IR Overview: Noeul’s Present and Future

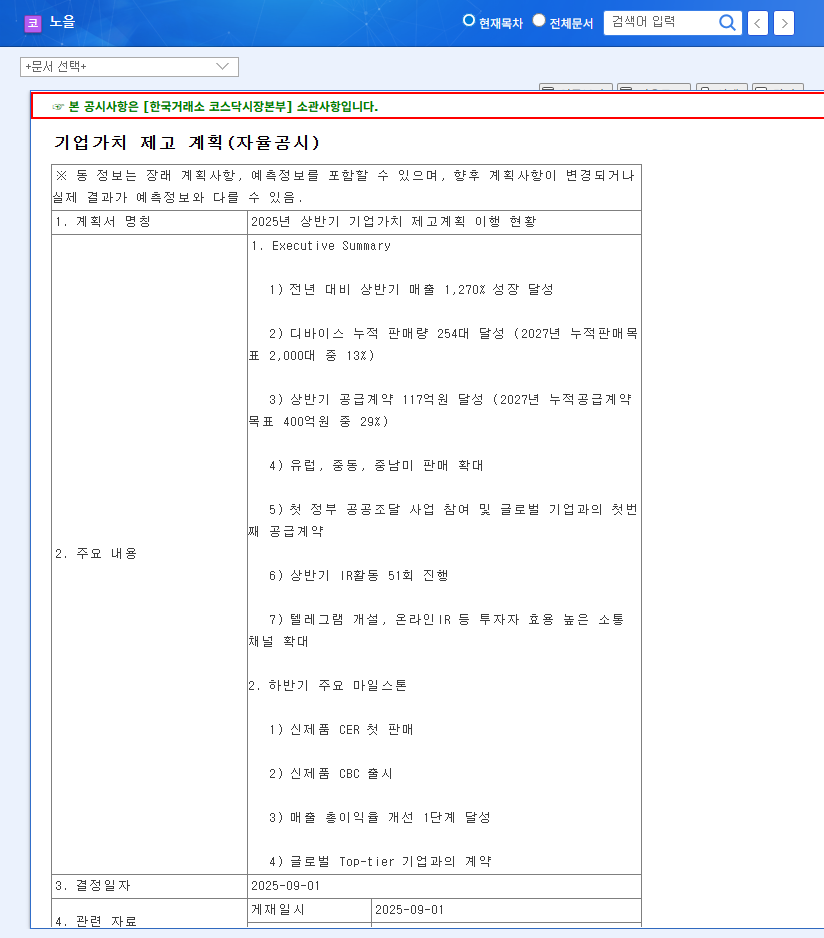

Noeul will present its current status, growth strategies, and future plans during the IR on September 3rd. The market is focusing on improvements in profitability and performance in overseas markets.

Fundamental Analysis: Opportunities and Risks

Strengths

- miLab™: Innovative on-device AI diagnostic testing solution

- Global market expansion: Over 200 units installed, expansion into various countries

- Revenue growth: Significant year-on-year increase

Weaknesses and Risks

- Profitability: Continued operating and net losses

- Financial soundness: High debt-to-equity ratio

- Market competition and regulatory risks

Key IR Takeaways and Investor Action Plan

Noeul is expected to emphasize its plan for profitability, global market expansion strategy, and technological competitiveness during the IR. Investors should consider the following:

- Explanation based on specific figures and data

- Roadmap for profitability improvement

- Concreteness and feasibility of the global market expansion strategy

- Demonstration of technological competitiveness

- Honest and transparent communication

Investment strategies should be adjusted based on the IR results and future earnings announcements.

Frequently Asked Questions

What is Noeul’s miLab™?

miLab™ is a compact, on-device AI-powered diagnostic testing solution that enables efficient testing even in areas lacking IT infrastructure.

What are Noeul’s main overseas markets?

Noeul has expanded into various countries including Africa, Southeast Asia, Europe, and the US, with plans to enter the Middle East and Latin American markets.

What are the key considerations when investing in Noeul?

Investors should consider risks such as lack of profitability, high debt-to-equity ratio, and intensifying market competition.