1. APR Q2 Earnings Analysis: Growth of Core Business and Improved Profitability

APR achieved sales of KRW 593.8 billion and operating profit of KRW 139.1 billion in the first half of 2025, continuing its solid growth. In particular, the sales portion of the cosmetics/beauty business significantly increased, and the operating profit margin also improved significantly to 23.43% year-on-year. This is interpreted as a result of strengthening the competitiveness of the core business and efficient cost management.

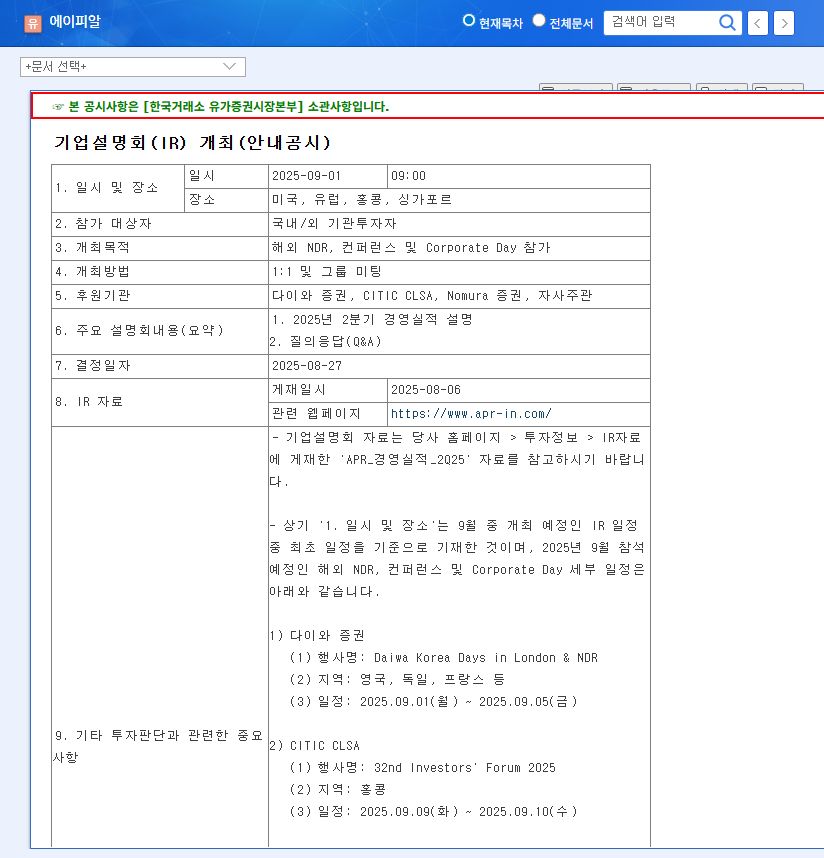

2. Key Contents of APR IR: Targeting Overseas Markets and Securing New Growth Engines

This IR will not only announce the Q2 earnings but also discuss future growth strategies. Of particular interest are overseas market expansion and new product launch strategies. Successful overseas expansion and new product launches are expected to play a crucial role in securing APR’s future growth engine.

3. Investment Precautions: Increased Inventory and Macroeconomic Uncertainty

Despite the positive aspects, investors should also be aware of several risk factors. The increasing trend of inventory assets, sluggish performance of other business segments, and global macroeconomic uncertainties are factors that can affect APR’s future performance. It is essential to pay attention to how management presents its strategies to address these risk factors at this IR.

4. Investor Action Plan: Review Investment Strategy After Checking IR Content

The results of APR’s IR are expected to have a significant impact on future stock price trends. Investors should carefully review the IR announcement and re-examine their investment strategies by comprehensively considering the company’s growth strategy and potential risk factors.

Frequently Asked Questions

What are APR’s main businesses?

APR engages in businesses such as cosmetics/beauty, beauty devices, and fashion/lifestyle (Nerdy, Photogray). In particular, the cosmetics/beauty business is the main business with the highest sales portion.

How were APR’s Q2 earnings?

APR recorded sales of KRW 593.8 billion and operating profit of KRW 139.1 billion in Q2 2025. Both sales and operating profit increased significantly year-on-year.

What precautions should be taken when investing in APR?

Potential risk factors include the increasing trend of inventory assets, sluggish performance of other business segments, and global macroeconomic uncertainties. Pay close attention to the response strategies presented by the management at this IR.