Convertible Bond Exercise: What happened?

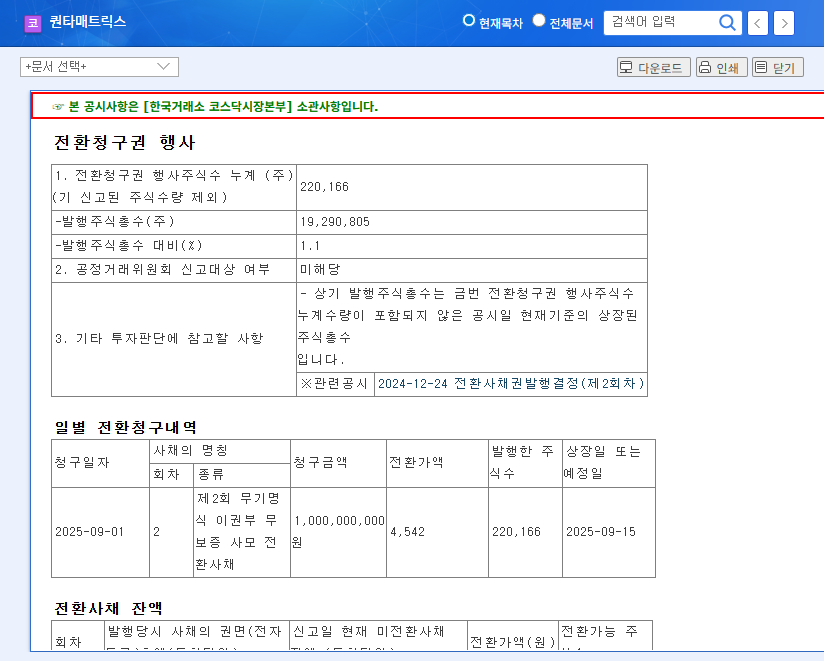

QuantaMatrix announced that the conversion right for 220,166 convertible bonds (conversion price: KRW 4,542) will be exercised on September 15, 2025. This represents approximately 1.1% of the total market capitalization, raising concerns about stock dilution due to the increase in outstanding shares. The fact that the conversion right is being exercised at a time when the current stock price is lower than the conversion price could negatively impact investor sentiment.

Why is this important?

The exercise of convertible bonds is a significant event that affects both a company’s financial structure and stock price. On the positive side, a decrease in debt ratio and interest expense can be expected. However, on the negative side, there is a possibility of stock dilution and a decrease in EPS due to the increase in the number of outstanding shares. Especially for companies currently recording operating losses, such as QuantaMatrix, the exercise of convertible bonds is more likely to act as downward pressure on the stock price rather than improving financial soundness.

Investment Strategies: What should investors do?

Short-term investment strategy: It is advisable to take a wait-and-see approach, considering the possibility of increased stock price volatility due to the exercise of conversion rights. Careful investment decisions are required, paying attention to short-term downward pressure on stock prices.

Mid- to long-term investment strategy: If you are confident in QuantaMatrix’s long-term growth potential, you may consider a strategy of dividing purchases when the stock price falls. However, it is necessary to continuously monitor whether profitability improves through future earnings announcements.

Key Monitoring Points

- Stock price movements and trading volume changes after conversion of convertible bonds

- Sales performance of dRAST and QMIA products

- Performance of entering the Alzheimer’s diagnosis market

- Efficiency of R&D expenses and SG&A expenses

Frequently Asked Questions

What are convertible bonds?

Convertible bonds are issued in the form of bonds, but they are granted the right to be converted into the issuing company’s stock under certain conditions.

Does the exercise of convertible bonds only have a negative impact on the stock price?

Not necessarily. While there are positive effects such as a decrease in the debt ratio and interest expense, the possibility of stock dilution due to an increase in the number of outstanding shares should also be considered.

What should I be aware of when investing in QuantaMatrix?

You should continuously monitor factors such as profitability improvement, new business entry performance, and financial soundness.