1. What is the Share Buyback?

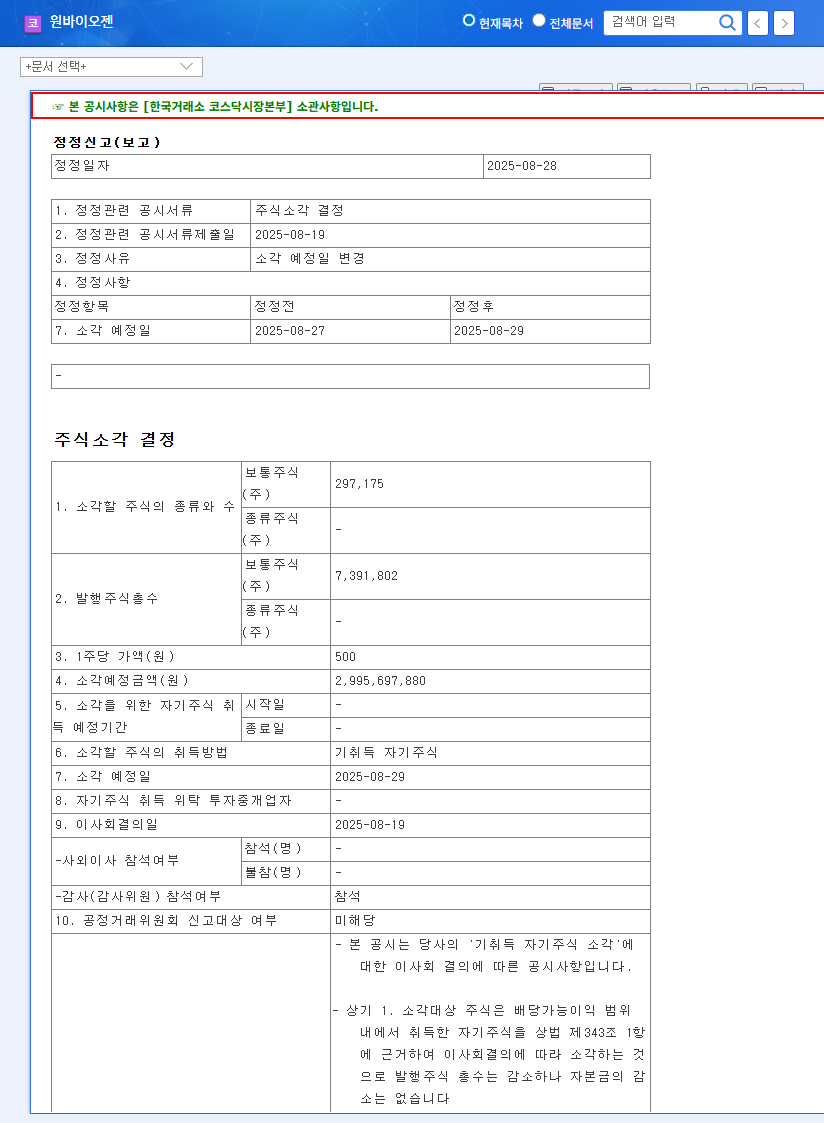

Wonbiogen has decided to repurchase and retire KRW 3 billion worth of its own shares. A share buyback reduces the number of outstanding shares, increasing the value per share. This is generally viewed as a shareholder-friendly policy returning value to investors.

2. Why the Buyback?

Wonbiogen is experiencing robust growth in its polyurethane foam dressings and cosmetics sectors, and is actively expanding into overseas markets. They are also focusing on new product development through active R&D. Despite this positive outlook, the company believes its stock is undervalued, leading to the share buyback decision to enhance shareholder value and improve investor sentiment.

3. How Will the Buyback Affect the Stock Price?

- Positive Impacts:

- Increased Earnings Per Share (EPS) and Book Value Per Share (BPS)

- Potential stock price appreciation due to reduced outstanding shares

- Improved investor sentiment and enhanced corporate image

- Potential Risks:

- Potential for increased short-term stock price volatility

- Risks related to ongoing lawsuits and seizures

- Intensifying technological and market competition

- Potential for profit fluctuations due to exchange rate volatility

4. What Should Investors Do?

While the share buyback may positively impact the stock price in the short term, investors should carefully consider several factors before making investment decisions. Thorough fundamental analysis, including future earnings trends, R&D performance, and lawsuit outcomes, is crucial. Investors should also closely monitor macroeconomic indicators and market conditions. It’s essential to recognize that ongoing legal issues can significantly influence investment decisions.

What is a share buyback?

A share buyback is when a company repurchases its own outstanding shares and retires them. This reduces the number of shares available in the market, potentially increasing the value of each remaining share.

What is the size of Wonbiogen’s share buyback?

Wonbiogen is repurchasing KRW 3 billion worth of its shares, representing approximately 7.22% of its market capitalization.

Does a share buyback guarantee a stock price increase?

While share buybacks are generally considered positive for stock prices, they do not guarantee an increase. Various factors, including company performance, market conditions, and investor sentiment, can influence stock prices.