1. What Happened?: Disclosure of Special Relationship Shareholding Change

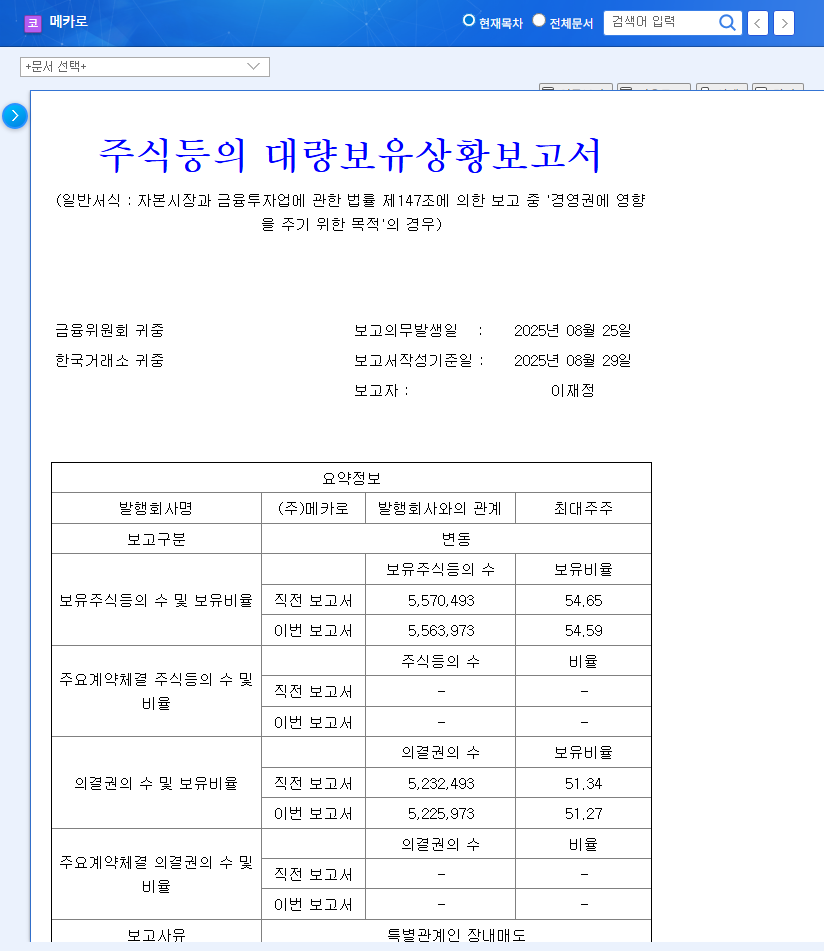

MECARO’s special relationship party, Mr. Choi Moon-gyu, sold 6,520 shares through a block deal, slightly decreasing CEO Lee Jae-jung’s stake from 54.65% to 54.59%.

2. Why is it Important?: Possibility of Management Change?

Changes in shareholding by special relationship parties draw significant investor attention due to the potential implications for management changes. However, the magnitude of this change is minimal, and CEO Lee Jae-jung still holds over 54% of the shares, making the likelihood of any impact on management low. It is more likely to be a simple adjustment of holdings or profit-taking.

3. So, What’s MECARO’s Future?: Maintaining Positive Growth Momentum

MECARO recorded sales of KRW 44.4 billion, operating profit of KRW 6.7 billion, and net income of KRW 7.2 billion in the first half of 2025, showing robust growth. With a dominant market share of over 90% in the domestic heater block market, a solid financial structure, and future growth engines such as ceramic components and solar cell businesses, MECARO’s fundamentals remain strong. The growth of the AI semiconductor market and the expansion of the Chinese market are also expected to be boons for MECARO.

4. What Should Investors Do?: High Investment Attractiveness from a Mid- to Long-Term Perspective

- Short-term Investment: A wait-and-see approach is valid, considering the possibility of increased short-term stock price volatility due to changes in shareholding by special relationship parties.

- Mid- to Long-term Investment: Based on solid fundamentals and future growth drivers, MECARO is expected to offer attractive investment opportunities from a mid- to long-term perspective. Managing investment risk through a dollar-cost averaging strategy is recommended. In particular, the materialization of results from new businesses can act as an additional upward momentum.

Frequently Asked Questions

What is MECARO’s core business?

MECARO is a company specializing in the production of heater blocks for semiconductor equipment. It holds over 90% of the domestic market share.

Will this change in shareholding affect MECARO’s management?

Given the small change and CEO Lee Jae-jung’s continued majority stake, the impact on management is expected to be limited.

What is the outlook for MECARO’s future stock price?

Considering the company’s robust fundamentals and the benefits from the growth of the semiconductor market, a positive stock price trend is expected in the mid- to long term. However, attention should be paid to external factors such as exchange rate volatility.