improving profitability and maintaining financial soundness. Changes in the macroeconomic environment are also key variables.

4. Investor Action Plan: Cautious Short-Term Approach, Long-Term Growth Focus

- Short-Term Investment Strategy: A cautious approach is recommended, considering the possibility of IBK PE selling its shares and market volatility. Consider a dollar-cost averaging strategy and avoid impulsive chase buying.

- Long-Term Investment Strategy: Continuously monitor the performance of new businesses, efforts to improve profitability, financial soundness, and changes in the macroeconomic environment to flexibly adjust your investment strategy.

Frequently Asked Questions (FAQ)

Is IBK PE’s stake acquisition positive for Hallacast?

The participation of institutional investors like IBK PE can be seen as a positive sign, recognizing the company’s growth potential. However, there is also the possibility of increased short-term stock price volatility.

What are Hallacast’s main businesses?

Hallacast focuses on future growth industries such as future car parts, secondary battery materials, and robot parts.

What should investors be aware of when investing in Hallacast?

In the short term, be aware of the possibility of IBK PE selling its stake and the volatility typical of newly listed companies. In the long term, carefully monitor the performance of new businesses, efforts to improve profitability, financial soundness, and changes in the macroeconomic environment.