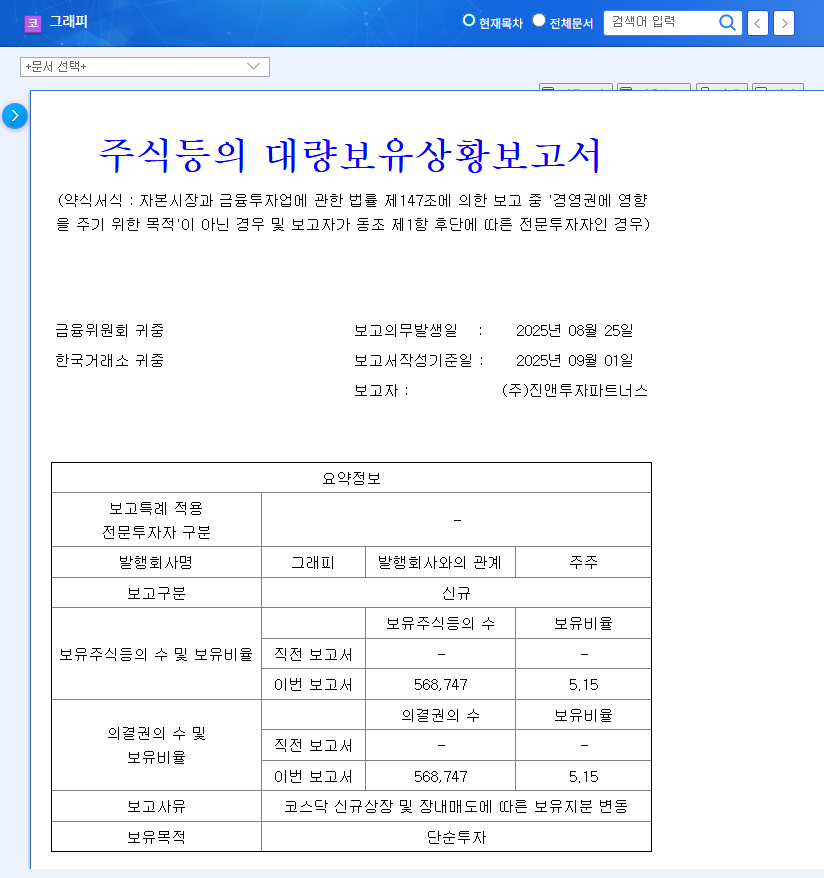

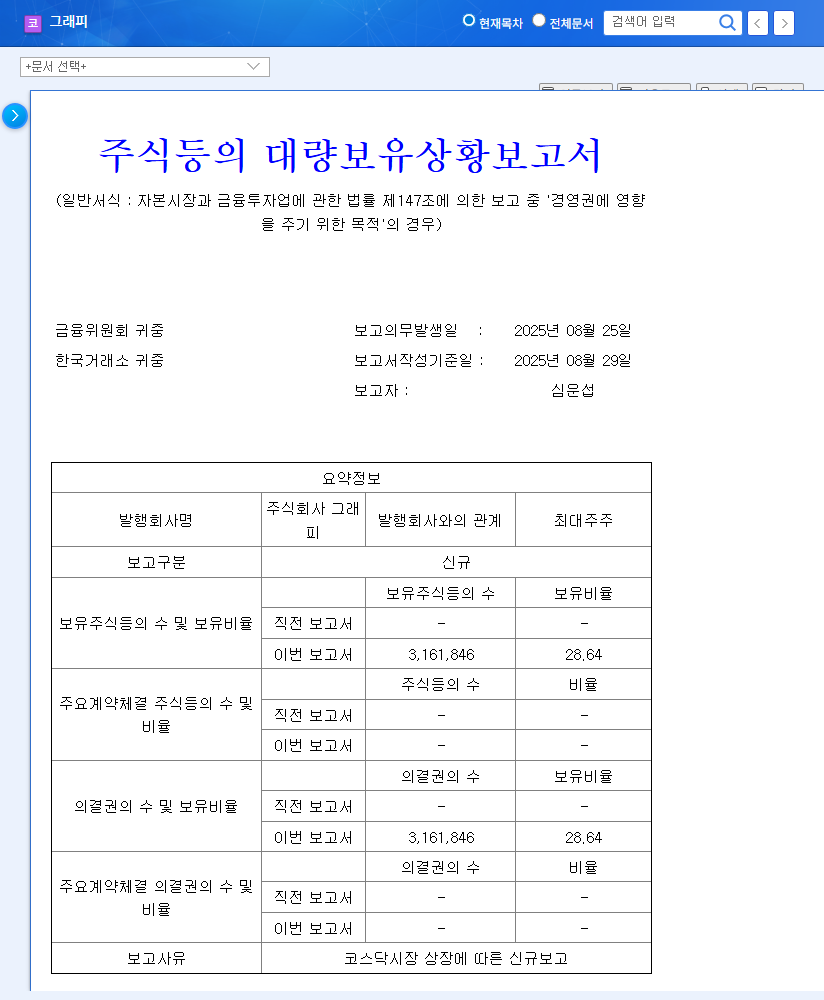

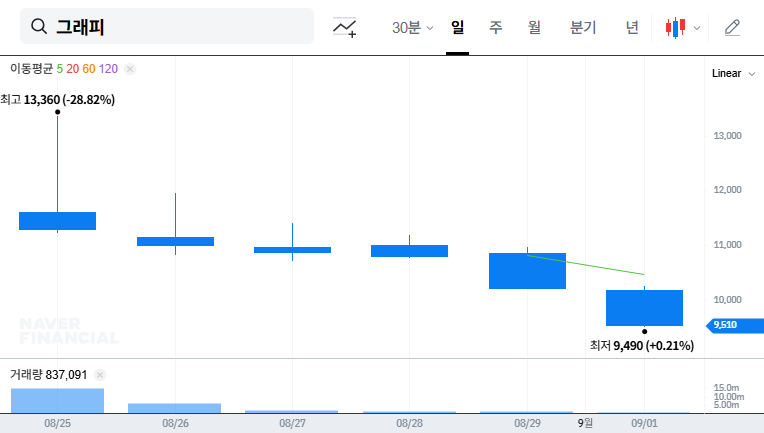

Jin&Partners Reduces Graphi Stake to 5.15%: What Happened?

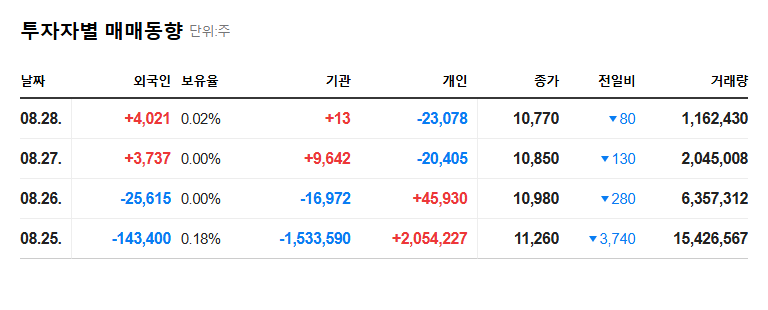

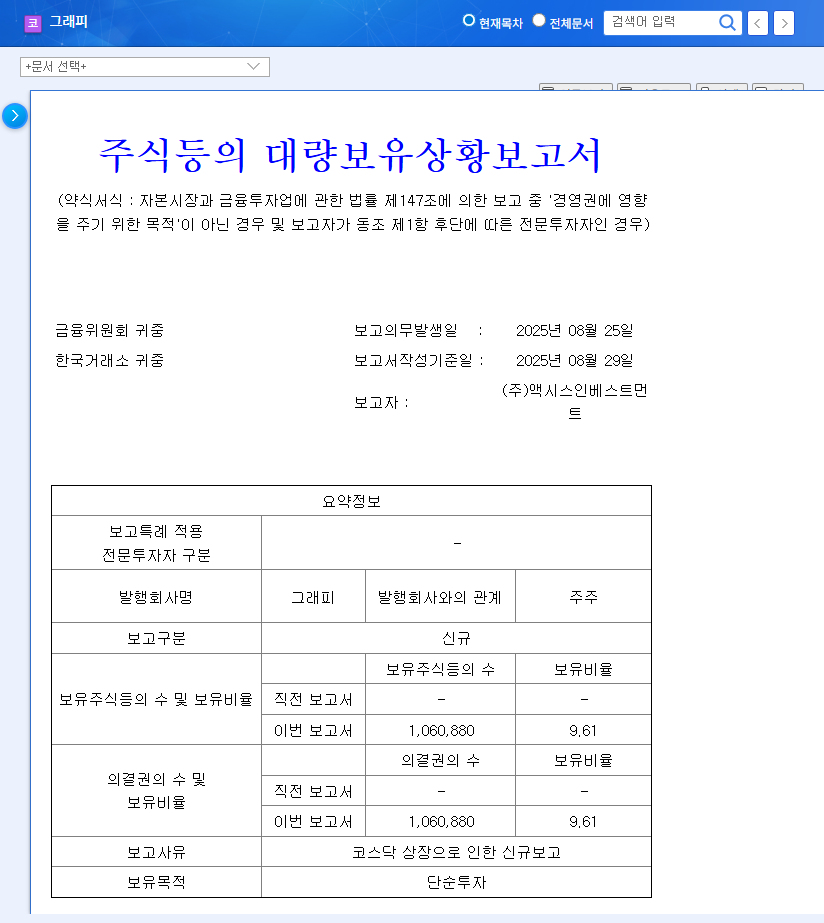

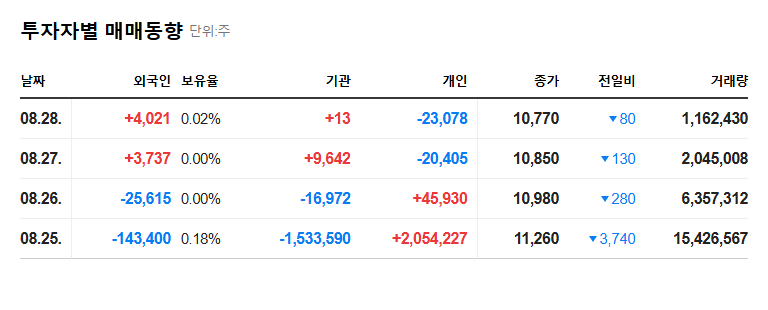

Jin&Partners sold some of its Graphi shares, reducing its stake to 5.15%. This was disclosed as a stake change for ‘simple investment’ purposes and is interpreted as profit-taking after the KOSDAQ listing.

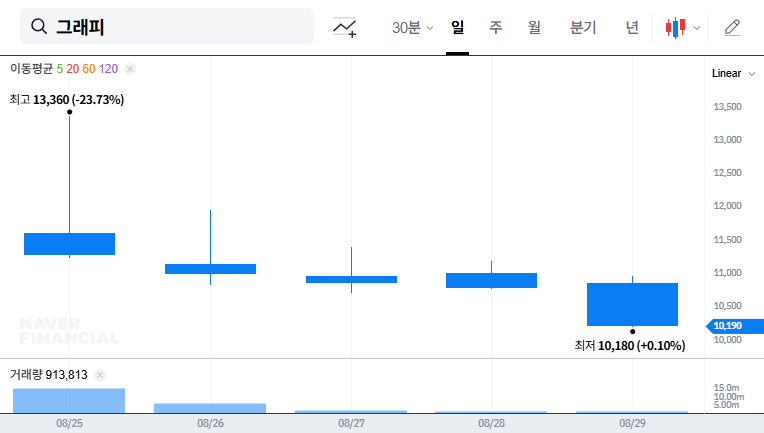

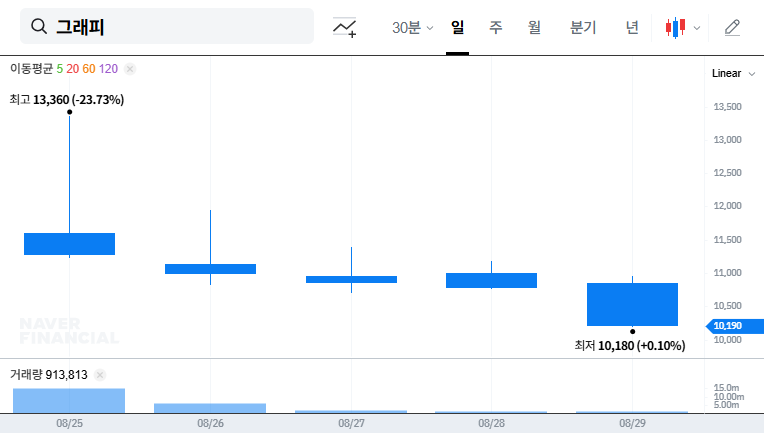

Why is Graphi’s Stock Price Declining? – Fundamental Analysis

Graphi possesses innovative 3D printing technology, but its financials are weak. As of the first half of 2025, it is in a state of complete capital impairment, with a high debt ratio and continuous operating losses. Although it secured funds through the KOSDAQ listing, this has not translated into improved performance.

So, Should I Invest in Graphi Now? – Investment Strategy Analysis

Graphi is a ‘high-risk, high-return’ investment. Its innovative technology and growth potential are attractive, but the financial risks are substantial. Careful analysis is crucial before making an investment decision.

- Long-term Growth Investors: If you believe in Graphi’s technology and market potential, a dollar-cost averaging strategy can be considered. However, close monitoring of performance improvement trends is essential.

- Stability-Seeking Investors: Caution is advised until clear performance improvement and financial restructuring are evident. It’s recommended to observe and wait for potential turnaround signs.

Frequently Asked Questions

What is Graphi’s core technology?

Graphi possesses shape memory 3D printing material and clear aligner technology utilizing this material.

What is Graphi’s financial status?

As of the first half of 2025, it’s in complete capital impairment with a high debt ratio and continuous operating losses.

What should I be aware of when investing in Graphi?

Be aware of its weak financial health and uncertain profitability improvement. Thorough analysis is necessary before investing.