1. Classys IR Day: What’s Happening?

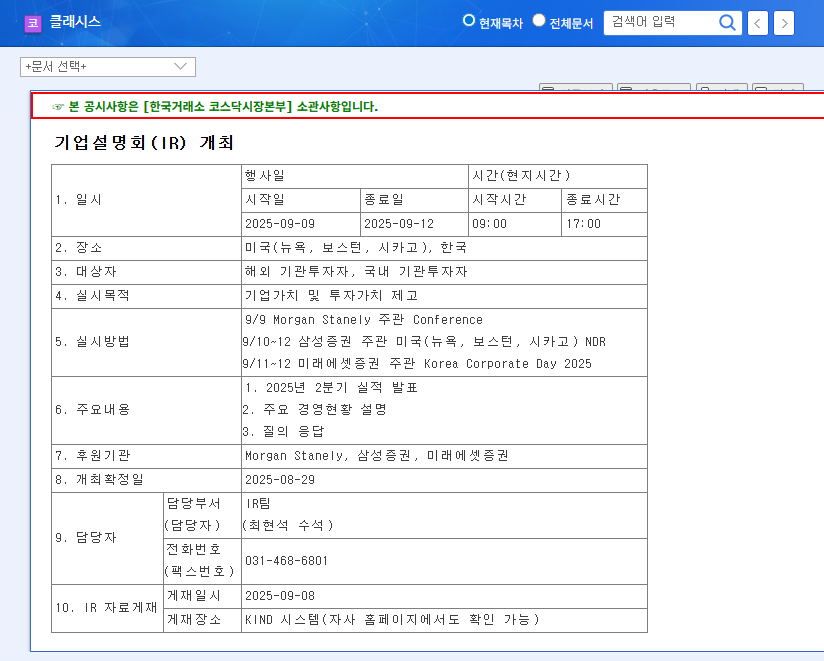

Classys will hold an IR Day on September 9, 2025, at 9:00 AM. The event will include the announcement of Q2 2025 earnings, key management updates, and a Q&A session with investors.

2. Why is it Important?

Classys has recorded solid earnings growth in the first half of 2025, driven by a surge in overseas sales. Synergies from the merger with Iruda are becoming evident, strengthening the product portfolio and securing technological competitiveness. This IR Day is a crucial opportunity to confirm this positive momentum and gauge the company’s future growth strategy.

- Key Highlights: Q2 earnings announcement, key management updates, Q&A session.

- Expected Impact: Increased investor confidence, improved investment sentiment, enhanced corporate value.

3. So, What’s the Outlook?

Positive Outlook: The announcement of strong Q2 earnings, coupled with the unveiling of future growth strategies, is likely to boost investor expectations and act as a momentum for stock price appreciation. In particular, the expansion into overseas markets and new product launch strategies are expected to further strengthen growth drivers.

Risk Factors: Macroeconomic uncertainties (exchange rate and interest rate fluctuations) and intensifying competition could increase stock price volatility. Furthermore, earnings announcements that fall short of market expectations may lead to a short-term decline in stock price.

4. Investor Action Plan

- Carefully review the information presented at the IR Day and incorporate it into your investment strategy.

- Continuously monitor changes in macroeconomic variables and the competitive landscape.

- Make investment decisions based on a comprehensive consideration of the company’s long-term growth strategy and financial stability.

Frequently Asked Questions

When is the Classys IR Day?

It will be held on September 9, 2025, at 9:00 AM.

What are the key topics to be covered at this IR Day?

The event will cover Q2 2025 earnings, key management updates, and a Q&A session.

What is Classys’ main business?

Classys develops and sells aesthetic medical devices. Its flagship products include Schrink and Volnewmer.

What are the key considerations for investment?

Investors should consider risk factors such as macroeconomic fluctuations and intensifying competition. It is also important to thoroughly review the information from the IR Day and assess the company’s financial stability.